- Mar, 2024

- Mar 22, 2024

-

Wharton finance professor sounds the alarm on soaring U.S. debt - YouTube

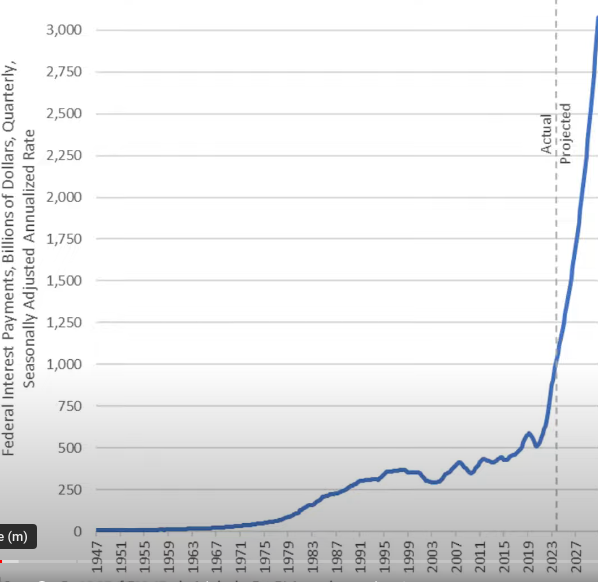

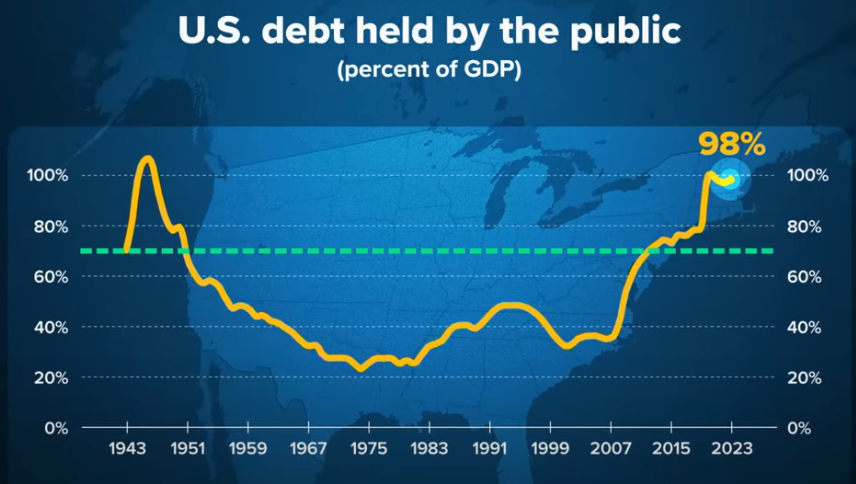

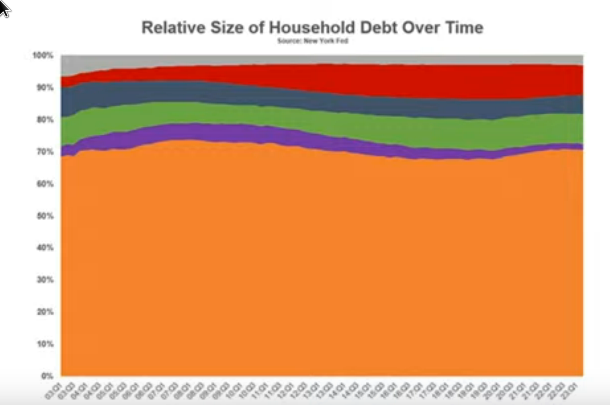

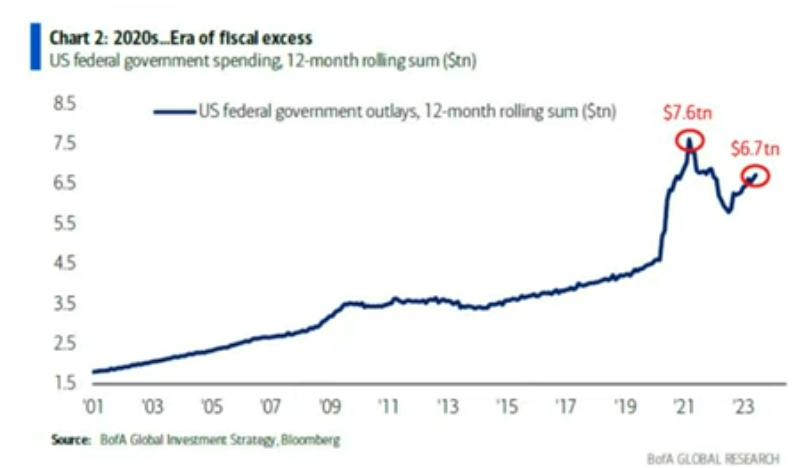

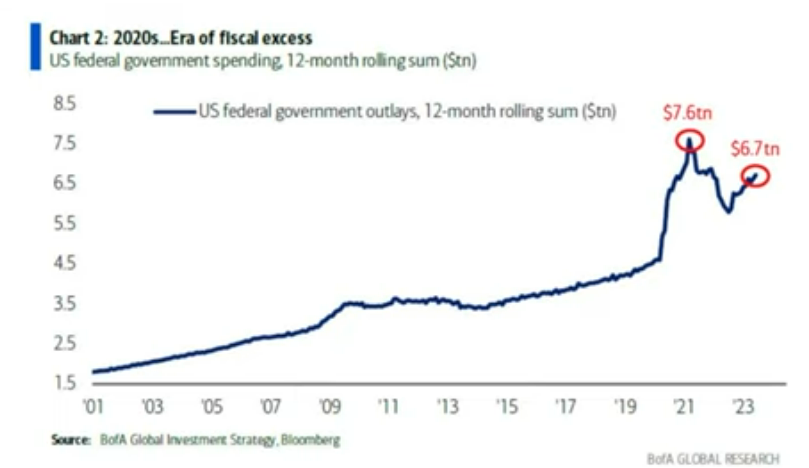

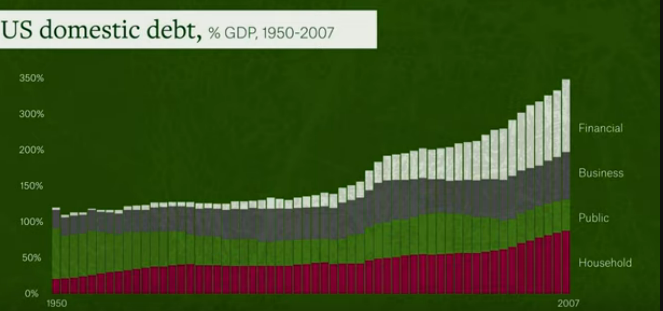

Adding $1t every 100 days.

Interest on the U.S. debt is really driving the growth at this point, says Maya MacGuineas - YouTube

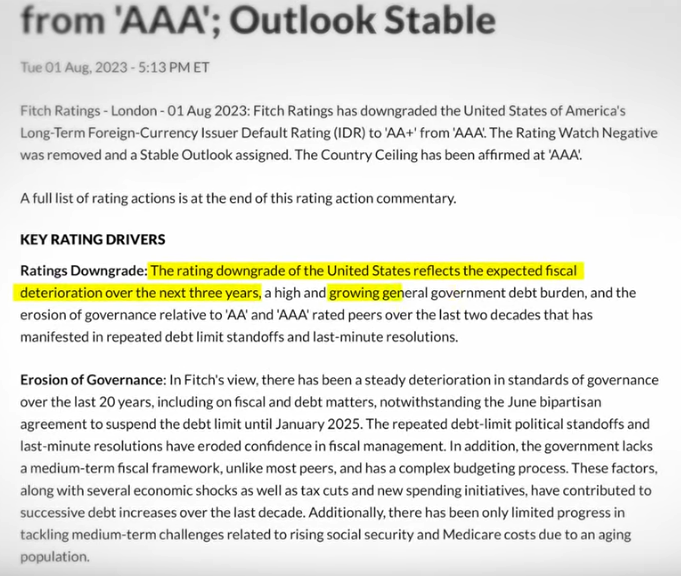

Steady march upward relative to the economy. Slows economic growth. Two parties can't compromise or work on the things they should be working on. Both say 'Not our problem at the moment.' Difficult to see how it connects to anyone's daily life.

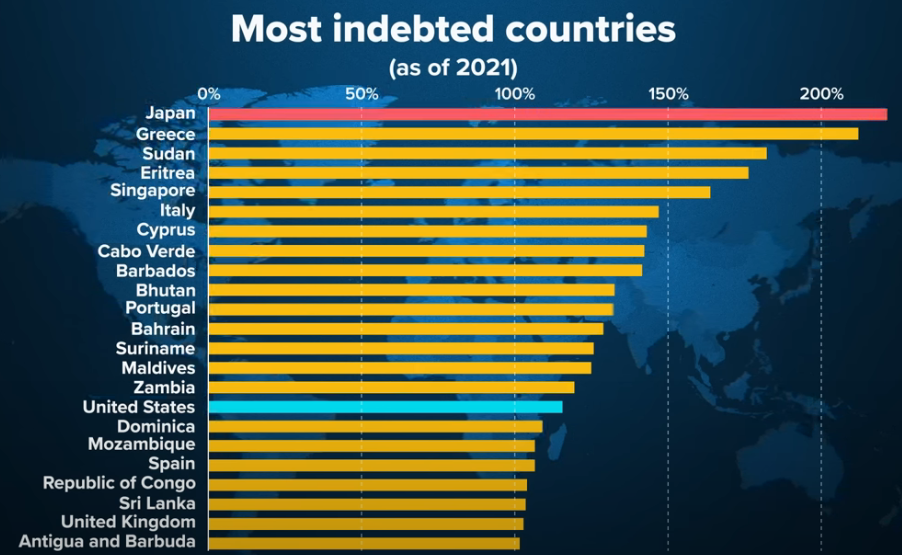

US public debt will be 100% of GDP in 2024?

Worse because we wait to fix them. The changes are more difficult than if they had been done earlier.

Where could the US cut spending? Defense? ‘Investing’? Health Care and Retirement (no candidate wants to talk about cutting Social Security)?

Soon tax cuts will expire. Both parties want some amount of tax cuts extended, which will make the numbers even larger.

Conversation might start the day after the election.

Taxes will have to go up.

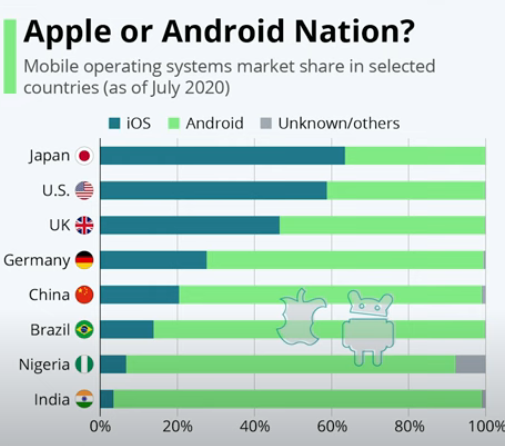

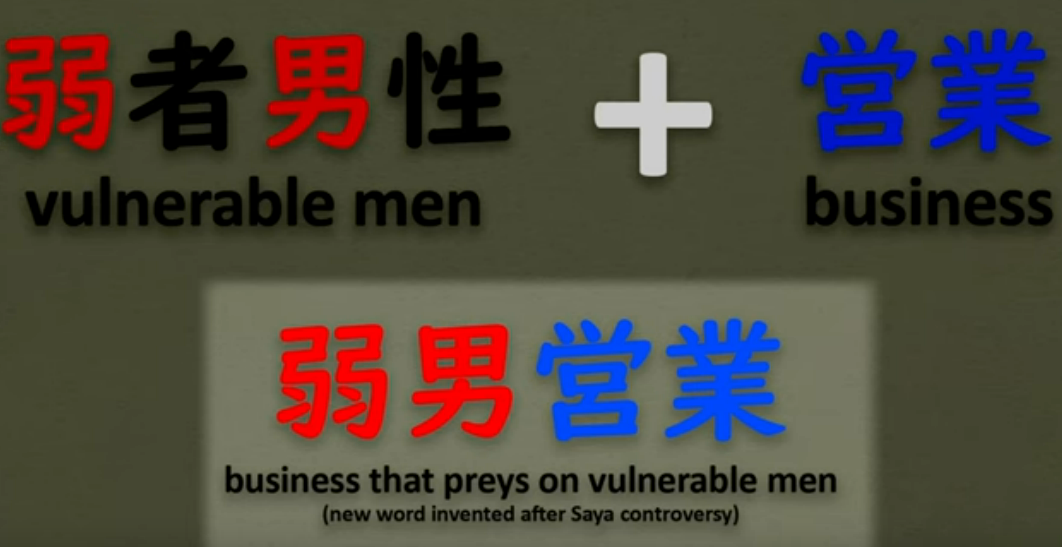

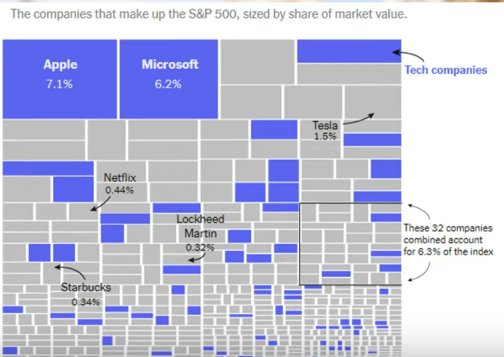

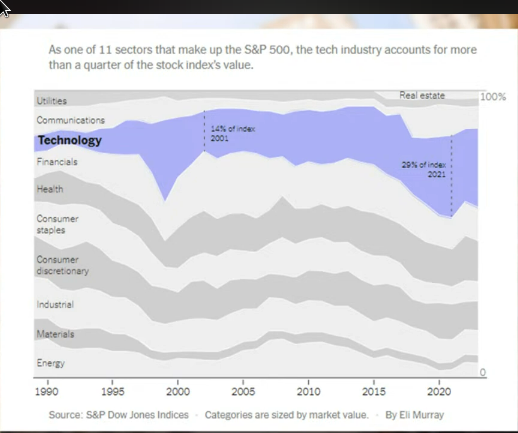

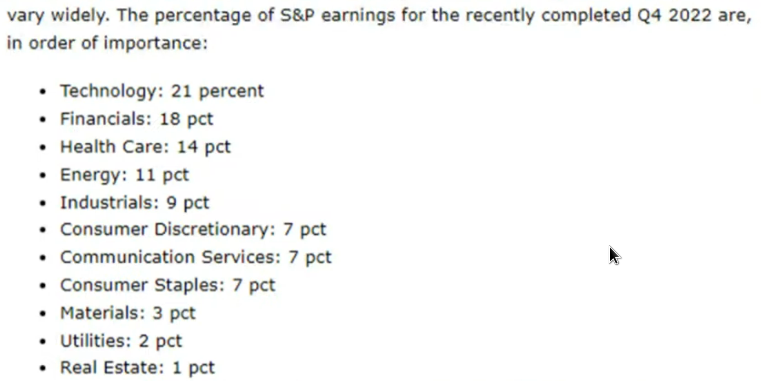

The winner-take-all economics of the 21st Century. Every business we look at, you're gonna see one or two companies dominating. Advertising 20 or 30 years ago, 2 or 3% was a big share of the market. Today, 2 companies have most of the 60% of advertising which is done online. Aswath Damodaran

At this moment, Jensen Huang is considered CEO of the greatest business ever.

Apple In Talks to Build Google's AI Into iPhones - YouTube

10 years of duopoly, why allow things to change? They made their search agreement in 2000. Google needed Apple more than vice versa since then, but now with an AI agreement Apple will need Google.

Apple will leverage Google's Gemeni. Google's AI has looked bad, but not as unstable and unpredictable and new as OpenAI.

This might mean Apple isn't as far along with its own AI as some thought. Why does it need Google?

If Apple went with Microsoft or another company rather than Google, that would put them at odds with Google. Apple is more afraid of Google. Google does more things that can compete with Apple, and can take marketshare if they want to.

Users don't care if Apple was first to anything. They care if the product works well.

Apple needs AI tech, some say.

This will be the biggest AI contract maybe, so Google will be ‘winning AI.’

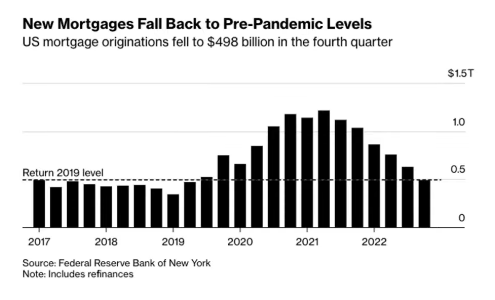

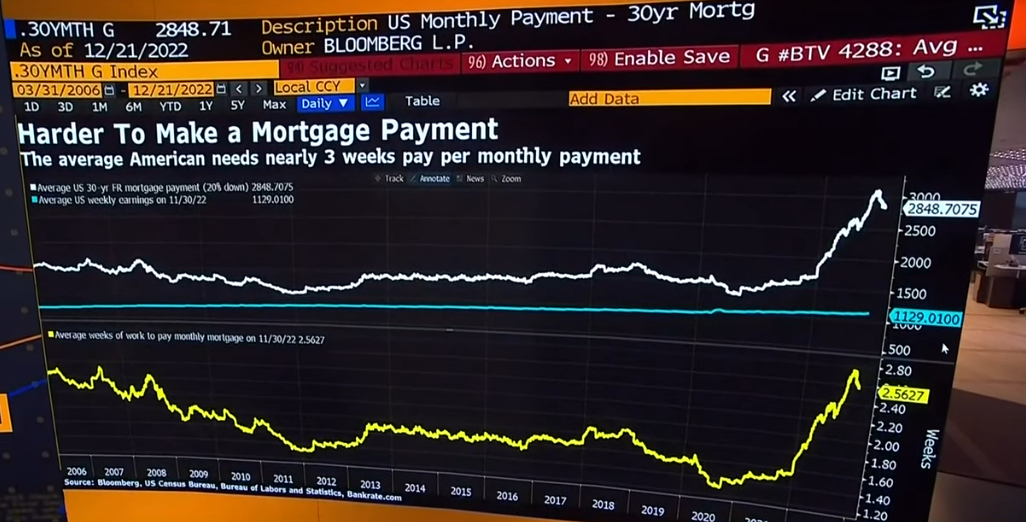

Homebuilder sentiment turns positive for the first time since July - YouTube

People starting to get used to this 7% rate, if they can afford it.

Apple is out of the low-margin, high competition industry of EVs.

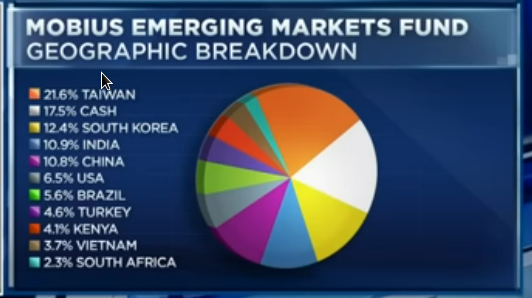

Indian as an EM has more transparency in the data than others. Combination of transparency in reporting and of fundamentals.

