- Mar 13, 2023

-

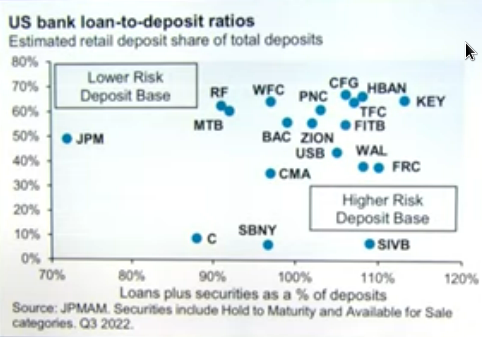

How to value banks (which could currently be on sale)Start with tangible book value, then make adjustments for unrealized losses that are in securities portfolios. The available forSale losses are already included.However, with banks, headwinds include that access to capital will be constrained. There won't be capital raises for a while.Loan portfolio reset as we go forward. With higher interest rates and Fed tightening.Marinac said the flight to BigBanks won't last forever. The main lending is still mid to medium sized banks.

Show More

Show Less