- Mar 15, 2023

-

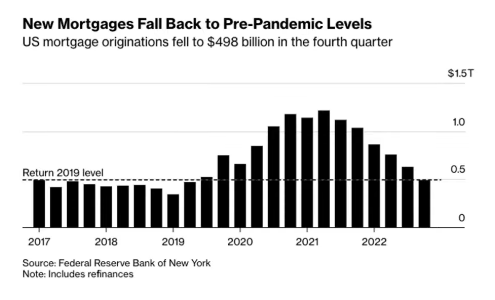

House buyers and sellers seem to be comfortable with mortgage rates between 6 and 6.5% - RossellAbove, activity stops. Back there, activity picks up. So that might be the longterm rate.

Demographic factor. Those mellenials tha had put off homebuying are now in their 30s, and will have to accept higher rates. Demographics will overpower anything else going on.Debt servicing. The group that is defaulting most is GenXers (young people).Still $2t in excess savings sitting around in bank accounts.An individual will pay their mortgage and their car payment, but cut everything else. Government service workers will be sent home. This will reduce consumer sentiment. People will stop spending money (people are currently spending just fine). Market and economy will decline, and everyone invested in those things will feel a lot poorer.Creditors around the world will demand higher interest rates to hold our debt because they will trust us less.What's ridiculous is that it's not that we can't pay. It's that we're unwilling to. (Contrast with Argentina who defaults because literally they can't pay.)

Demographic factor. Those mellenials tha had put off homebuying are now in their 30s, and will have to accept higher rates. Demographics will overpower anything else going on.Debt servicing. The group that is defaulting most is GenXers (young people).Still $2t in excess savings sitting around in bank accounts.An individual will pay their mortgage and their car payment, but cut everything else. Government service workers will be sent home. This will reduce consumer sentiment. People will stop spending money (people are currently spending just fine). Market and economy will decline, and everyone invested in those things will feel a lot poorer.Creditors around the world will demand higher interest rates to hold our debt because they will trust us less.What's ridiculous is that it's not that we can't pay. It's that we're unwilling to. (Contrast with Argentina who defaults because literally they can't pay.)

Show More

Show Less