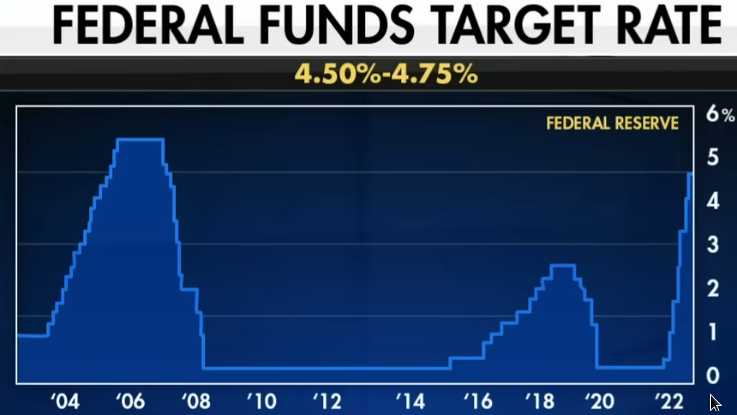

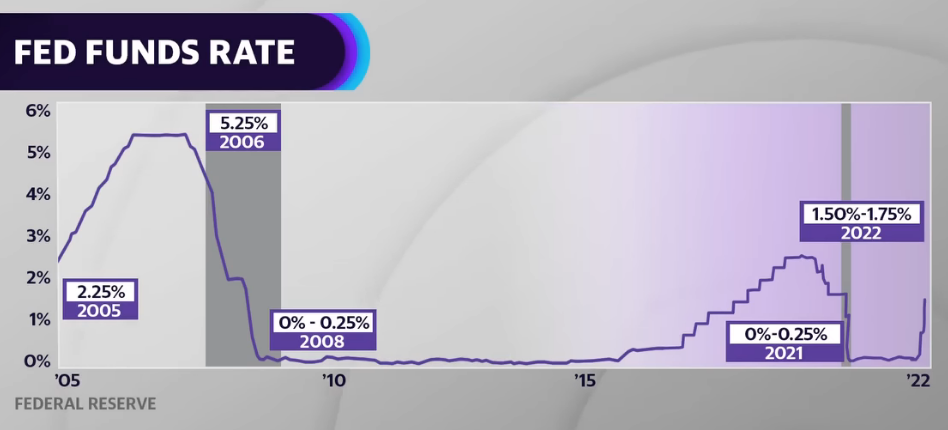

5% Fed funds rate 'not restrictive' at this point, says Richard Bernstein's Michael Contopoulos - YouTube

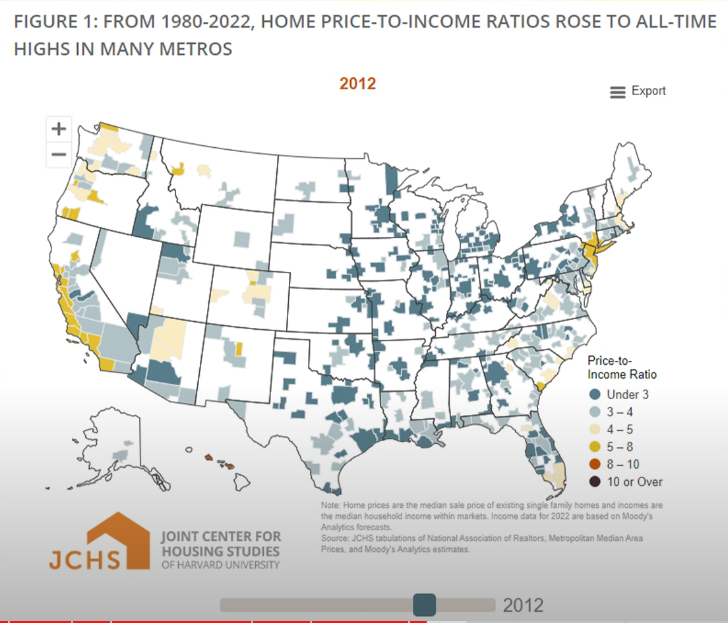

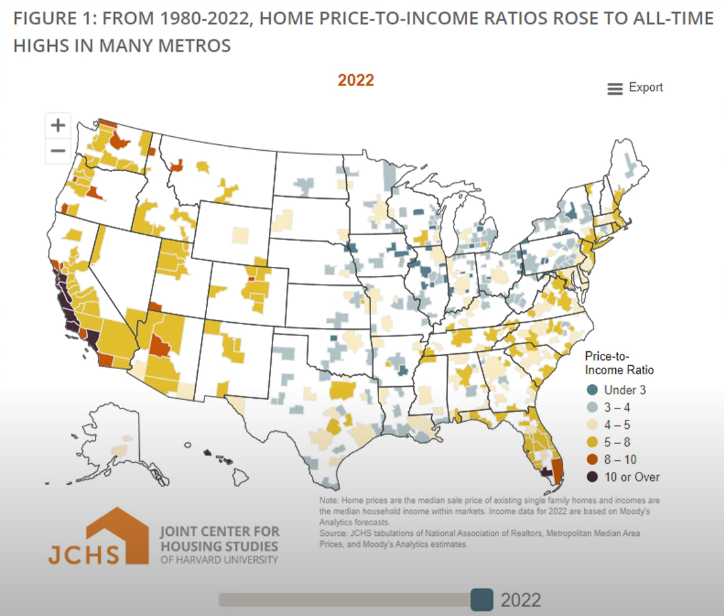

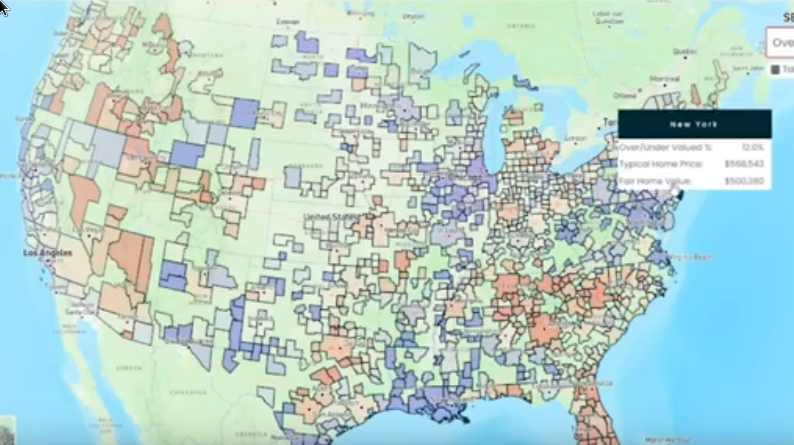

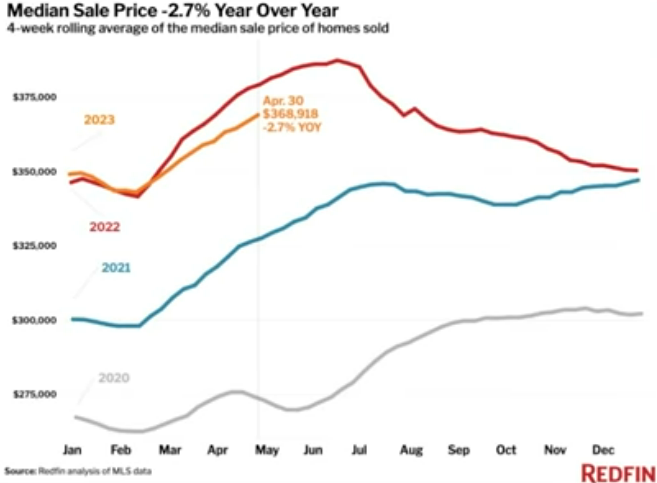

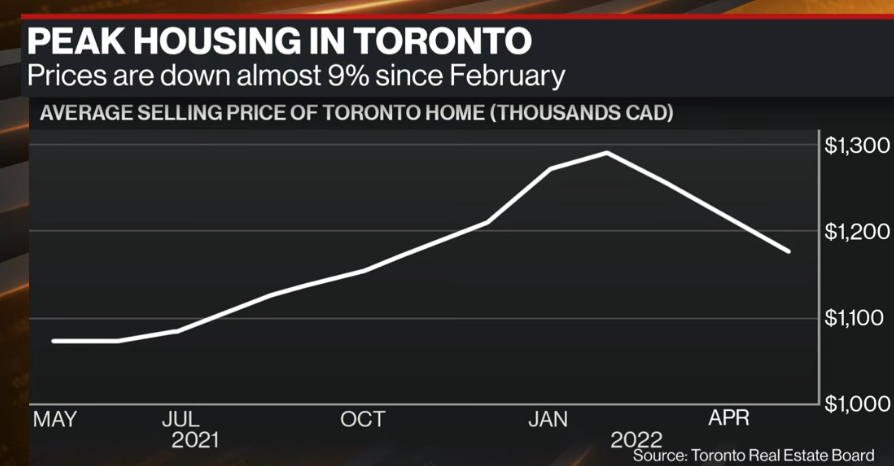

Home prices are going back up.

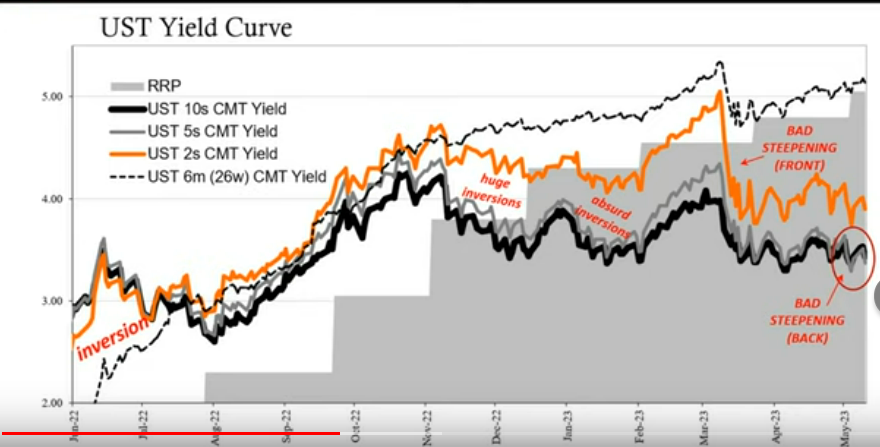

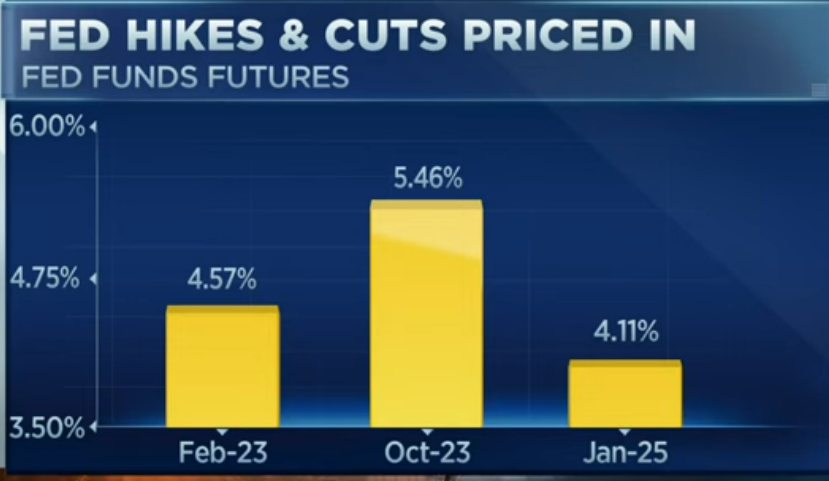

Starting to talk about a hike.

How Nintendo Avoided Massive Layoffs - YouTube

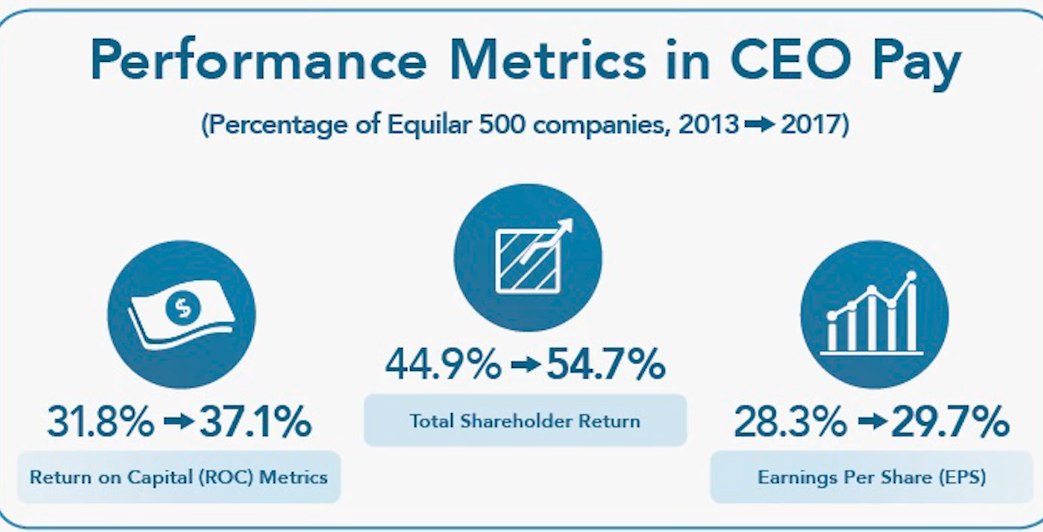

He argues against ‘corporate America’ (different from capitalism). CEO took a 50% paycut. Sometimes the owner of small businesses take no income because they had to make payroll, that's a normal thing in small business. If you lay off people to keep making profits every period, no one wants to work for you, because you're not a leader.

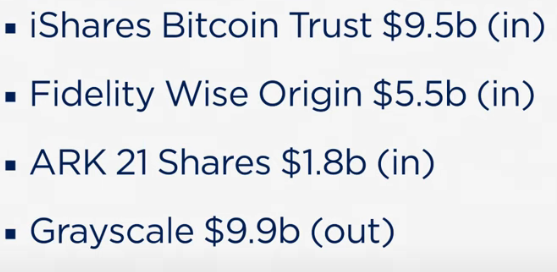

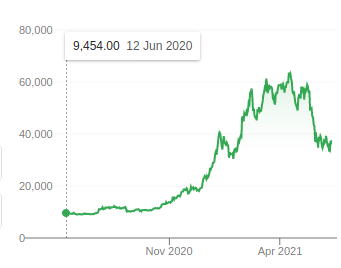

Bitcoin. Today asset class (crypto) is $2.5t, but if 3% of all assets end up in crypto, it will be $6t asset class.

The tokenization of a lot of commercial assets. Storing digital assets or property. Tokenized economy could be $20t by 2030, which would be 10% of all the tradfi assets today.

Halving probably priced in. Most of current move is the credibility lent by institutions and the allocation.

‘Bitcoin is the gold of the crypto market, Eth is the oil’.

‘Most of capital markets will be tokenized. Most of the record keeping, settlement payment, reconciliaiton, will be on blockchain, and the oft talked about instantaneous transfer of ownership will be instantaneous.’ Civil asset forfeiture, anyone? Freezing of bank accounts of labelled-by-government-‘terrorism’-supporting citizens/ 2-years-later proven-in-court law-abiding protesters', anyone?

#humanrights

Ali will probably be profitable for a while but will eventually be out-competed.

Analyzing Economies: USA, China, Japan, Russia, India, Korea, & More - YouTube

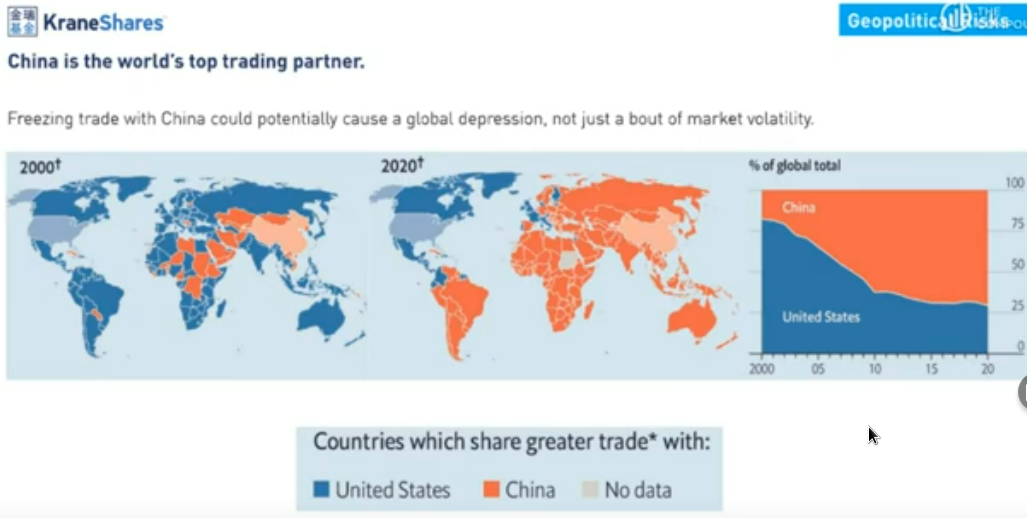

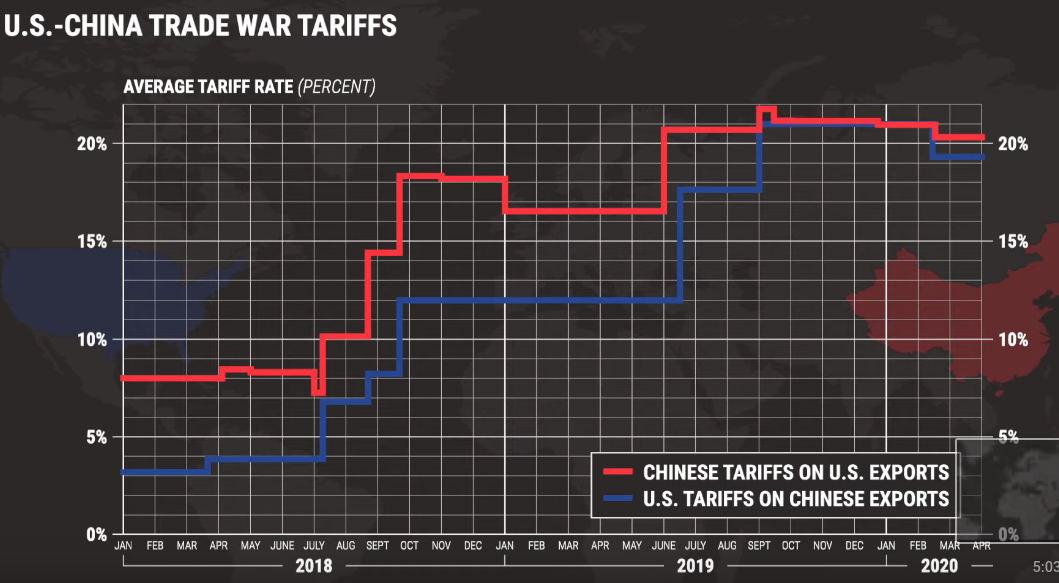

China, many places will block its stuff (like EVs) (not just through tariffs but actually just block). The countries (India) who want cheap Chinese stuff don't have a lot of money.

China graduation level currently low.

Japan's low fertility rate (bottomed out about same as Europe) is higher than anywhere else in eastern Asia.

Japan permitting is relatively easy for making chips and other things. It took only 1.5 years to get up and running.

IBM, which doesn't even know how to make chips, is making a chip in Japan now.

Japan and Korea are now friends. Papered over historical things, small reparations, no truth and reconciliation. Young people like Japan, like Korea.

Koreans work a lot, have very few kids. Korea reportedly has gender problems. Korea has a lot of debt. Koreans like to consume. Koreans might pump up immigration (Vietnamese).

Taiwan is centered around small businesses, like Germany. Taiwan remains rich and poor. TSMC is not typical, but might be a bellweather.

Vietnam copies China pretty well. Samsung phones are made there. Vietname is cheaper, less regulations sometimes than China (for Chinese companies), less ‘under the watchful eye’. Needs bigger businesses, which the government fears. Needs more college education.

India incredible poverty was ended by rapid growth, massive transfers (to make people not so rural which was the problem). Get people food, get people houses. They got food and water. Now they're doing trains etc. Girls are still not going to school. Factory workers are all women.

Pakistan is a mess. Poor but not fast growing, doesn't invest, consumes whatever it gets, borrows from IMF and defaults. Has nukes and tariffs. Low income. Military coups, power struggles, instable, two main provinces in constant revolt basically. High crime. Fertility high. Nazis. Trying not to be dragged into China alliance and China's conflicts globally. Pakistan started out richer. Focus a lot on competing (militariily) with India.

Philippines leadership less wild. Less corrupt. Because recent leaders left.

Aus is a masterclass in creating a nice society based on mining (bauxite and coal), supplimented by high end services, high minimum wage. Doing better than Canada, has institutions that we could copy, and are copying (Biden copied income based repayment of student loans). But international demand controls their economy, at risk of China reducing purchases.

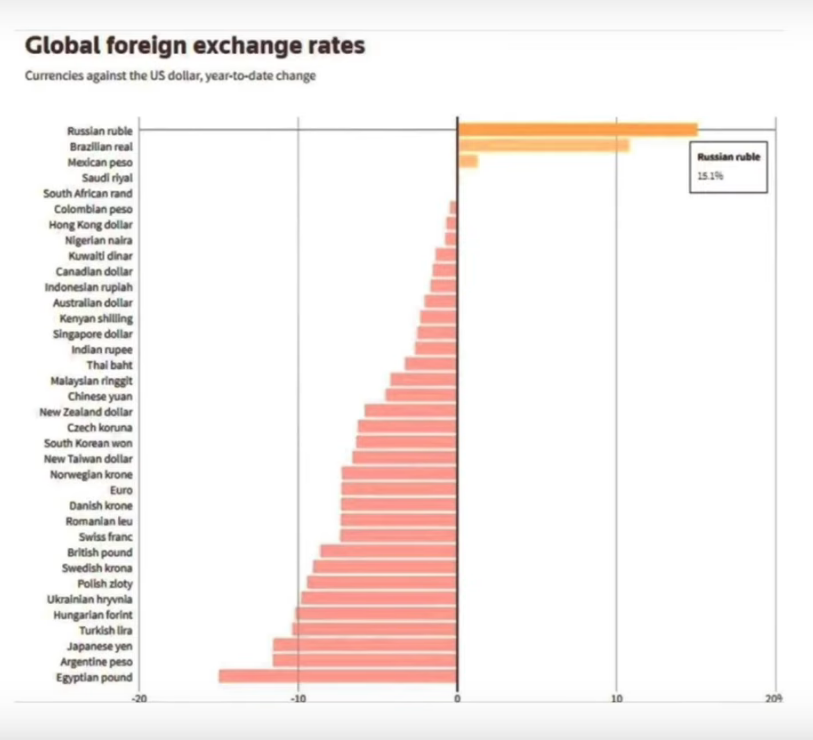

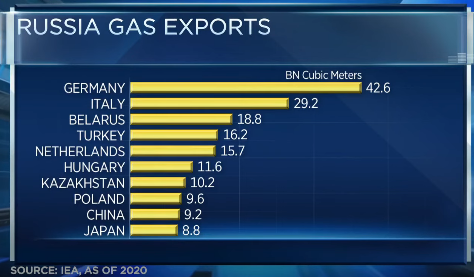

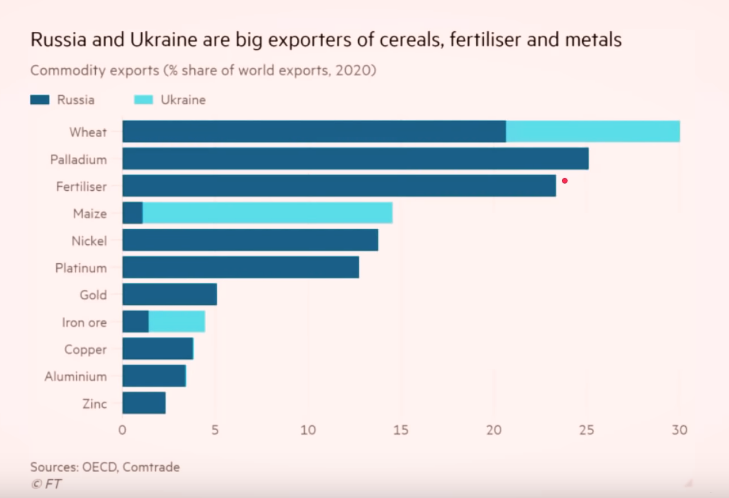

Russia is on a wartime footing, war economy. Everything shifting to war economy. Germany selling through third countries to Russia. China is buying Russian oil and selling Russia its stuff, but this is a business relationship. If price of oil goes down, China will drive a hard bargain. India buys military parts from Russia. Likes that Russia can protect them militarily from China.

Interest rates and inflation high.

Russia still import dependent.

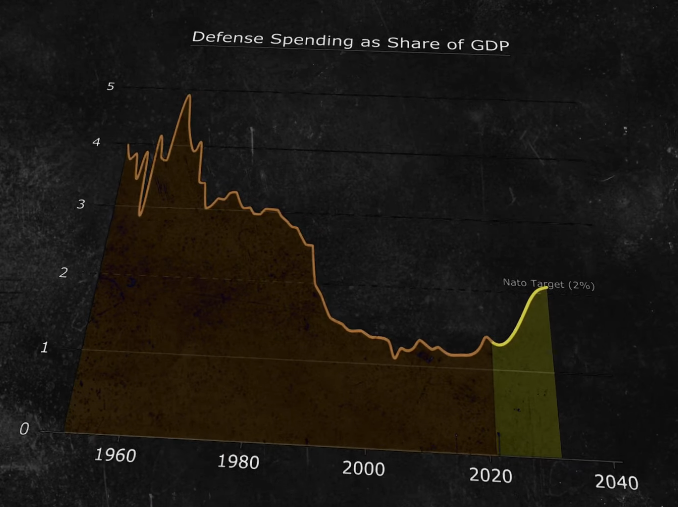

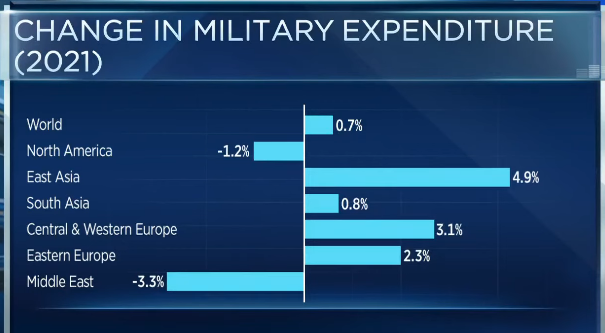

Russia's reserves running out, will run out this or next year. US no longer backing Ukraine like it was. Europeans are backing Ukraine. France, Poland (4% of GDP for military spending, drones).

Poland is same size as Ukraine, but better tech.

AI. Routine jobs will be out. Decision-making not, maybe.

There will always be full employment because of relative costs. Erik Torenberg. Famous CEO is a good typist but hires a well-paid typist. They'll get paid very well to do these little tasks, because there'll be so much wealth. He thinks people will still be doing tasks even if AI does it better.

AI could be worse. It could be malevolent.

People already prefer AI doctor's bedside manner. AI girlfriends are already popular.

The year of AI efficiency layoffs. Like 90s with internet.

Routing the right task to the right model, which will be smaller than the total everything models used on ChatGPT right now. Small models on the device even.

It's not even ‘liquidity,’ it's juts ‘money printing’, said Lynette Zang

Inflation. It's just not the US dollar going away, it's the entire system, which has to reset into the new system.

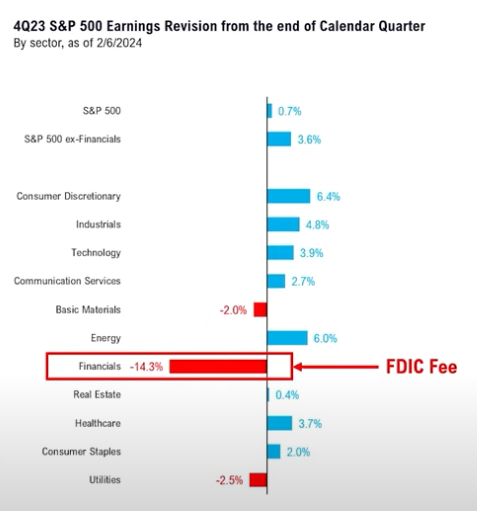

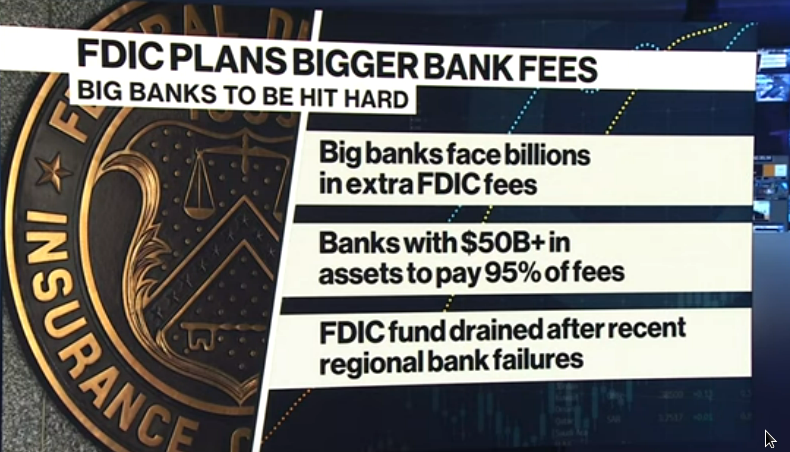

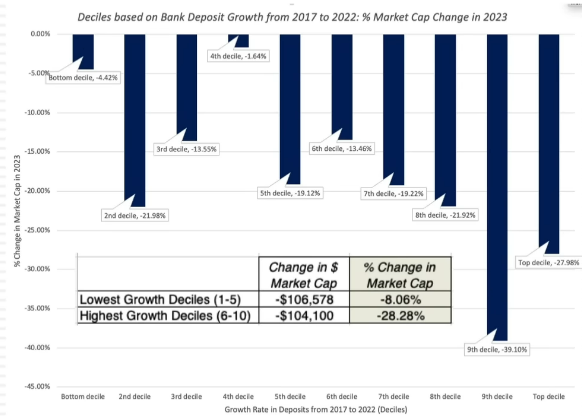

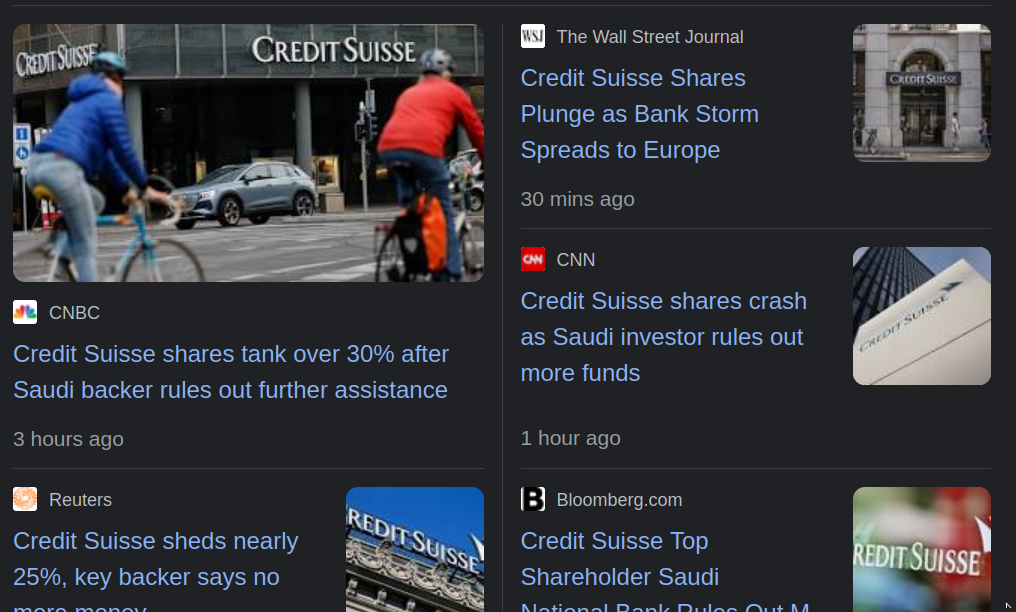

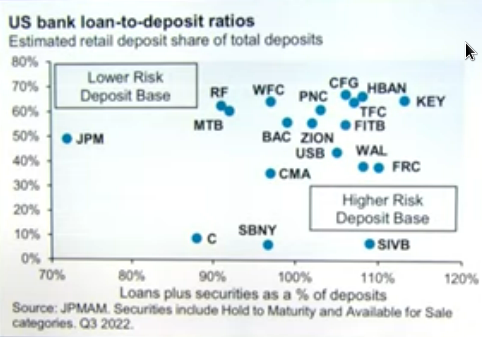

The banks are all insolvent right now, she said. All banks, because they're based on debt. Interest rates have pushed down market valuations of all that debt. Derivative bets against those debts. Debt at high levels. Fine unless forced to liquidate.

Mnuchin came in and bought NYBC with private money.

All this means everything, houses, clothes, can be tokenized and put on your phone.

Risk transfer from many to the few, maintaining the system will be too expensive, market will crash. From Debt to Hyperinflation: More Banks to Collapse As System Implodes, 'They Need a Crisis' – Zang - YouTube

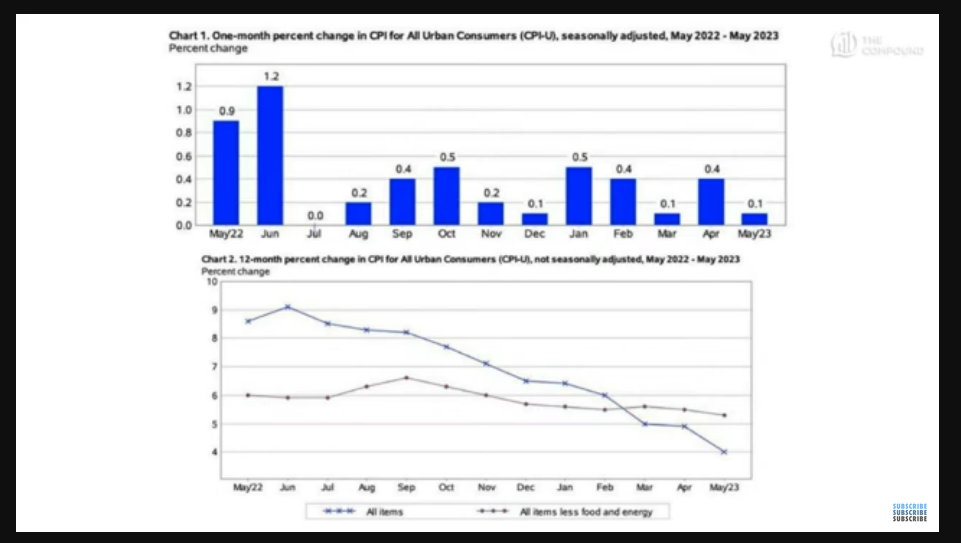

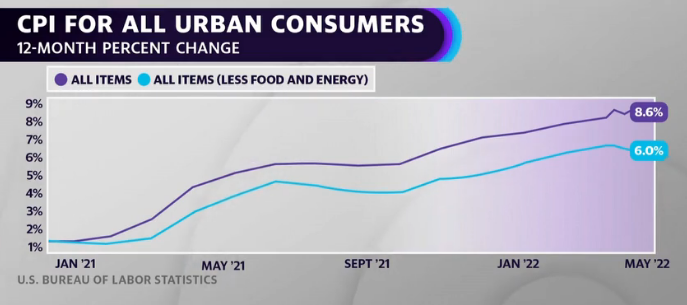

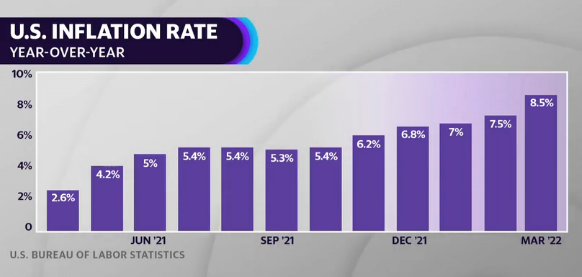

2% inflation, people don't notice it. Not that the price stays the same, but that the public doesn't change its behaviour. But if it happens quickly, then they notice and they don't trust.

After 70 years: German national team takes off adidas, puts on Nike | DW News - YouTube

Microsoft did another aquahire of a whole AI team. Speculation that they have so much difficulty doing anything because of their monopoly they don't bother to buy the asset but rather just hire the people.

Is this a new way to go around antitrust? Just buy a team or licence something.

Large-scale bitcoin miners are competing head on with AI companies for power: Marathon Digital CEO - YouTube - Mar, 2024

- Mar 15, 2024

-

If you could teleport gold from Tokyo to NY in a couple minutes, people would like it.

#Crypto

It's not digital currency. It's digital property. It's capital preservation for everyone.

Michael Saylor: Bitcoin, Inflation, and the Future of Money | Lex Fridman Podcast #276 - YouTube #Saylor

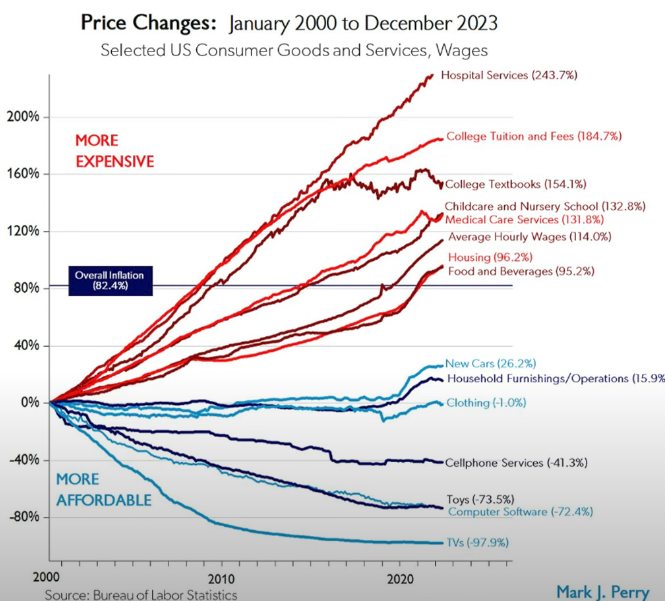

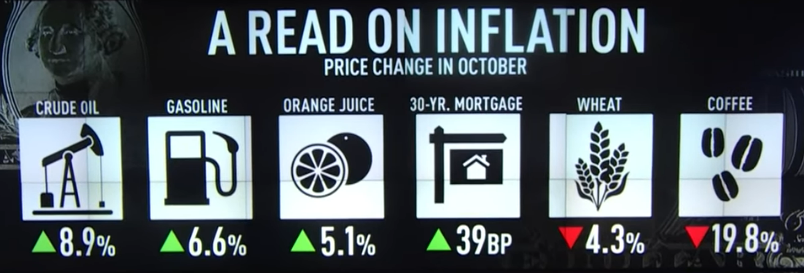

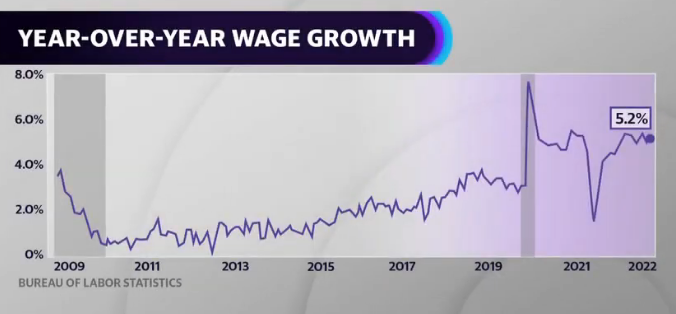

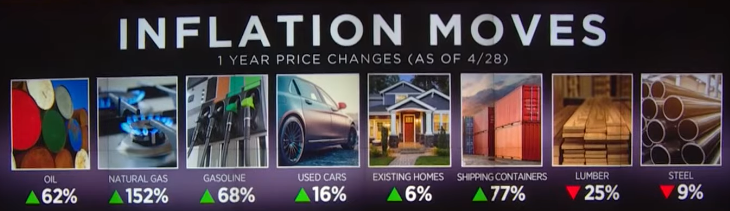

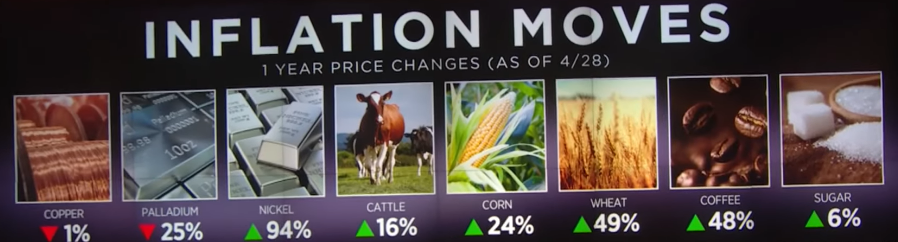

Inflation CPI understates the suffering inflicted upon the working class and on companies by the political class. It's a massive shift of wealth from working class to propertied class. Shift of power from freemarket to the centrally governed or controlled market, from people to government. Saylor

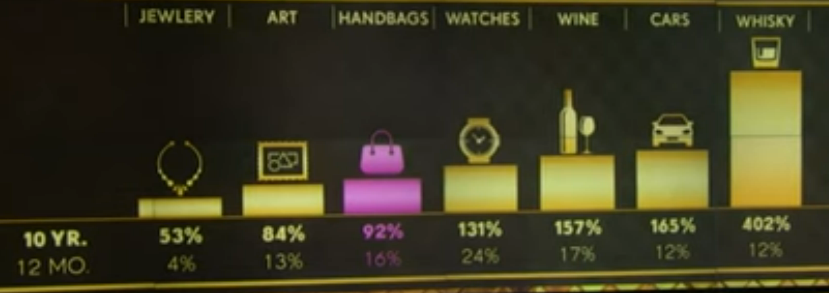

In an environment where you're infating the money supply and keeping assets constant, assets will appreciate in proportion to money supply, and the scarce desireable quality will determine value of inflation. Money supply expands 7% per year on average. Many houses have gone up in price more than 300x in 100 years, or around 6.5% per year. You're sucking 6% of the energy of the fluid that the economy is using to function. Currency moves economic energy around.

All government policy is inflamatory and inflationary. Any policy. It interferes with free market and prevents some rational actor from doing it in a cheaper, more efficient way.

Wars (and other policies) are never paid for with taxes. It's too transparent. If people understood the true cost, you will lose 95% of everything, you might reconsider a policy and vote for a politician. A lack of humility. People overestimate what they can accomplish. Experience causes you to reevaluate that. Our mistakes are our good ideas that I enthusiastically pursued, to the detriment of my great ideas that required 150% of my attention to propser. People pursue to many good ideas. There's a limit to what you can accomplish. Everyone underestimates the challenges of implementing, overestimate the benefits of the pursuit. Overexuberance. As the exuberance of the government expands, so must the currency supply.

Inflation is completely misunderstood. Inflation is a vector tracking price change in every good and service.

You can't blame them, because economists don't even understand economics. If they did, they would measure every price of housing, the full array of foods and the full array of assets, and they'd publish this every month.

The primary problem is ‘The government will try to do good.’ It will do more harm than good. They will try to pay for it by expanding the monetary supply. They won't realize this. They'll collapse their own currencies, and mismeasure how badly they're doing that. They'll say the dollar lost 95% over 100 years. Actually it lost 99.7% over 80 years. They'll overestimage their budget and means to pay for it. They're oblivious to the damage they do to civilization. The mental model they're taught, it's Ok we can print lots of money, is defective. ... Other countries lost 99.9% or all (currency failed).

If house prices are going up 20% per year and I say this is great for the American public because most people are home owners, I'm misrepresenting it because it's really a negative.

Look at the ship next to us. What if I told you your ship leaked 2% every year. It's rotting 2% per year.

MIT costs hundreds of years of many families earnings. Inefficient. The seats are uncomfortable, too. Now we have the same teachers you watch on your chair at home. You need PHDs. A PHD is $1m. There's 10m in the world. How many people COULD get a PHD if it were affordable?

If you try to solve this by throwing money at it, you can throw a trillion dollars. $10t, you still don't get there. Harvard can't educate that many.

Education can be infinite and for everyone.

Open, permissionless, not censorable. Non-sovereign bearer instrument. Property. Irregardless of anyone else or government. Twitter stock will never be property in China. It will never be trusted. Property is low-frequency money. If you wanna hold it for a decade, maybe you buy a house, maybe in a decade you sell the house and buy the property again.

What makes bitcoin ethical (to endorse) is no person can change it (well, but they can if they have influence or power). No one can do what they could if it were a security, print 1000 more copies tomorrow.

Bitcoin is the first time we created a digital property. Everything else is securities. Sending money digitally is an IOU.

An armed society is a polite society. If you disagree, you can always withdraw your resources from it.

You can promote a property to the extent that you don't control it, ethically. There's an interest still, but that's different from a conflict of interest.

8b people with mobile phones serviced by 100m companies doing billions of transactions per hour. The companies are settlings on the base level, and the companies are dealing with the consumers on proprietary layers like layer 3, and on occasion people are shuffling assets on layer 2 (moving $50 or something).

You can't trade with a company in Nigeria. No amount of money or time. You get shut down at the banking level (you can't link a bank there with a bank in the US). At the credit card level (because they don't have the credit cards so they won't clear). At the compliance/FCP level your system is from a different political jurisdiction and it can't interface with theirs. You can do it with crypto, fast, cheap, with anyone.

Bitcoin's a universal trust protocol. So is English. No one's payment system works everywhere. US payment systems in Russia? But bitcoin also can't be done easily in these places.

No security can be a currency for the internet. Only a property can be.

If bitcoin goes up, because of how much he owns, Saylor could become the wealthiest person.

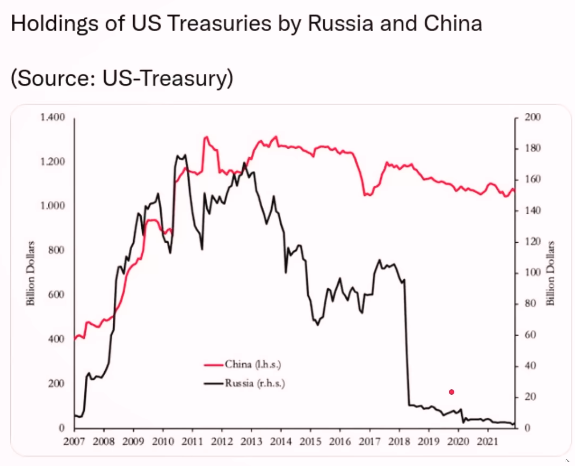

The Canadian trucker protest educated millions of people and made them start questioning their property rights and their banks. War in Ukraine was the second shock, Russian sanctions. Hyperinflation in the rest of the world a fouth shock and persistent inflation in the US a fifth.

Bitcoin's volatility attracts all the attention, massive gains and losses, which sucks money into it. Also, it results in massive gains for traders, and that attracts capital.

Temu spent $1.7b in 2023 to advertise and got, in a year or two, 161m users, nearing what Amazon has. It might spend $3b in 2024 on Facebook, Insta, Tiktok, Suprebowl. Temu replicates what Ali did. In 2023 sold products at a loss of about $7 per order. But others say it isn't really losing money.

Temu connects factories with customers, cutting the middle man.

Temu gamifies shopping with games on the app to win prizes. They have countdown timers running on each product to show when a sale ends.

Temu shows that consumers are willing to wait (not fast shipping) as long as the price is cheap.

Morgan Stanley reported they think their growth is cresting.

The quality is low. Safety is a question.

There is a data risk.

China considering liberalizing household registration program. Currently migrant workers in cities can't access any social benefits because their household is registered back in their village. If they change this, they can buy apartments etc in the city.

China is buying ETFs, stimulating their market similar to US did.

If China changes just a smidge in the right thing, they'll attract tons of foreign investment.

China government has the money to spend.

China continues to clash with Philippines fishing boats etc. Some concern it could go too far.

There are hundreds of millions invested in Bytedance out of the US, which represents billions in value.

This week lots more headlines on China, not negative, some modestly positive.

China growth more in lower-tier cities. Tier 1 and 2 are 20 or 30% of economy, 6 or 7% of population.

China the companies that have outperformed have been doing outside markets. Growing rapidly overseas markets. Appliances and durable goods benefit from this trend, maybe.

Some China sectors in bull market of 20% off low. Materials, renewables, smaller cap tech.

Miniso CFO discusses company's plans to add about 1,000 stores a year over the next 5 years - YouTube

#Retail #China

In some countries (Nigeria currency) it's ‘staggering how much wealth was preserved.’ 'Until you get countries that run more credible fiscal policies, people are gonna wanna buy that story, and it's a story that's spreading.'

The monetary policy for this ecosystem was set in code by Satoshi whitepaper.

Chinese space company founders are coming in significant part from Finance (like America). Samo thinks maybe they're coping it from America, but that they don't have an Elon-tier person so it won't happen. But even if they did it would be, internationally, so controlled, similar to exporting nuclear reactors, where you better be on good terms from US or a similar Western country if you want to buy these instead of making them yourself.

Jack Ma may have been an example of the highwater mark of how much impact on Chinese society can a purely commercial or technocratic actor that's not aligned with the CCP have. The ceiling is pretty low. Not even critiquing their policy.

China is not like Singapore, which will use a sovereign wealth fund that will try to develop a totally new product, a novel solution to a problem. (Singapore working on insect protein, which is kind of what you need for a tiny city state to feed its population.) When China says they're going to invest in AI, it probably means close the AI gap by copying the US. What makes the individual threatening to the CCP is their popularity. If they offer something Chinese people want or like, they'll be liked too much.

Might be a spot ETF for bitcoin in HK, and there's a lot of interest.

To do this, you need a bunch of financial institutions working together. The stock exchange, regulated asset managers who can manage the product, licenced brokers called participating brokers, and depository services who support the running of the fund. In HK also asset custodians in cash and crypto sides. And good quality market makers to support a product after it starts trading on an exchange.

They've seen how the US did it and can use that roadmap.

The HK might have an advantage over the US product because you can actually pull Bitcoin out from the funds.

The HK fees have to compete so be as low as what they US ones were set at.

They can't launch too fast because they think most important is to have a product people like, a quality product.

Eth etf race. US hasn't approved any product yet, so there's a more global race for that. Being first to market is critical for players investing in that space.

China, reportedly the young are really spending, and it's their income that is limiting their spending.

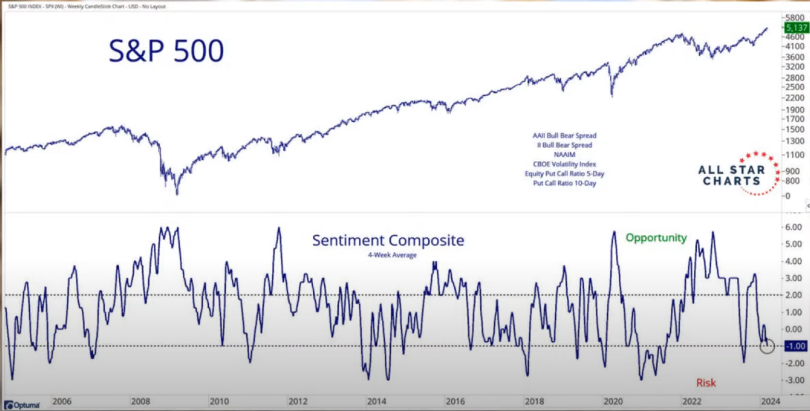

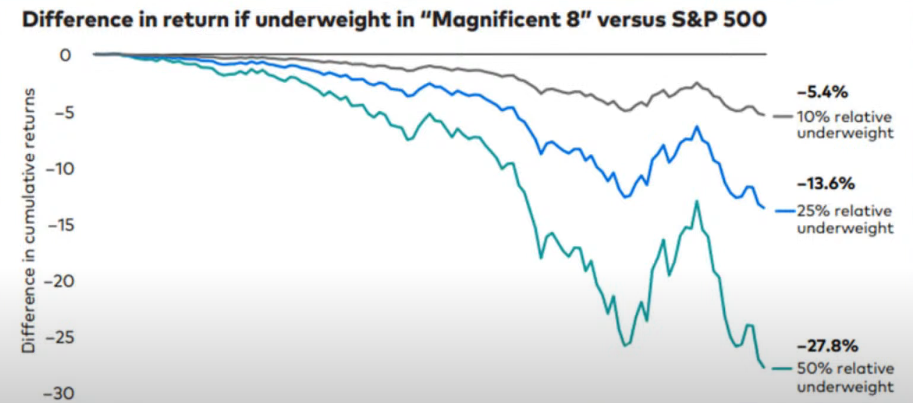

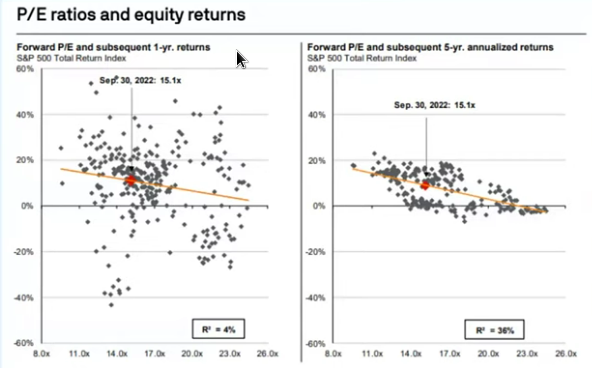

S&P large cap around 15x the mag 7. While the Russel2000, looking at the profitable companies, around 12x. ... When rates cut there will be multiple expansion plus risk appetite growing, perhaps. Tom Lee

‘The fallacy of a 2% inflation target by the Fed’ - Bookvar

Because of technology, 'prices usually fall. Tech prices are keeping a lid on goods prices, and that's 0, then something else has to rise by 4% to get to the 2. So J Powell is actually rerouting for higher other prices to offset that natural decline in prices from technology, and that makes no sense.'

The reason why there’s a 2% inflation target is not for the best thing for the economy. ‘If the inflation is at 2, ideally we would have a Fed funds rate of maybe 4, and if we go into recessoin we’ll have 400 basis points to cut in a downturn.' ‘It’s right for their own policy.'

But they do also think 2% is good for the economy. It greases the wheels of the economy. You want a steady modest rise in inflation so people go out and spend. ... But there are a lot of people who would say the right level of inflation is 0.'

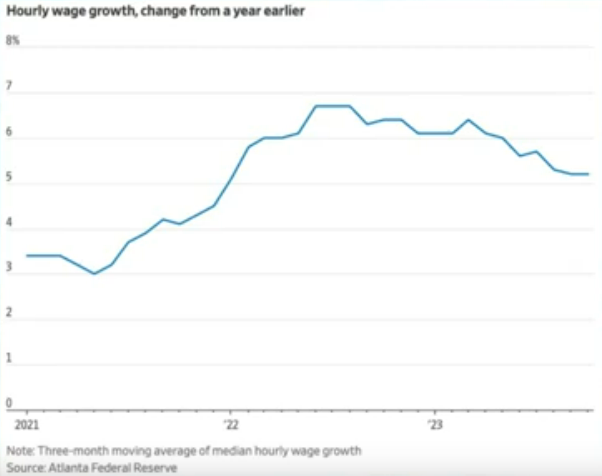

Restaurants don't have a lot of productivity levels to raise to offset higher wages. You only have one and that's to raise your menu prices.

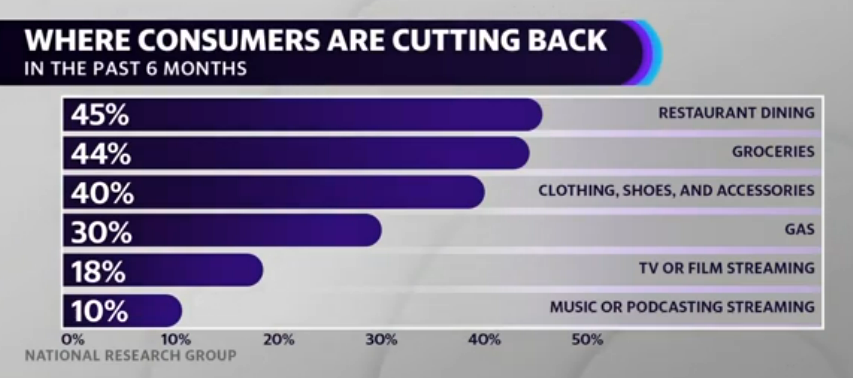

VISA sees everything, every type of consumer. If the consumer is trading away from Macdonalds and going to Taco Bell, VISA sees the spend.

They see basically no weakness anywhere on last call.

There's also a shift in how people spend and pay. They pay with cards and don't even carry cash. They buy less for stuff around the house and go out to eat more.

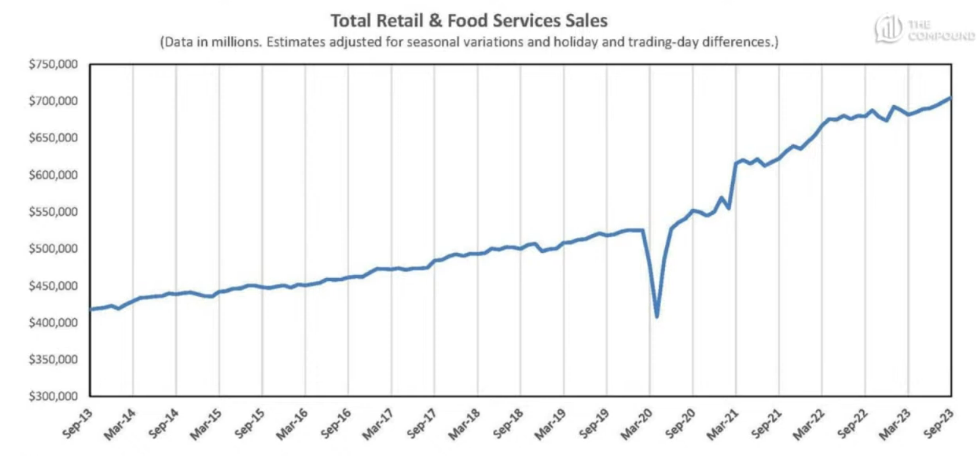

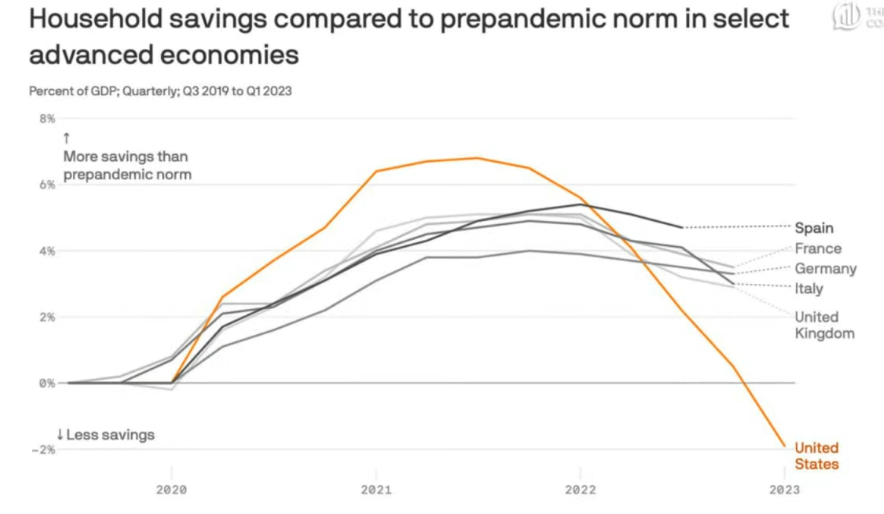

BofA says there are still excess savings. The lowest savings accounts still have a few thousand in there. They have 4x than what they had saved pre-covid.

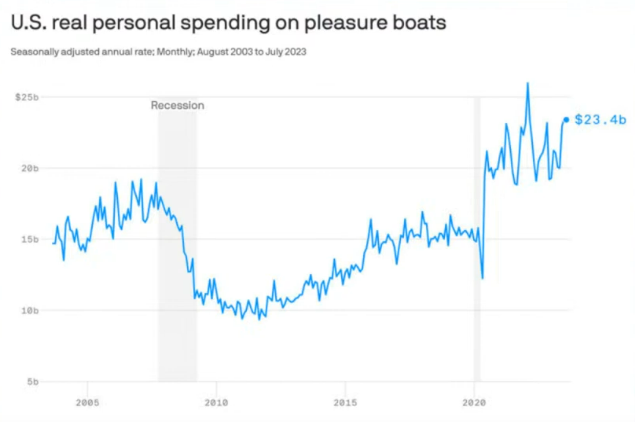

Cruise lines said they've seen no slowing in spending. Home restoration supplies are a little soft, because they've been booming for several years and that's already done.

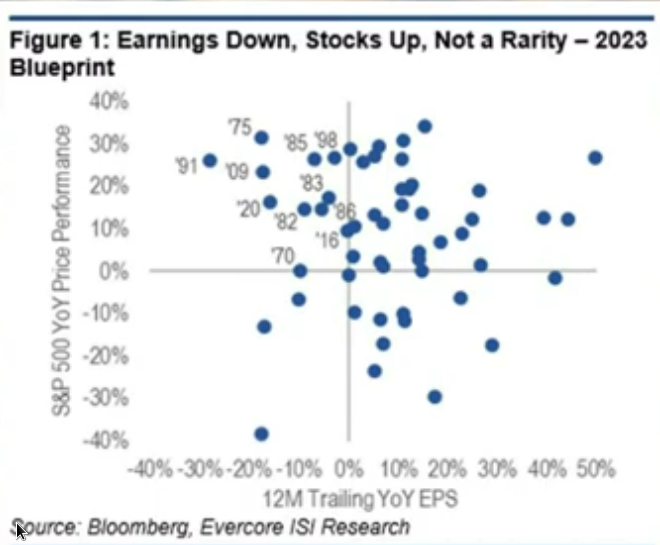

Fed might have been suprised by QT not having an impact. Then the AI boom in 2023 and earnings recovery animal spirits. Fed might have been thinking they were sailing into a deflated direction but AI boomed, and tech companies buying from each other meant high revenues.

Nvidia's biggest customers today are trying to be its competitors. They're all trying to make their own chips.

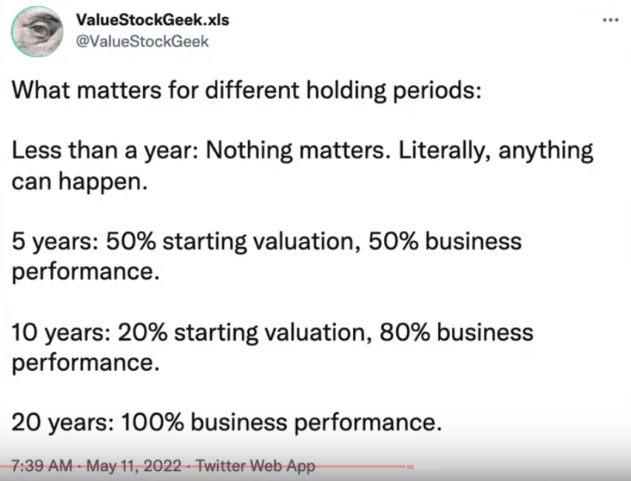

When a stock goes vertical (on good news or whatever) you're pulling forward a lot of future returns. It matters what you pay. A stock parabolic move can pull earnings forward 25 years.

There's a pro-shareholder thing going on in hottest stock market Japan and hottest EM India. Whether they're actually doing this for the stock market not sure. Whether they're looking at US and saying Hey maybe there's something there not sure.

China's middle class, over the next 5-10 years, will go from 400m to 800m (add the size of US population). Chinese love to travel to Japan, Singapore, Thailand, Indonesia, Vietnam, India. Middle class stories. Chinese travellers sprinkled $250b around the world in 2019. Shopping luxury, eat out, experience things. The more they make the more they wanna buy.

China, even if grows 3% per year for 10 years, in terms of dollars that's still a lot of dollars.

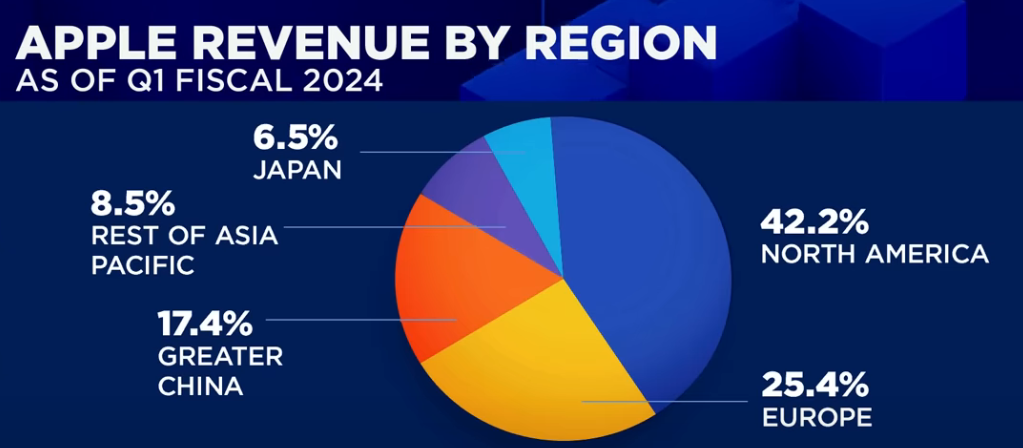

Apple needs another China, but the whole (asia) region will be that. But they have to compete against $10 Chinese phones.

Netflix et all used to be like How do we get these movies to open big in China? Now it's all India.

India printed an 8.4% GDP number for Q4.

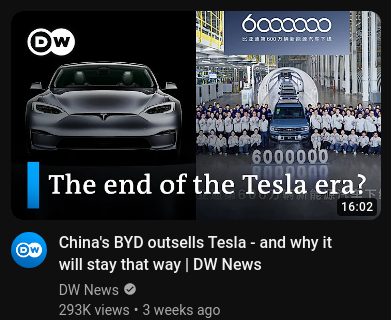

Tesla, multiple is still so fat. No margin of safety when fundamentals turned to the downside. Has to reach a bottoming in sales numbers for dip buyers to return, maybe. Hybrids are so hot, and that wasn't assumed years ago, they thought it was EV or not. The hybrid bridge. Toyota was in it, no one else. - Mar, 2024

- Mar 11, 2024

-

-

-

-

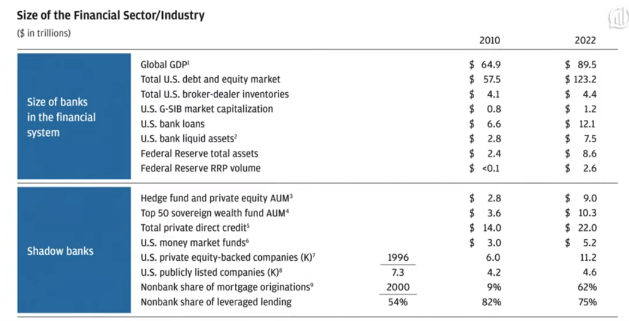

Private credit bubble. Chairman of UBS.

PIKs. We prefer less transparency, we want them to lie to us. Huge forward risk. Things are not being priced appropriately.

Streaming isn't profitable, people are saying.

Alibaba to Invest in China AI Firm MiniMax at $2.5 Billion Valuation - YouTube

Government regulator website featured(endorsed) Eddy Woo. Endorsing in what Alibaba seems to be doing (for now), which is investing in one of Xi's key initiatives, AI and cutting edge scientific innovation.

China looking to lift all foreign restrictions in manufacturing sector, they said, it's reported.

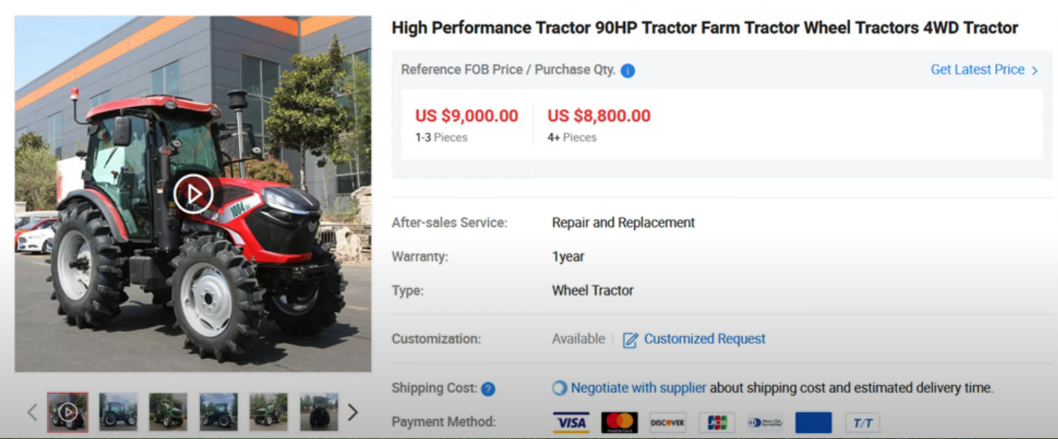

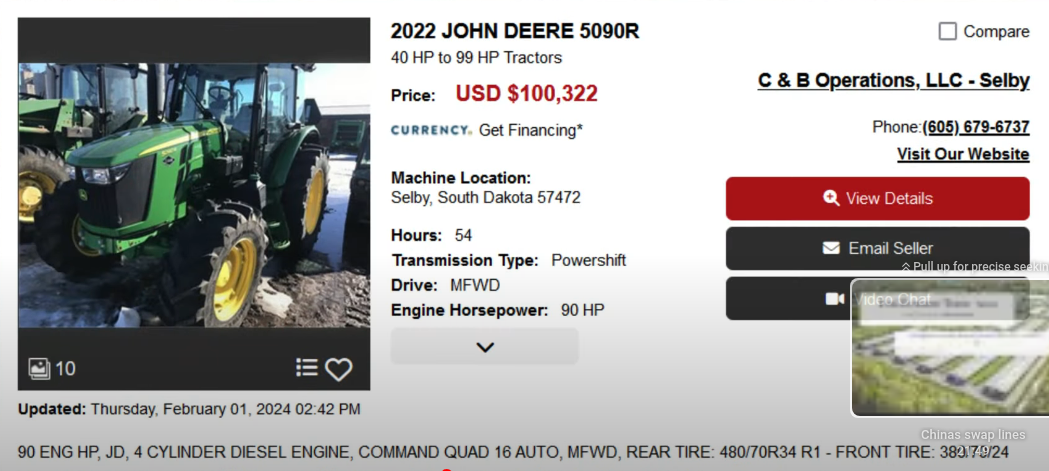

Investors Beware: US farmland to see historic price crash, amid soaring global ag productivity - YouTube

US paying much more for machinery than rest of wrld. EPA is part.

#China

Wall Street investment funds lose billions on Evergrande bonds gamble - YouTube

People outside China don't understand China. These things (property speculation gaming, Evergrande failure) aren't problems, they're solutions.

China wants 100s of m to move to cities.

We can't learn very much from China other than that the system/structure is very different, they're starting from a very different place. They can just build roads and infrastructure, but that can't be done in the West because you can't just kick people out of their homes. The West prefers our structure, so the things achieved in China can't even be considered in the West (to be done in the same way as China). Clifford Coonan

China's government doesn't have disputes. It just gets rid of oppositions.

Live: How China plans to resuscitate its economy | DW News - YouTube

You can't subsidize EVs or solar panels in Germany to the extent of China, where the company's DNA has the state in it. Theoretically the subsidies on Chinese imports to Germany ‘should be massive’ to protect an industry that will otherwise disappear, like Nokia, whose tech was absorbed and more cheaply produced and sold to into the market. Germany used to have solar panel companies but China subsidized theirs and they exported to Germany. Germany didn't combat this with subsidies/tariffs, and now German solar panel companies sell Chinese panels.

On the other side of things, China could theoretically grow in lots of areas but it's limited by the structure of control by the Party. Internet, journalism, communicaitons, privatization (insurance), tech companies. All are part of the broader picture of economic well-being. The West can do these things. The internet in China is just buying and selling goods.

And the Party can't really reform. It can't make a lot of these reforms. They would be fundamental reforms. It would require levels of freedom that it cannot tolerate.

Cash for clunkers policy in China. They buy your old car or home appliances, and want you to buy a new one. In the past people would just save the money to pay for education etc. Now the money goes straight to their phones and they have to spend it. (Smallish effect.)

China big focus on exports. State subsidies, loans for EVs, probably will be for chips.

China has no green party, so climate change is not an issue in that way.

China, because lockdown was so severe, is perhaps still reeling from that. Could this mean growth for another year just from continued unfreezing (they did 5% last year in whatever part because of this)?

China has deflation. You won't buy a big ticket item if you think price will go down.

Making difficult decisions to protect national brands, not shortterm sales.

China property markets represents savings for a lot of Chinese. Is destruction of these savings a tacit goal?

A porsche, a lakehouse, first class.

China will export components, parts of manufacture, in their move to circumvent tarifs and sanctions in export, relocating manufacture to other places.

2017 China started cracking down on unsustainable growth in banks. Depositors have become cautious in investing in high-risk products. Leverage.

State owned banks lend to domestic businesses. State funded.

Insuring project completion. Banks will be selective in property development. Safeguard asset quality. Not just affordability but confidence the projects will be delivered on time.

China mainland stocks. Fundamental investing is not quite working because there's a lot of structural outflow. Policy and regulatory uncertainty, people are just giving up. Low return on effort. But the reset might be largely done.

Look for companies that can help themselves, reinvent themselves, improve operating efficiency, find new markets, be winners of industry consolidation.

China macro is quite unpredictable.

Musk Vs OpenAI. If people can form a company as a nonprofit (lower tax) and then make it public and make profits, why wouldn't everyone do this?

Microsoft bought 49% (estimated Microsoft invested $10b in OpenAI). Microsoft has gone up $63b since OpenAI, putting Microsoft at $3t, the largest company in the world now.

It appears OpenAI started opensource, with the stated concern that one company (then Google but now Microsoft appears the same thing) would get all the benefits of AI. Elon was a big investor, the biggest investor, on tihs goal. They got other investors, on the idea it was opensource and would benefit everyone. Then it was closed. (Did they also remove all the opensource people?) Then they raised money on the idea of profits and employees sold a couple billion of stock into their pockets. If it had been opensource, Microsoft could have just used the models for free and not had to pay OpenAI.

There's also consideration Altman may have used the openAI name to do other deals not for OpenAI which might be in the region of taking the corporation's opportunities. (Alman may be getting corporate opportunities as a form of compensation when perhaps he should just be getting compensation in the corporation and the corporation should own all its opportunities. He can monetize the ecosystem. He ‘famously’ doesn't get compensated at OpenAI directly.)

Musk put in the first $40m, most of the money. Elon would own half the company if it had been initially private, maybe. So maybe you could give him 20% to make him whole (but Elon doesn't want money it seems)?

You would think it was more valuable in 2020, nonsovereign, decentralized, the fundamentals seem good but the product wasn't valued. ... 98% doesn't understand it, it's a bit too complicated, they're afraid of it. Saylor bought Amazon, Apple, Facebook and Google. ... Just because you don't understand it doesn't mean it's not true. ... Then, in 2020, 20-somethings know they should buy Amazon, every Uber driver knows that. Get off the mobile wave, get on the crypto wave and think that through. It wasn't without risk but the alternative was throw in the towel pretty much.

Companies forget what it means to make great products.

Rebecca Patterson says China is biggest factor driving gold prices higher - YouTube

From 2k to 2200. China government has been buying reserves 16 months straight, not expected to stop. Chinese people putting money in gold because where else?

Gold's not a story until it is.

I haven't seen gold in economics news for months, not even one headline.

The Downfall Of Amazon Has Started - YouTube

New fees (which theoretically should have been there before but Amazon bore them itself to win over sellers). Fees for carrying low inventory (so Amazon can't easily store it everywhere and deliver it in a day like they want to to maintain their value proposition of fast delivery). Fees for returns if a product gets a lot of returns. Cost subsidy. (This reminds me of what we might expect from Uber at some point, because other than removing number-of-cars limits for cities, it's basically taxis, which was already a long-settled cost/profit system.

This particularly affects low-margin sellers.

Anectodally, some shipment costs rise from $10 to $100. 20-30% cost increases.

These fees are to use Amazon's own shipping, Amazon Prime. Sellers can use FDM if they want, and this is expensive.

Twitter spoke up, then reddit, then MSM.

FTC now probing Amazon. Chain Lina Khan has been writing about the Amazon ‘antitrust paradox’ since college. Now there are public complaints, whereas before going after Amazon would have provoked large criticism (from market entrants not from established businesses which were put out of business by Amazon, Walmart, etc).

All of Amaon's profit since 2017, presumably, is from AWS, Carlson said. Amazon has actually been losing money on retail for years.

Amazon still offers customers their (?artificially) cheap shipping, fast shipping, trust (this is under question), consistency. Amazon customers are considered wealthier than average, and sticky, not likely to switch to a third party to save money.

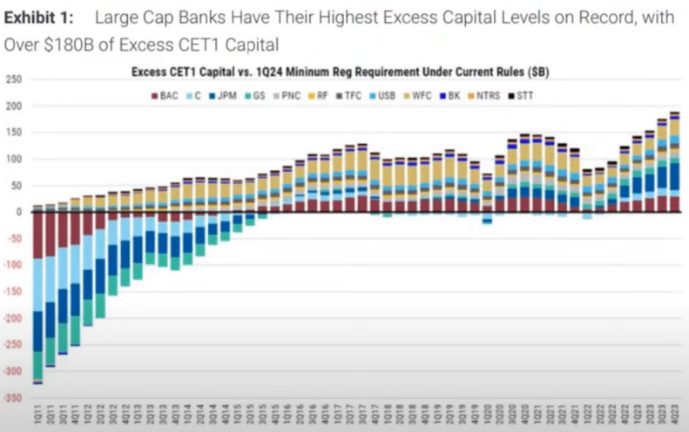

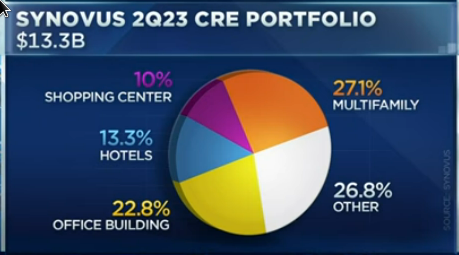

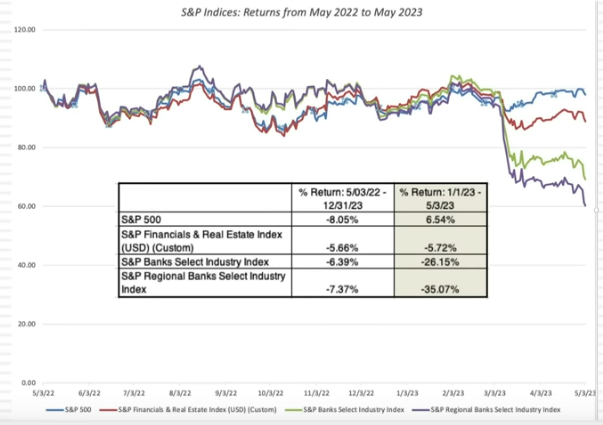

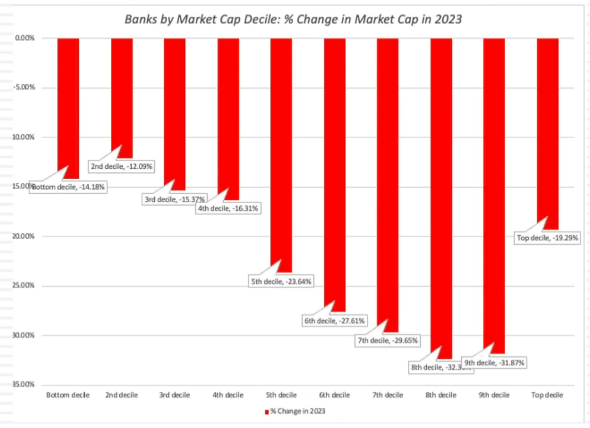

For regional banks, once they reach $100b, they get extra regulations without the benefits of scale. Marketing, technology, regulating ability to spread across banking market. More mergers? Even if smaller banks have billions on the books and appear safe, compared with what JPM has, just scale makes them look less secure.

It's been 30 years since law allowed interstate banking in the US. Diversification.

Big Tech has been deteriorating in relative standing for 6, 8 months.

China is world leader in EVs, low-cost photovoltaics, wind turbines, fast rail, 5G.

A lot of these are global directional trends. Low cost supplier to core infrastructure.

Europe and US protectionist fighting against import of Chinese EVs, but rest of the world wants them bad. ... American business is not in line with American politics. American business people applaud Chinese when they visit. - Mar, 2024

- Mar 05, 2024

-

HR should be an outside lawyer versed in employment law who can set up the company nicely so there isn't problems. Not a comisar in the company who knows and acts the gatekeeps of secrets, this person made this much, this person did this with this ...

Coworkers should never know intimate details of another.

HR should be administrative. But that can be software now.

Google vs. Google: The internal struggle holding back its AI - YouTube

This is how people are talking about it (people in the investing world). They think the problem is that Google is a liberal echo-chamber where people use their product as a tool to influence the world, at the expense of the utility of the tool. The problem isn't that Google can't, it's that it doesn't want to. (That it could easily fix the issues that produced black George Washington but because of the people and culture inside the corporate building they won't.) The employees are happy with how things are.

Search is considered threatened by AI ‘search’, and is considered the best (most profitable, most moated) business in history. 20 years of it or something. I don't think Google search will fail, as search is about giving answers, not just information, not just words. And they know how to give answers and monetize use through the only large-scale acceptable monetization, ads and free use.

Government just giving (stimulus checks) money to people suspected won't work, because people will just save the money (whether because of lack of confidence or just because Chinese culturally save money), not like USA.

Confidence is really low, expectations the leadership is going to change, a rollback of regulations and pairing with the West not expected, and confidence is required for economy rebounding, perhaps. Even if government does this, it would still take a long time to convince them, because government has lost their confidence. The overall direction used to look good even when there were bumps in the road, and maybe that's not there now.

Redistributing resources means redistributing authority. Giving money now to consumers means redistributing power.

Changing the tax structure means changing the central/local government relationship. The levers to bend the local governments to their will.

They control the pillars of the economy, which sectors.

They're always fearful of major uprising in big cities. Control city populations. Never have visible inequality. Harsh policy to drive migrants out of the edges of the city.

The leaders are failed reformers, not reluctant reformers. That makes a difference.

They don't collect much tax on individual incomes (6% of their tax base, 1% of GDP), nor domestic consumption.

They collect their tax mostly on investment-led growth model: value-added tax, enterprise income tax.

They only use SOEs to stimulate the economy. Performance of SOEs should become worse. They need private sector power from now on.

Fiscal revenue as a part of GDP is 14%. Declined steadily since 2015.

Their fiscal constraints are more binding than observers think.

A transitioning economy would require a different tax base, tax system. IMF raises this issue every year with China. They've said yeah we agree, for years, but last session they said they had a just-fine tax system.

Give the market a decisive role in the economy?

'Have we been gullible?' - Antidepressants taken by 'MILLIONS' of Brits go under the microscope - YouTube

APPL down 3%, 10% this year, despite launching a new laptop ‘the best for AI’ which just has improvements to regular existing services. New $1.6b Europe fine. This week Europe regulation against Big Tech. Is APPL handing over the torch (to Microsoft, Nvidia?) It's a huge part of the market, of 401ks, etc.

China's 5% GDP target is 'really ambitious,' economist says - YouTube

Contractionary fiscal policy mostly. Require a very large infrastructure project (size of Three Gorge Dam).

They might set a higher deficit budget.

10 elements: Modernize supply chains, domestic brands, produce that supply chain. Higher quality development. Really encourage domestic consumption (consumer sentiment is not high).

China sets 2024 economic targets: Here's what to know - YouTube

Shift from mass production to high quality products, national security, social equality. A noted shift. A focus on communism.

It's more profitable for companies to cooperate on prices than compete, says Columbia's Tim Wu - YouTube

The most obviously anti-competitive deals are not gonna get through. The ones where they combine obvious competitors with the excuse that they're trying to take on other companies.

The airline merger was the first that's been blocked in history, a such a minor pairing compared with ones they've allowed in the past. 10 years ago you could get any deal by saying we're coming together because we need to fight Walmart or Amazon. The industry was allowed to consolidate. We just saw airlines merge recently and not much good happening for consumers.

There are 7 companies. Then 6 and 7 want to combine to compete with 1 and 2. They were allowed. Once there are only 3 or 4 companies, they see it's easier to cooperate on prices than to compete. Mobile, airlines. They didn't compete. T-mobile 10 years ago said they were never gonna survive, and now they're the most successful company.

How many companies need to be in each sector to ensure competition? And how big can any one be allowed as a percentage of total sector share, before it makes it impossible for smaller ones to compete?

Investors Beware: China's factories are moving. But not to Mexico or Vietnam. - YouTube

Inland smaller cities.

Much of Mexico manufacturing is China too.

Weighing down the taxpayer: Why weight loss drugs could cost taxpayers over $1 trillion per year - YouTube

Math.

44m people at $15k each, $1t gross, minus savings of $200b. $800b per year, equivalent of entire medicare program.

IP theft? ... As public payers paying that much, you do have leverage, and you should be able to use that leverage in the marketplace. It could get to the point it represents a direct transfer from US taxpayers to shareholders of these companies. There is an opportunity here (they have 35% versus need-to-have-10% profit) to come to a more reasonable price for the taxpayer without discouraging innovation. We're moving toward a place, already, where we're going to blow a giant hole in the budget. But that's not the way free markets work, that's the way central planning works. Negotiating a ‘fair’ price. That fair word again. But doesn't that work both ways? The company might be developing and pricing based on the expectation of advantage in dealing with nationwide public purchase.

Lots of cryptcoins are way up.

BONK coin. $15b in volume in 24 hours.

Like last time people will buy at the top these meme coins. But this time people know, everyone's in on it, but they want to play anyway. It's a game.

Coinbase and Robinhood are up. - Mar, 2024

- Mar 01, 2024

-

Japan Pulls Off an Early Chip Victory - YouTube

TSMC.

Reddit's 'Wild West' reputation isn't something that advertisers want: New York Times’ Jim Stewart - YouTube

It is a feat if you can eek out a tiny tiny profit now.

US government is funded not by taxes, but by treasury bonds, which are purchased by the Fed, which are purchased with printed money, which is backed by the treasury bonds themselves. - Bukele

‘Americans pay high taxes only to uphold the illusion that you are funding the government that you are not.’ ‘Paper backed with paper, a bubble.’

It will entail a reengineering of the government top to bottom, Bukele said, not just the result of an election.

‘Put up the fight, because in the end it will be worht it.’

Concerning reports over resources at Canadian food banks - YouTube

The reason Canadian banks are down the last two years is because they haven't grown earnings: Wessel - YouTube

Alphabet has an attractive valuation, but is a 'show me' stock, says BakerAvenue's King Lip - YouTube

Other headlines about how Google could do what Meta did a year ago, when it looked like the company was ‘done’ but Zuck fired tons of people, stopped focussing on the metaverse, steered the company back towards making money. But peope say Google could but probably won't do this. We can notice here that Meta has just one person who feels completely entitled to do what he wants with his company. Google had 2 but they were (people assume) influenced to leave while government-friendly CEOs were put in place and a ‘woke’ culture prevailed over the citizens. This is a reaction to Google's AI fail making black George Washingtons etc. ... People say Google has the tech, it started a lot of the tech years ago, which smaller newer companies made public, or versions of it, and are profiting. But Google won't make their tech public. Perhaps because it's dangerous? perhaps because they've played it out and they know it's not much more than hype? Perhaps becaues it's government technology basically and they can't share it?

Google Gemini AI is anti-white - and so is Google search - YouTube

Microsoft now has a larger market cap than Apple.

Also now, people are saying the NASDAQ can go up without the participation of Apple. That had been debated before. Dispell. 2% revenue growth, 7% earnings growth, for past few years, or something.

Is capital now a burden? $10-20t excess capital that has no use? Just floating around searching for a use. Creating opportunities solely to put that money to work?

Disaster capitalism - How financial markets benefit from the climate problem | DW Documentary - YouTube - Feb, 2024

- Feb 22, 2024

-

-

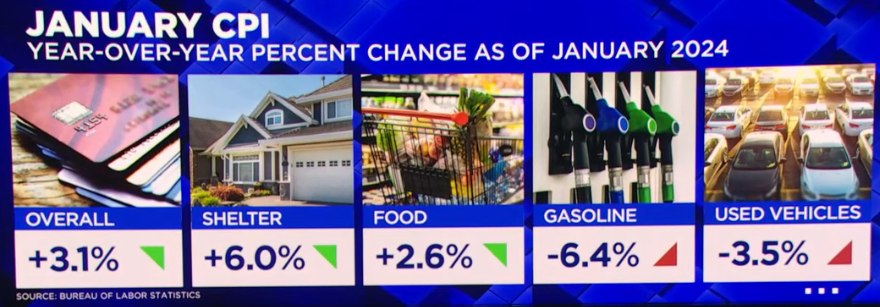

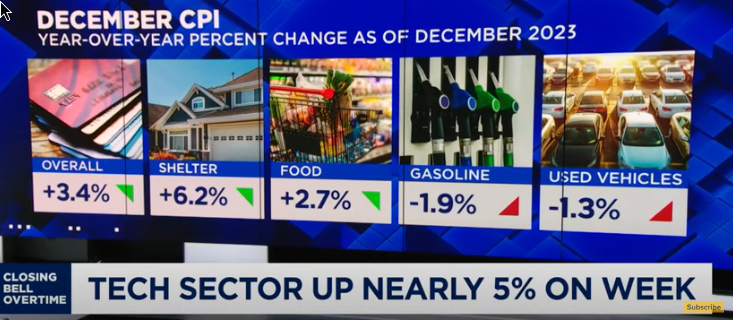

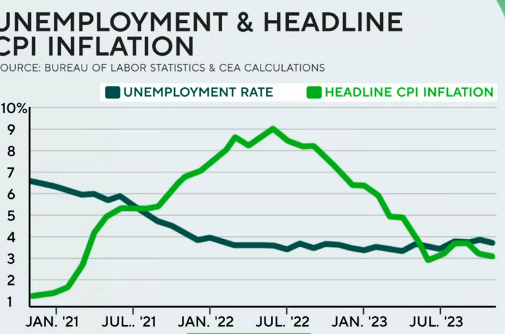

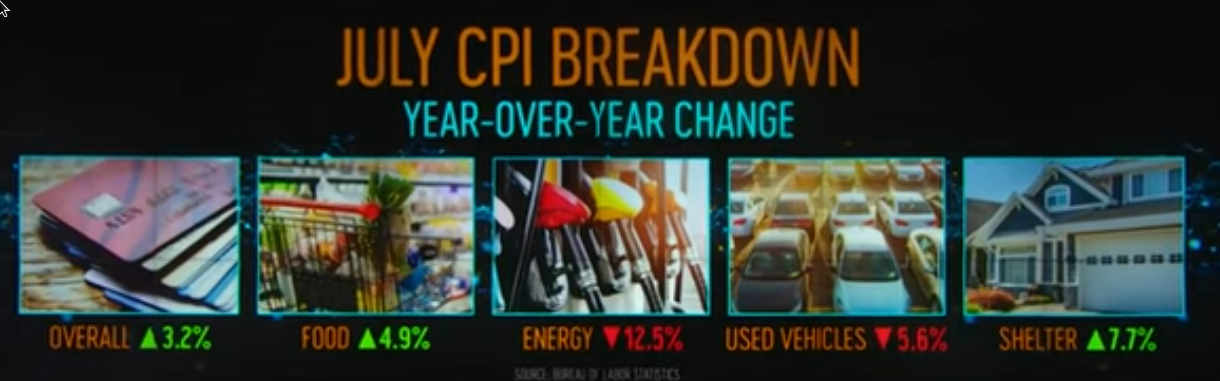

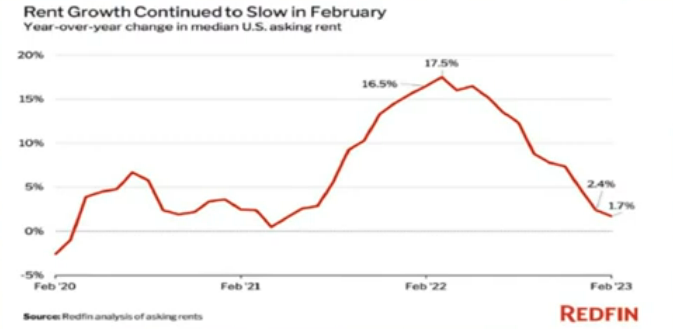

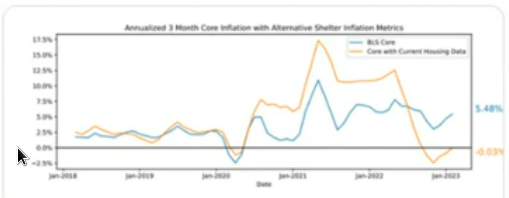

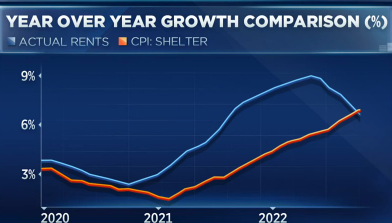

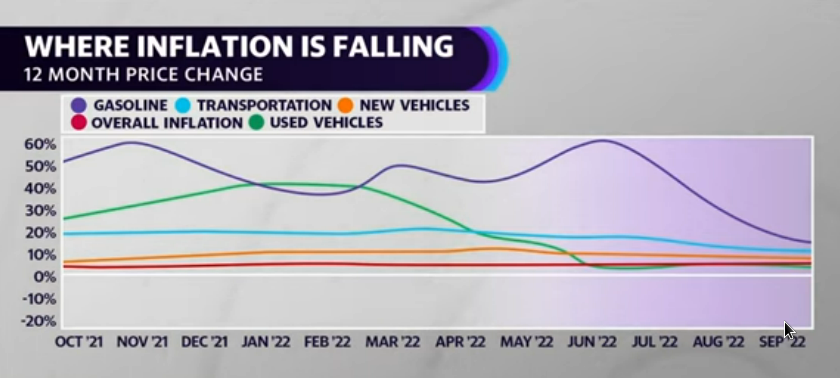

Broadly, inflation is still going down. But housing is up, headline at 3.1% instead of expected 2%.

WM CEO James Fish: We always raise prices because there is always some type of inflation - YouTube

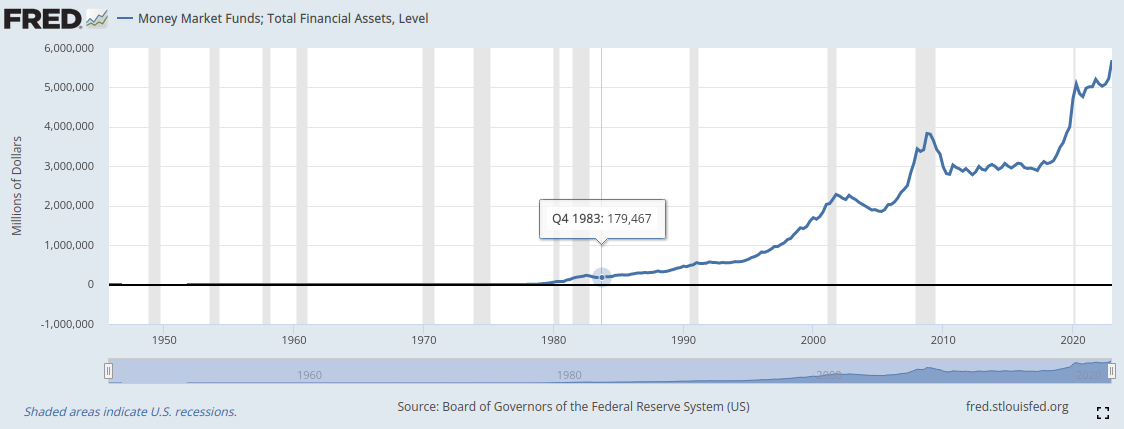

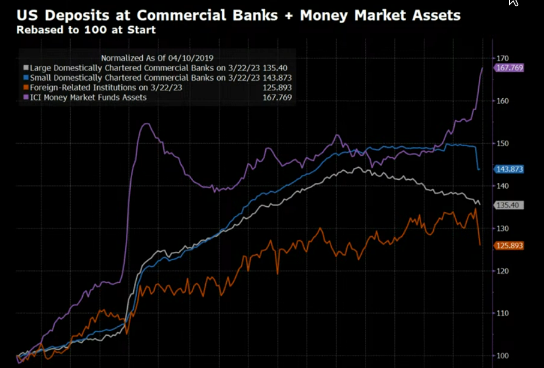

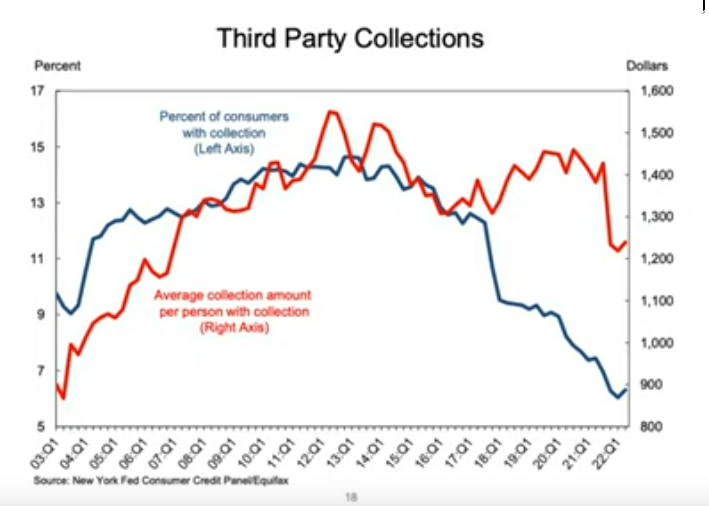

Credit squeeze 2024. Less cash in banks becaues it's in money market funds, and isn't available for loans. Savings from pandemic government measures are spent. Auto, credit card loans at 20%, sapping savings.

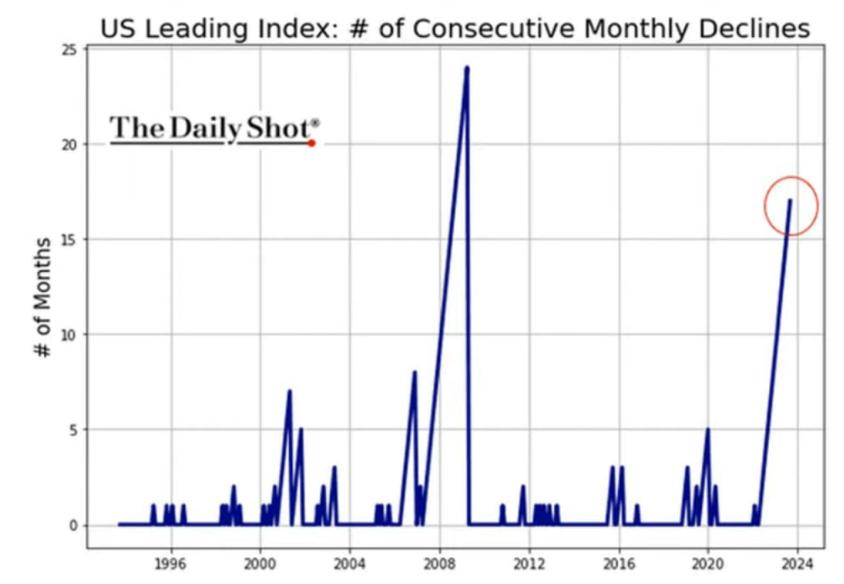

How much debt expense US has, and might start to think longer term interest rates should go up. - Gundlach

Economy is more vulnerable under rising rate than falling rate regime. Under a falling regime, companies in trouble might have to pay more on a spread basis, they're paying lower interest rates. They can refinance and take money out and reduce their interest expense, which prevents defaults and supports risk assets.

Rising rates, maybe those companies will have to default.

The 2-year is telling us we'll get 100bps of cuts within 2 years. Gundlach

MSCI Cuts Swath of Chinese Stocks From Indexes as Market Slumps - YouTube

Nvidia briefly overtakes Alphabet as third-largest company by market cap - YouTube

Japan Slips Into Recession, Clouding Central Bank Rate Path - YouTube

“$600 Million” - Jeff Bezos Strategic Move to Miami - YouTube

Seattle to Miami. Will save from Washington States's new capital gains tax.

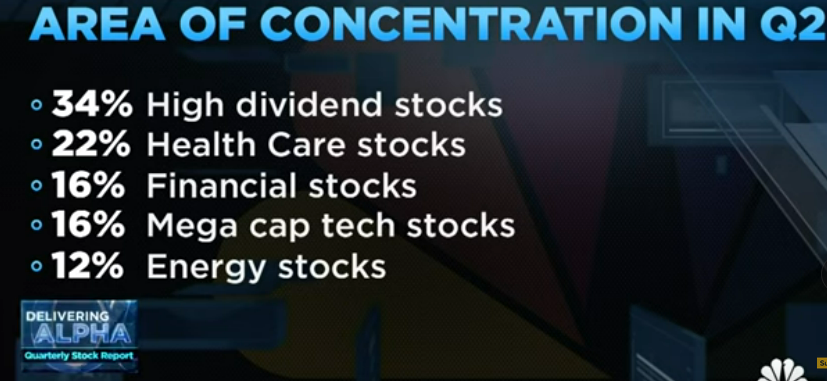

Money is moving into the same sectors (tech). 25% last quarter. Concentrated.

Misery Index (has been worse 80% of time since 70s)

ppi vs cpi (have a lot of components, and have to look at the trajectory of each of those components)

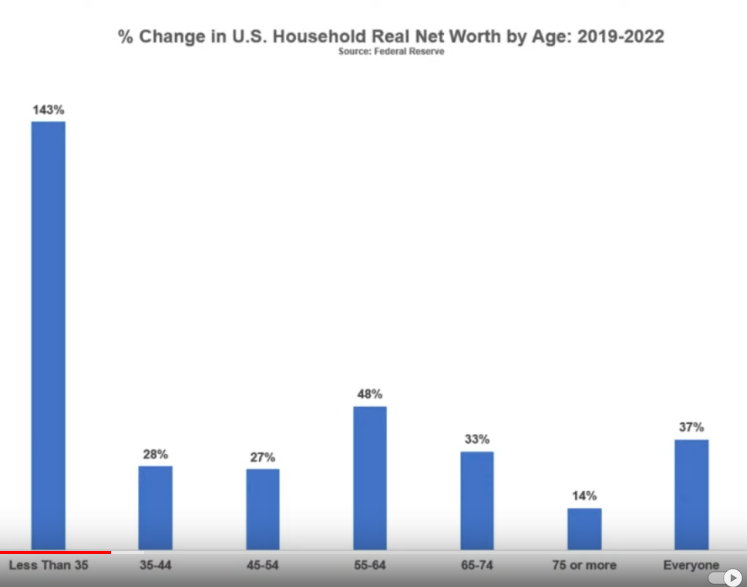

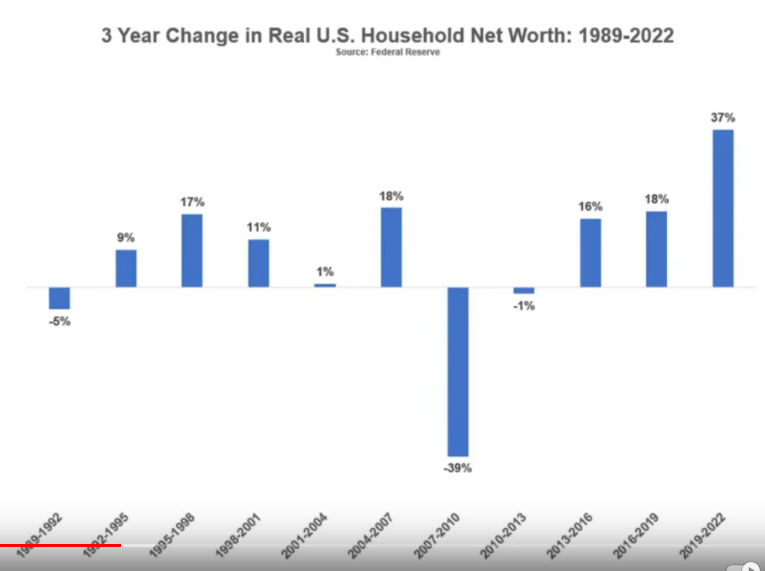

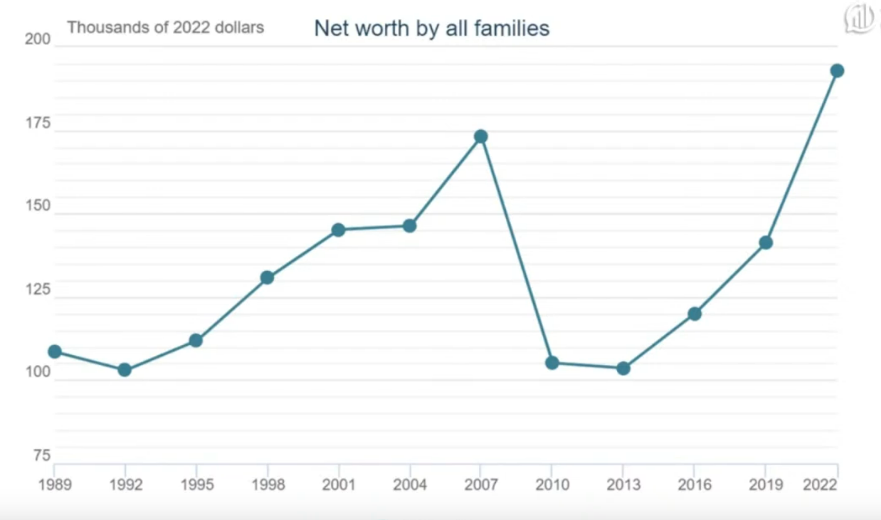

household net worth is in the 96th percentile

cost of capital (not higher than 2009 or 2012) (business consideration)

What will the terminal rate be, rather than when Fed will cut. When their costs will come in for longterm R&D.

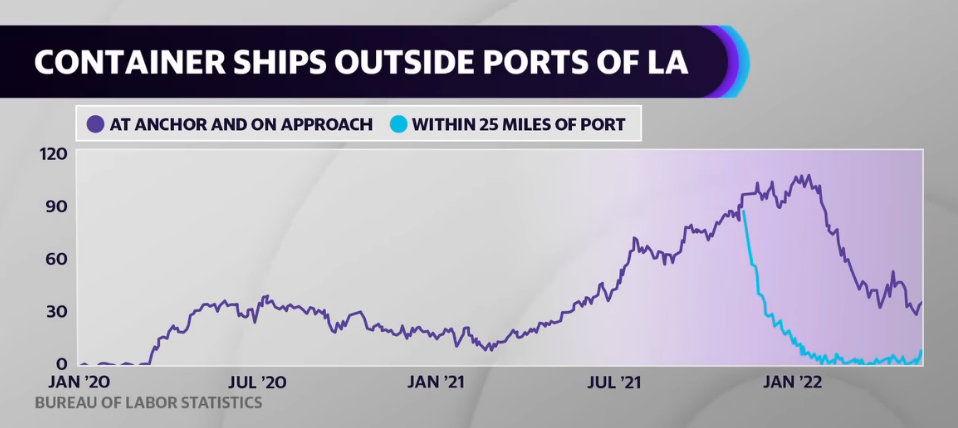

What we're hearing from earnings, and what the CEOs are saying (they're slowing down in labor practices). How to use AI and supply chains (haven't been that bad considering shipping prices).

Hardest year to have a macro outlook - Drukenmiller. Not the hardest, always difficult - E Burton

How Ghost Kitchens Went From $1 Trillion Hype To A Struggling Business Model - YouTube

Lithium prices plummet on slowing EV demand - YouTube

Canada giving Ukraine over 800 drones worth $95 million | Power & Politics - YouTube

Made in Canada.

(Not new money. Part of $500m Trudeau said last year. Total amount to Ukraine like 2.4b.)

Company behind Stanley tumblers faces lawsuits over lead - YouTube - Feb, 2024

- Feb 13, 2024

-

-

When Nebula sells, all the creators then get a payout.

China itself is now looking at offshoring factories outside of China.

China’s Consumer Prices Drop at Fastest Pace Since Global Financial Crisis - YouTube

Negative inflation -0.8% for CPI. 4 months of negative inflation. 16 months of producer prices deflation.

They need (manufacturing and infrastructure, because home investment is weak now) investment momentum. Maybe social housing construction.

Policy credibility is low after lockdowns, less expectation about the implementation, positive incentives for government officials is low. Doing nothing is more incentivized. Cash to low income families to support their consumption suggested by analyists.

Lots of top officials in China replaced recently. Securities regulator since 2019 on his way out. This is often associated with a boost in stocks. New guy is a discipliner. ‘The Broker Butcher.’ Government will maybe go after malicious short selling.

Year of the Dragon, ‘most auspicous’, just started in China.

The year of promoting consumption.

Hermes has a wait list who've been waiting several years for a call saying they can buy a bag. So we can expect their customers will never be seen to dip, because they can just call the next person on the list.

Chinese stocks, when will sentiment change? Need systemic change for any rally to be sustained (if there were a rally now investors would be selling into it probably). Other EM markets are looking pretty good (and their potential story is more understood), competing for the international fund flow. SKorea and Japan have corporate governance stories. American big tech only has real forseeable solid business plan. Chips and AI.

Nvidia looking to build out custom chip segment: Reuters - YouTube

Big companies have been looking at/starting to build their own chips for themselves, but Nvidia is saying hey we're already building chips, and we can build your custom chips for you cheaper. More specified chips.

Off the Charts: Nikkei hits 34-year high - YouTube

White House investing $5 billion in chips: Here's what to know - YouTube

X Inks New Deals with WWE, BetMGM - YouTube

Nvidia passed Amazon's market cap.

Since last Jan up from $200 to $750. Valuation though is lower than before, at 33x (Amazon is 40x, META is 23x).

Best capex going, but other companies have the same market.

ARM is up 100% or so in the past few days.

Delaware's corporate shake-up: Billionaires take aim at the state - YouTube

Nevada, Texas.

Ontario brewery receives onslaught of online hate after hosting Trudeau - YouTube

Why Direct-To-Consumer Companies Like Casper, Allbirds And Peloton Are All Struggling - YouTube

DTC brands have to keep themselves on people's radars constantly, which means continuous ad spending. Ad spending on Facebook and other platforms has gone way up over the past couple years. 10 years ago the first DTG brands had no competition and cheap ads. Now there's tons of people trying this and even competitors for the same target demographic, and then also ad prices have gone up a lot. Right now that looks great for Facebook, who raised its cost per impression 90% in 2021 (Google did 100%). But what happens when these companies stop trying?

Warby Parker, the quintessencial DTG brand, did glasses, where there was no competition, and started right at the start of this all. But they started making brick and mortar right away. Shops with their products and brand. Also, their product is just cut out for this model, because glasses you can just mark up a lot from what they're produced for.

Peloton pivoted to selling in big box stores. Some of these DTG companies had to make changes along te way.

Birkenstock, Chewy also did well.

‘When I’m on social media, I want to be able to purchase your product right then. When I'm walking by your shop, I want to be able to purchase your product right then.'

USA fundamentally gave away manufacturing to overseas during the 60s and 70s.

Machine versus machine is equal USA prices to China prices for manufacturing. Labor is different. (We don't know how much Chinese factory workers make.)

The supply chain doesn't exist in the USA becaues it hasn't done it for years.

Through laws, USA government is funding manufacturing (chips).

China is still the most efficient place to produce.

If China continues to be a security threat, other countries will continue to try to look elsewhere.

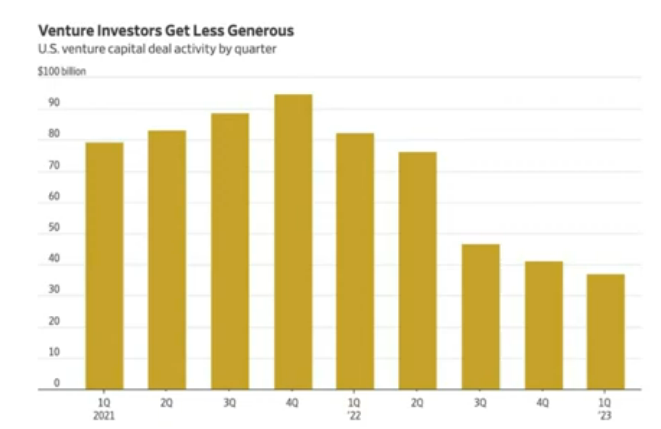

Startups Are Shutting Down! - YouTube

Nontech companies that were made to look like tech. Old businesses repackaged to get billionaire investments.

People hoping to repeat some profitable examples like Facebook.

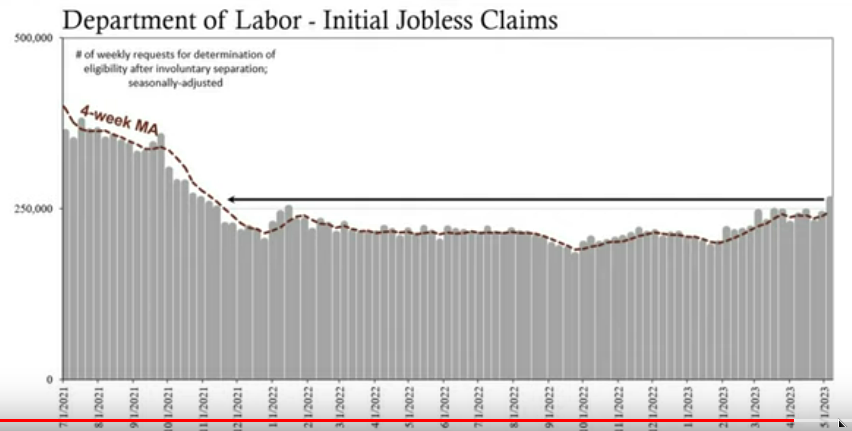

AI was the only bright spot last year. But the economy is doing just fine, labor market is tight, stock market at a high.

Creative destruction of bad business models is a part of the capitalist system, but ‘zombie companies’ have been propped up for a while artificially with banks etc.

‘The deeper human connection is going to be the edge in AI.’

Spikier print on inflation. Consumer prices up 0.3%. People talking now about higher for longer, more. The labor market has reportedly broke though. I also have not yet seen any reason to slow down on rates. You have to break something in the economy and destroy wealth/money to make dollars worth more, right? You have to have people wanting to work balance out the money to pay them, right? It was an artificial inflation, and the deflation has to mirror it, right? But I'm still invested, because you have to do what you think people will most likely do, not what they should do. ... Another way to look at is that the Fed has made the right choice (so far this year in not cutting rates).

‘It seems that the Fed is not finished, perhaps.’ So we might stay higher for longer and have that recession after all.

Some people at the start said you should raise rates high and fast, to snap something to a break, and then return to normal. Then the economy, which was running at the level people wanted it to, would not break it's trend and people would continue in their habits. ... But if you prolong a different situation, a different economy, people will modify their habits and behave, longterm and habitually, a different way.

Probably the Fed is not as suprised about the print as the market. The market is coming closer to the Fed, maybe .

However, people are now using their savings to pay for things.

How 2024’s Record Retirement Numbers Could Spark a Recession | WSJ - YouTube

Alberta’s honey industry is a buzzing business - YouTube

Romance scammers target Americans - YouTube

Maybe private equity will lose, as they can't compete with cash. - Feb, 2024

- Feb 05, 2024

-

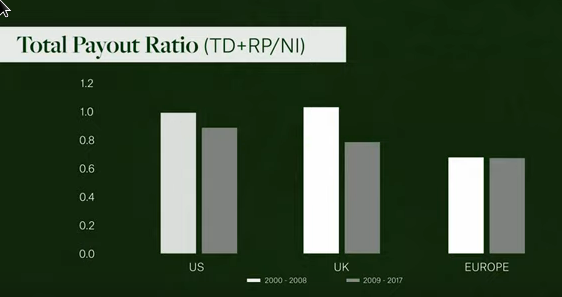

Everything was reinvested in bigTech companies, but now Facebook just announced a dividend. Apple does regular buybacks.

It means they're probably not going to do moonshots, not going to just do acquisitions that don't make any sense (which is not working also nowadays because of govenrment). ‘We’re really focussed on shareholder value.'

An aspect to Zuckerburg/Congress/Governments is that once you get a certain size, you've ‘won too much’ and people will start pulling you back down a bit. Big Tobaco. Pharma. Big Tech. We have an easy consession, which is age. 15 or 16 maybe, for social media.

High housing prices force wildfire victims off Maui | DW News - YouTube

Doctors unionize as healthcare services are consolidated into corporate systems - YouTube -

Bottom of real estate market 2012

Bottom of real estate market 2012

- Jan, 2024

- Jan 30, 2024

-

- Jan, 2024

- Jan 26, 2024

-

-

China stock market has fallen near it's earlier bottom. They reported 5% growth, ‘hitting' the government's target. Doubts. If they stimulate their yuan will depreciate, and they don't want a weaker exchange rate. China faces a lot of headwinds, and Xi doesn't really believe in the free market. State owned enterprise valuations. It would be so interesting to gets news about and follow events in China, but there is no such information made public. They buy 12m barrels every day, 8bcf of LNG every day, 40% of their food every day, and they have to buy it in dollars. WIlling global trading partners. CEOs there are moving their supply chains out of China, the majority, reportedly.

They have 100m vacant apartments and condos. $57t in banking assets, $2t in banking equity. Local financing market $13t, 90% of the market is in default (?). Estimates of $4t in real estate losses.

Everyone very pessimistic on Europe. They've saved their stimulus, though, and debt a lot of it is floating rate, and so they've already suffered the shock of rates. Also, they've already had an energy shock.

Google pulls back on Moonshots - YouTube

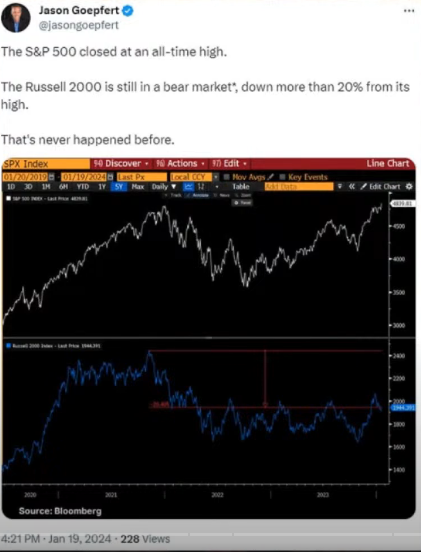

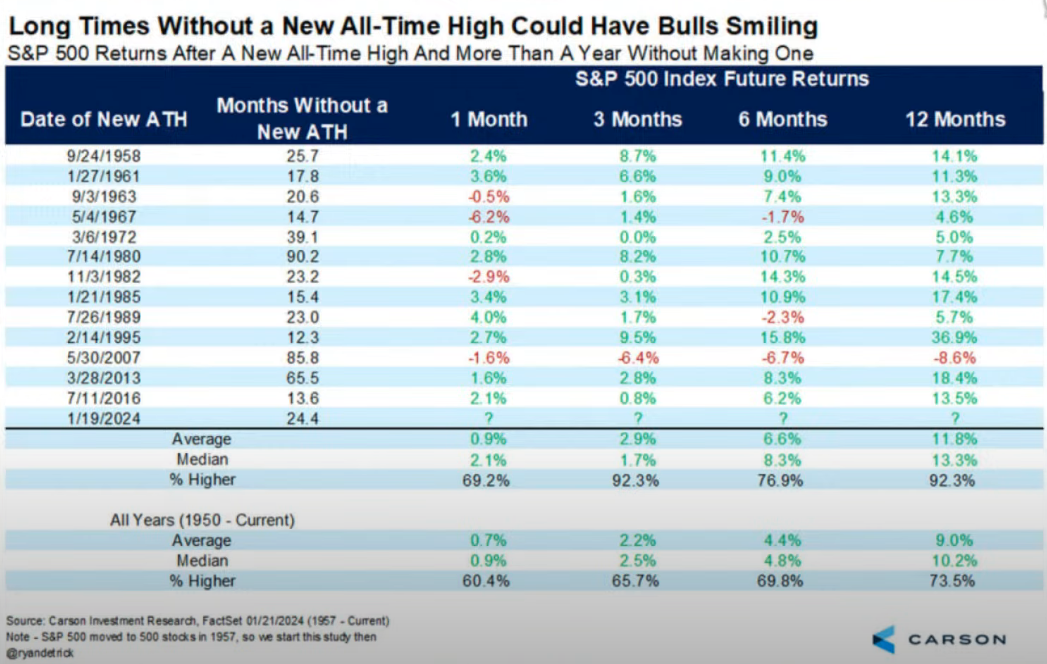

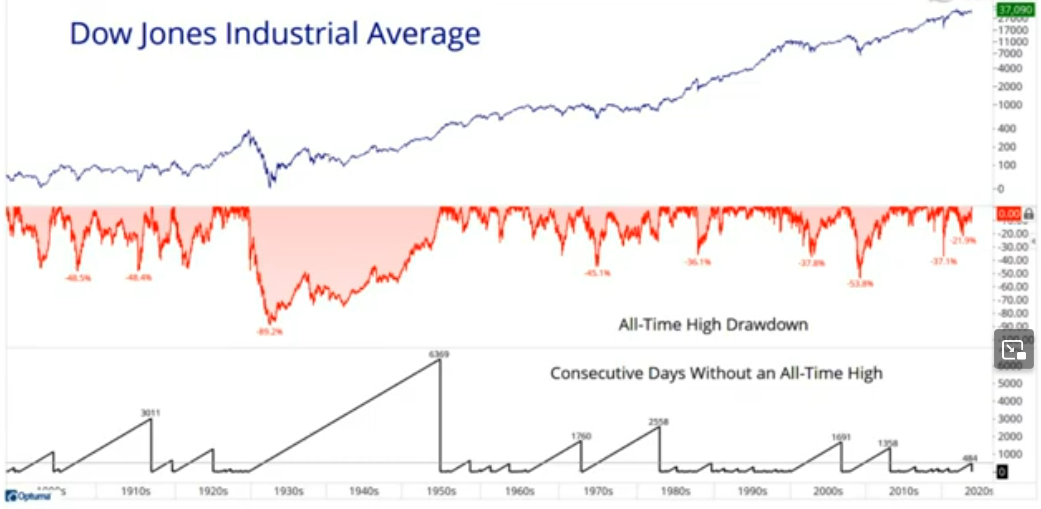

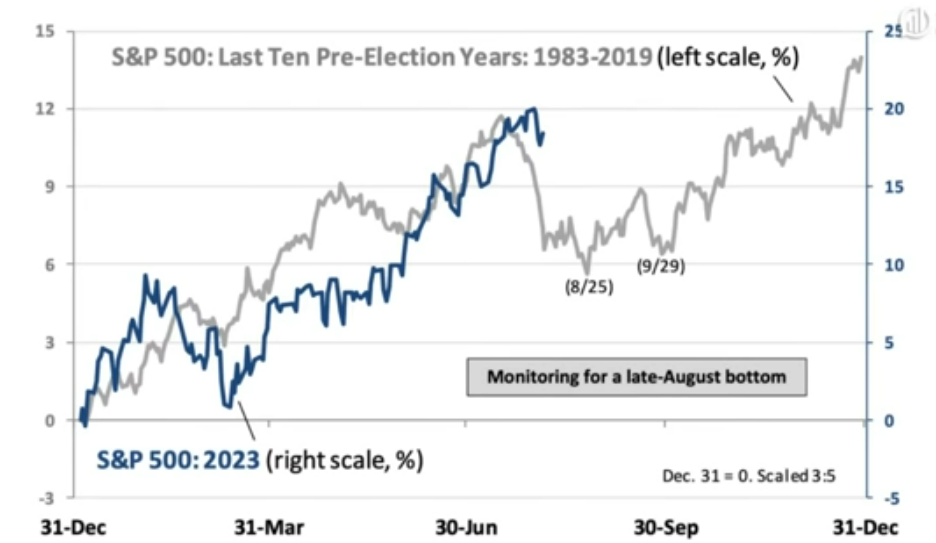

S&P new high. Almost always when that happens, 12 months later you're up. This is market behaviour, not random (but not necesarily related) historical data, Compound said. 746 days since last new high.

Netflix up 20% in past 3 months, recently boosted by deal with exclusive WWE and surprisingly higher subs. They have no M&A intrigue. No activists. No linear decline. They don't have to focus on sports. Their TV shows have done well, not so much for films so far. They made 100 new series in 2023. Other streamers did like 10 or 15. Other platforms are now selling on to Netflix.

Stock picking. Have to get the fundamentals right finally this year, say some. Because NVDA and APPl are both the same multiple, but Nvidia is making huge revenue percentage increases and is expected to continue, while Apple did 5% increase. Earnings reports to follow will show what the company's fundamentals are doing. Texas Instruments was quick to meet supply chains and so is now in like 4 quarters of losses, while other companies this is still or never to come.

United Airlines CEO publicly criticizing Boeing, and mentioned they only have one other option (Airbus). Limitation of duopoly producers.

FTC scrutinizes megacap's AI deals - YouTube

Essentially bankrolling their own businesses.

Comes back to them through credit for services

2/3 of startups run out of cash in 2024/25 or something, so lots will sort of fold, freeing up talent to join other new projects. It's mostly the junior devs who are being replaced by AI reportedly.

U.K. suspends trade negotiations with Canada - YouTube

UK wants more access to Canadian cheese and Canada isn't going to give it. It's a supply managed protected sector (policy now but law is in congress right now to possibly pass).

Mass EV adoption is a lot harder than early adoption, says former Ford CEO Mark Fields - YouTube

Spot bitcoin ETFs move away from original ideals of crypto, Beam CEO argues - YouTube

Financial institutions are getting more influence over crypto. The core promise of crypto was that people are in control of their money. So far there are no products that uphold the values of crypto at the same time as being as easy as buying an ETF. Centralizing.

Even if the institutions are negative in terms of trading power for value, structurally they add liquidity to bitcoin and allow it to function better. - Jan, 2024

- Jan 22, 2024

-

-

Consumers have reached a point where they don't have the incremental spending power: Clarence Otis - YouTube

2 years of inflation. Winding down of inflation. Efficiency instead of hiking prices. Maybe have to work harder at it.

VanEck CEO Jan van Eck talks SEC approving bitcoin spot ETFs - YouTube

We have a clearer idea how Bitcoin is valued, how it trades, how it is bought and sold.

😱SHOCKING! Charging My Electric Car Costs 2X As Much As GAS!😱 - YouTube

?

Costco opened its 6th store in China, massive lineups. Costco has been successful in every market they've moved into, even frugal Japan with small spaces and not as much carry transport maybe. They love moving into terrirtories of the middle class. ... Lots bought a giant US-cartoon-famous bear. Costco is limited in the amount of stores it can open in China because of lack of qualified managers, reportedly.

Netflix may have won the streaming war. It has something for everyone, it cuts across every demographic, they have significant growth drivers, strong engagement. Like the classic bundle.

Lots of YouTubers posting videos about ‘quitting YouTube’. YouTubers have no alternative platform. Some have come up but been attacked by YouTube etc, it seems. However, the sentiment has been there for a long time that vloggers/broadcasters are forcefully kept on YouTube's platform.

If a company has a 30 or 50% profit margin (or more), that's a sign already that it's a monopolistic business, because in a competitive market you can't have that. A mutual detante with your biggest competitor.

The best churn rate is Netflix, who will lose 40% per year. Disney and Hulu maybe 50%. Starz and Peakcock and Paramount, like 100 or 140%. But that means NFLX needs 100m new people per year. Facebook and Google benefit because that's where the ads will appear. Without fresh content, people will churn.

YouTubeTV subs is doing really well. Without a box, on your phone or any device, you can view the old offering set. Will YouTube win? - Jan, 2024

- Jan 08, 2024

-

Barclays downgrades Apple: Here's what you need to know - YouTube

Tesla Deliveries Meet Estimates, Falls Behind BYD in Sales - YouTube

World's richest billionaires add $1.5 trillion in wealth during '23 after losing $1.4T in '22 - YouTube

Bitcoin soars to kick off 2024, topping $45,000 for first time since April 2022: CNBC Crypto World - YouTube

Bitcoin is driven by global liquidity: Marathon Digital CEO - YouTube

When it's risk off or when people need to sell a bit of their portfolio. Or when they want to avoid a volatile investment.

Costs to mine, during the halving, low to mid $20ks is breakeven. Marathon went from 7x a hash to 25x.

Government might delay or reject the ETF, or might approve it.

YouTube now has one or sometimes two non-skippable ads before videos quite frequently. This is beyond what even I am willing to sit through. I found an alternative so no ads play, something I didn't want to do, as I recognize ads as the way to fund publishing, and am generally against adblockers. However, this is too much, and YouTube has dominated the market for online free videos, partially through unfair anticompetitive measures, and are about the only platform. If they were one participant in a rich market of online videos, or if they didn't have what I now consider way too much advertising for the offered product, I would not have to do this.

Amazon, I bought a laptop there, and after they already completed the sale, retroactively went and ‘froze’ my 5-year account (so their customer service couldn't even ‘see it’ and help), and wanted me to phone in to verify, a certain manipulation of leverage to violate privacy. Note that this wasn't before accepting the contract of sale (which is anyone's right), but after they already made the sale. I will use Amazon as little as possible henceforth. I can but things from Walmart, computer manufacturers, etc.

Note that Amazon also manipulates their reddit sub. When you post something, they have an auto-reply saying you may only post complaints on a given thread on a certain day called ‘meltdown’ (as if any complaints are the fault of the customer who just can't handle things). They don't say the post is removed, so you think it's published. But if you view their page in a private browser, you won't see your post because it's not public.

Why Everyone is Abandoning GoPro - YouTube

How cheap it's going to be to copy an existing business in 2024. - Chamath. Create these really cheap

and then basically attack the existing big business which have just a lot of upside-down economics because they've taken on so many costs, employees. GPT can replicate this for free.

Pro sports franchise/enterpirse values peak? - Chamath. Live Tour versus PGA forced PGA to merge. Country SA bought Christiano. College athletes will be making millions. Uptick in churn at Netflix.

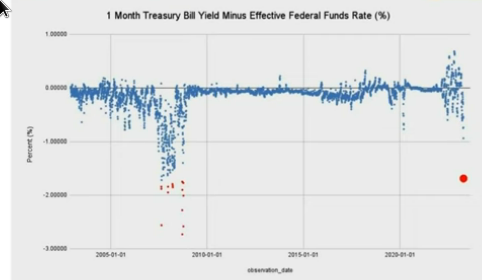

BTFP, used to bail out regionals last year, supposed to be a temporary program of 1 year, but banks might not be strong enough to survive without this funding (impaired comercial debt portfolios, and until the yield curve deinverts).

GPTs, the request time length is way too long (30 or 90 seconds versus should be milliseconds), and the cost of credits is too high.

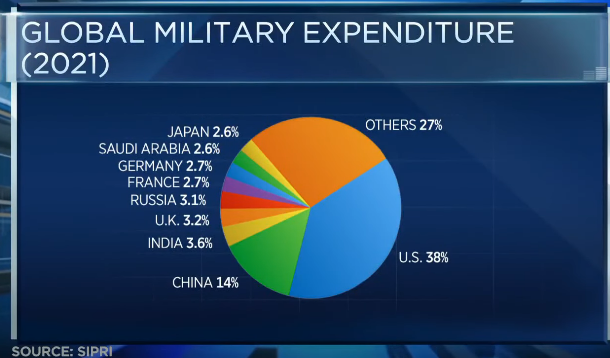

Will decline in military resources and appetite for spending resources lead to an increased risk of nuclear weapon use? - Friedburg

Many AIs and they might value down 70 or 80% this year. Just like having 15 search engines.

Competition is coming on in software engineers, with AI. - Jan, 2024

- Jan 02, 2024

-

Tuesday, Jan 2, first stock market open day of the year. Looks like people can take gains in BitTech, and rotate to their ideas for 2024.

Tuesday, Jan 2, first stock market open day of the year. Looks like people can take gains in BitTech, and rotate to their ideas for 2024. -

From FedEx to airlines, companies are starting to lose their pricing power - YouTube

Finally?

How Creators Monetize Poverty - YouTube - Dec, 2023

- Dec 29, 2023

-

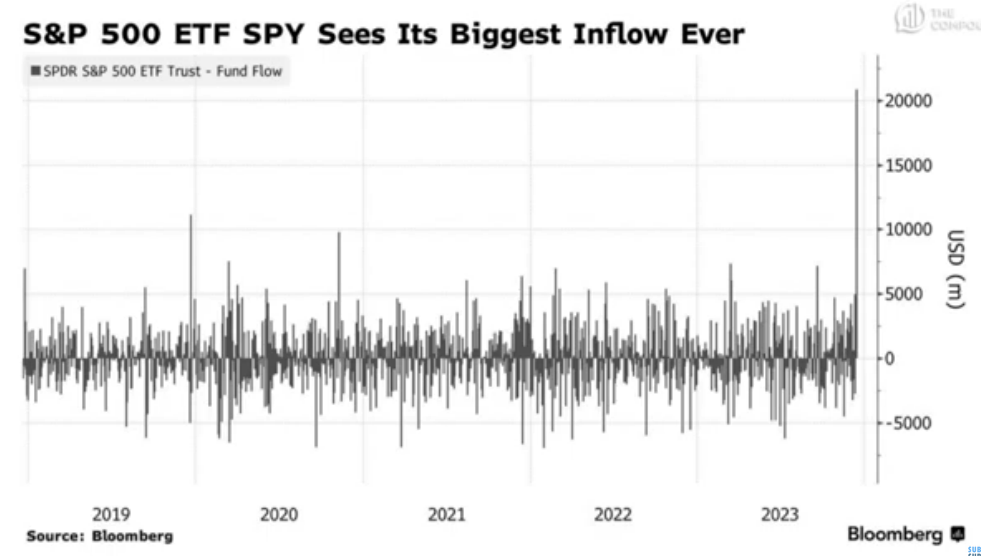

SPY had is biggest incoming flow. Partially rebalancing of some big fund. QQQs saw a big outflow same day (they sold the DOW).

Trading Floors Make a Comeback in Japan - YouTube

BOJ changed monetary policy on government bonds, and this meant a return of volatility.

Alcohol sales underperform when cannabis is available, says Cowen's Vivien Azer - YouTube

The studio at Paramount is the 'asset' that people want in a merger, says Puck's Matt Belloni - YouTube

Everyone thought there were all these subscribers out there. Turns out it was much harder. - Matt Belloni on Netflix

Sports, you're renting those rights. The payment of $2b is coming up to Paramount for NFL.

Apple stops selling some Smartwatches Online - YouTube

Apple initially talked about hiring or licencing from Mossimo, but ended up just hiring about 20 of their developers to just work on Apple's prodcut.

Average age of farmers in US 55, in Japan 68. Highest rate of suicides in UK is farmers. Agriculture. In the US, more people study public relations that agriculture. Nobody wants to be a farmer. Get hot and dirty all day.

Americans have $1t in cc debt. They payed $120b in interest and fees last year.

Half a billion in rewards getting forfeited or devalued. Bait and switch.

Why Wall Street Is Rushing Into Private Credit Market - YouTube

A mix of who has the money (credit lenders) and who has the relationships (the banks). Symbiotic relationship coming? The banks act as a bridge, because you have no idea how to call Blackstone. How do you manage the underwriting process, the terms of the deal, when a default happens. Those have to be worked out.

Tencent loses over $43 billion in market value after China proposes new online gaming rules - YouTube

When you see clients start buying individual names, that's when things begin to rally. - JJ Kinahan

Tesla removes Disney+ after cursing out Disney CEO: why automakers removing carplay matters - YouTube

So all Tesla owners who want their kids to watch Disney in the back seat can't? (Not saying it's a bad thing for them, just for Tesla economics.)

The average holding period for an individual investor is 10 months. Mutual fund 2.5 years.

Masimo CEO Addresses Smartwatch Patent Dispute With Apple - YouTube

$1.3t inflow into cash in 2023, BofA said. Record. Also, $177b into US treasuries.

REITs are the best sectors when rates are coming down. WELL, senior living part of the real estate sector.

VIX at a 5-year low.

OpenAI IPO for $100b? Went from $20m to over a billion in revenue, reportedly.

2023 The Financial Year in Review - YouTube

Dimson research from a couple years ago. Majority of stock market returns come from periods of falling interest rates.

US Pending Home Sales Index Holds Steady at Record Low - YouTube -

-

-

- Dec, 2023

- Dec 21, 2023

-

2023 the supply chain and the bulwhip effect really created that initial inflationsurge, and then the media helped fuel this idea that inflation would be sticky, which allowed people to raise prices, and people to demand wages. But as that psychology broke, that cycle is now drifting lower, even expectations. - Tom Lee on what many ‘pundits’ got wrong about 2023, saying the reason was that they had only ever experienced at best the 80s frequent inflation, but never an inflation like the 70s. They focussed on a single analogy. 65% of largecap fund managers are missing their benchmark right now for 2023, way above average underperformance (usually about 55% are missing).

2024 Fed is no longer flighting an inflation war so it doesn't need to be hard on stock market. Instead it just wants to keep the business cycle healthy. That gives them room to cut rates. We're in an earnings recovery cycle. Economy is shifting more towards goods, which helps S&P earnings. Europe and Chine might recover, so earnings backdrop is quite good. People are in cash and will see they could have made way more money if they'd just stayed in the stock market. So market is well supported. Tom Lee.

But there could be big changes. It might not be as narrow. If probabiliy favors market expansion you overweight small caps. They're very cheap relative to S&P right now. The 10 year has a lot of room to come down, and that should bring down mortgage rates, so be overweight groups leveraged to mortgage rates or a recovery in housing, like regional and largecap banks. Financials have a balance sheet recovery, a credit recovery, and even maybe improved demand for credit because pentup capex. (People had been cautious and underordered and didn't expand, but then when the hard data is correct they have to start spending again, which is upside to Industrials earnings, but also helps Financials because capEx is consuming more credit. 2024 a backend loaded year, more money made in second half. AI momentum might go away (timing gets pushed out). Tom Lee.

Calling smallcaps, which have been a drag on portfolios the last few years, ‘zombies’ is an ‘unfair characterization. The Russel has always had only 70% of its companies profitable. So that’s not a problem if companies aren't profitable because that's always been the nature of the index. What matters is macro, like retail inflows. If people are taking money out of the stock market, they're not putting money into any Russel small cap index, so that's why there's been such a drainage out of smallcap and collapse of valuation. P2B is same as bottom at 1999. They have higher cost of money and are generally more levered, so this tight money has punished smallcap businesses. Soft landing isn't good for smallcaps but expansion if it happens is a huge tailwind. Tom Lee.

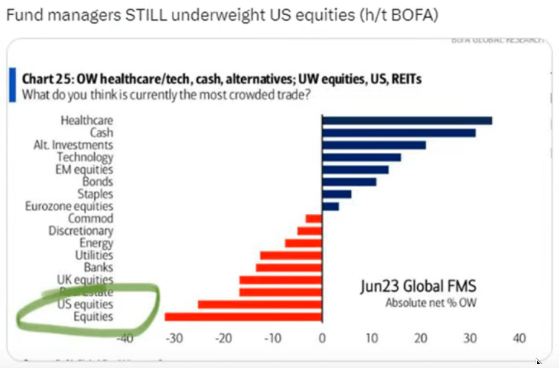

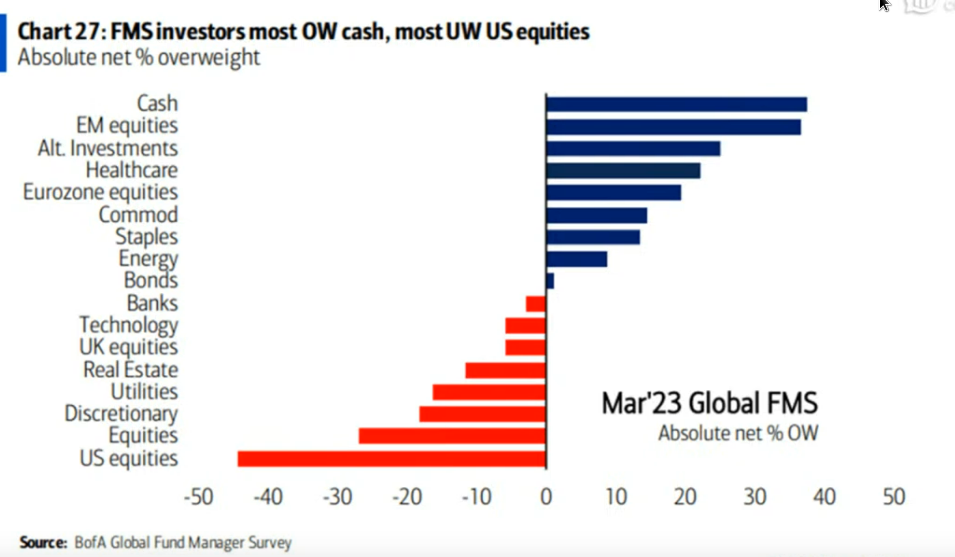

Financials are underowned. Positioning is lowest in 10 years for hedge funds. Tom Lee.

Technology companies are going to grow earnings faster than S&P, and multiples don't have to contract for Tech. It's just there's less juice in the thesis because there's less room for surprise. You only sell Tech if there's going to be a hard landing and then companies would slash capEx (but then you just want to be in cash). Tom Lee.

History reading is the most important way to understand society, but it's also helped create thematic research for us. Demographic studies. (Crypto disruption, millenials' dislike towards banks.) Labor shortage and AI. Listening to credit and internals. Inflation at the 32-component level. Tom Lee.

Bitcoin is the most secure way to move money. No fraudulent transactions in 15 years of their ledger, with banking 6% are suspicious. Tom Lee. You've never had a downcycle in crypto when Fed is easy.

- Dec, 2023

- Dec 19, 2023

-

Devaluación del 50% y fuertes recortes, las primeras medidas económicas del Gobierno de Milei - YouTube

#Argentina

Jim Bianco discusses Yesterday’s FOMC Meeting, Reaccelerating Inflation & Financial Conditions - YouTube

Current bull market, it seems to most. Sentiment is good among investors. Bianco says it might be premature, because if there are market gains people who made them will spend that, feeding inflation. Or has the Fed enacted an economy-cooling method that only slows down the poor while investors do fine?

‘Economic projections cannot be the only driving focus of your portfolios, because everyone last year was calling for a recession.’ - Marta Norton

Pair it with valuation, base case economic scenario, and the range of economic outcomes.

‘People were fooled by the yield curve at the start of this year, thinking we’d have a hard landing. And they didn't want to fight a Fed, but they're forgetting the Fed was fighting an inflation war, not a business cycle.' Tom Lee

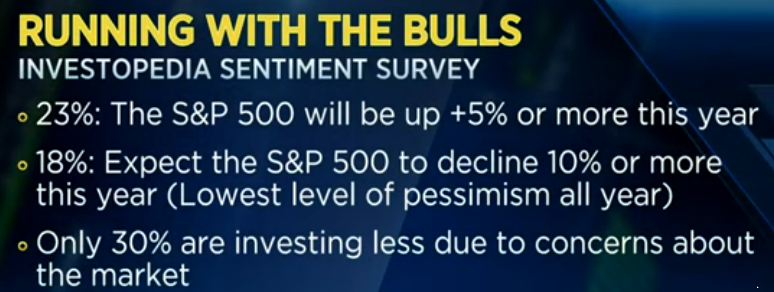

'Improving liquidity, as investors took $240b out of stocks this year.'

$6t on money market funds.

All-in Podcast:

(9:29) Jury rules in favor of Epic Games over Google: How to handle the app store duopoly?

(23:21) OpenAI inks deal with Axel Springer

(35:02) FCC cancels Starlink subsidy, dissenting FCC Commissioner says federal agencies are targeting Elon Musk on Biden's orders ('A pattern of the Federal government harrassing Elon and his companies, and it all stems from Biden at that press conference saying ‘We gotta look at this guy.’

(58:25) Alex Jones reinstated on X

E157: Epic legal win, OpenAI's news deal, FCC targets Elon, the limits of free speech & more - YouTube

FTX files revised proposal to end bankruptcy and return billions to creditors: CNBC Crypto World - YouTube

Economy will slow 'substantially' next year compared to the current pace: Marathon Asset's Richards - YouTube

‘Year of the refi’. High-yield bond market, leveraged loan marketplace, private credit, all doing 12% plus this year. Credit has performed well. 2024 will be similar, but there will also be very strong volumes. M&A has been down. But as rates come down, it will unleash M&A and private equity.

Consumers will refinance into lower rates. Auto loans and mortgages. Corporate refinancing. - Dec, 2023

- Dec 12, 2023

-

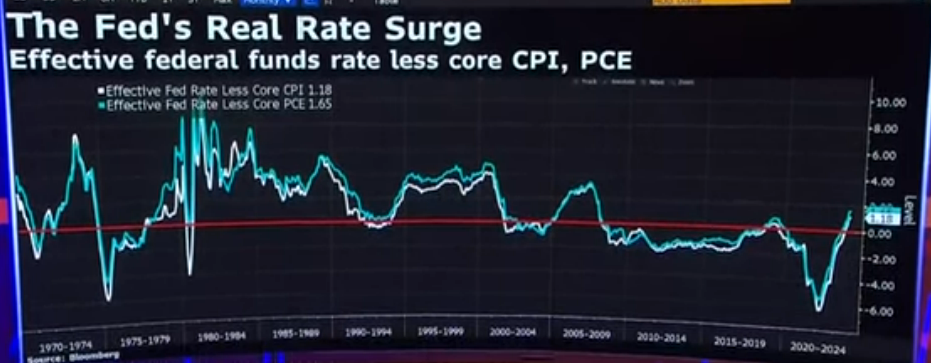

‘[T]the real rate of interest, which is what impacts the economy, keeps increasing as inflation declines.’ - Ackman

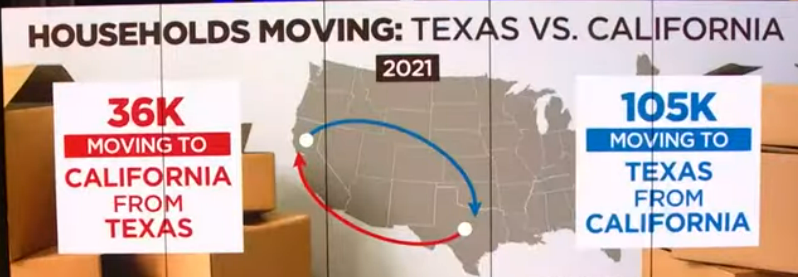

More people moving out of Austin than in, first time. Some are moving from Texas to Cali. Although 3x that amount are moving Cali to Texas. House prices in Austin are up, so a house might cost the same in SF or Austin now, and taxes are different (Cali has prop13 to protect against high prices(?). Austin still has no income tax though.

The last Fed hike and then a cut is actually bearish.

Vol only works as in indicator, when it's high, extreme.

Pfizer to discontinue twice-daily weight loss pill due to high rates of adverse side effects - YouTube

Pharma is the biggest advertiser, because they want to be able to shape news coverage, and they influence news coverage, because they're the biggest advertiser.

The rules of TV entertainment news are pretty harsh.

Nov a buy-everything market, stocks and bonds.

Last 10 years Tech has compounded at 16%, non-tech at 6%. Matches earnings for these two. We're back on trendline for Tech versus non-tech.

U.S. oil production is a 'real problem for OPEC', says top energy analyst Paul Sankey - YouTube

Saudi will decide.

Bitcoin doesn't have a lot of buyers at the bottom. When it gets high it gets a lot of buyers.

The Fed has 'basically become a giant hedge fund', says former World Bank President David Malpass - YouTube

It borrows at 5.4% from banks and dumps it into government bonds, so govtthinks its better off than it is, which encourages it to be short when rates were zero. It's a risk for USD.

A floating rate loan from banks to the Fed. Banks can get squeezed out for this. We're relying on private equity. I banks weren't doing this loan to the Fed, banks could consider small business loans and things that are thought to grow the economy. All the major Central Banks are doing this. Allocating capital to government will slow growth, thinks Malpass.

Not balanced. Small borrowers (who would like to borrow at floating rate) have to borrow at short end. Wealthy can borrow at long end.

(There's no money printing. It's all money borrowing.) - David Malpass

Moody’s cut China’s credit outlook to negative on rising debt risks - YouTube

‘Fed is paying people not to take risk.’

Citi is cutting ‘5 layers of management’. How many layers were there?

‘The same factors that delivered better than expected growth still intact.' - Julia Coronado

Better productivity, better labor supply. Fed has ammo and can cut rates 100bps. If we uninvert the yield curve that can be a positive tailwind for growth in the second half. ‘We’re in the soft landing' and there's another cycle to come.

But there are lags in monetary policy, rates are very high, money is tight and could start to bite. Housing in deep freeze.

Trade settlement going from 3 days to 1 day in US. It guarantees you got the things you bought, sooner. It's guaranteed by someone in the middle for now 1 day. ‘Counter party risk.’ But banks don't get to keep that spread for 3 days now.

Netflix released their numbers, in order to look good? - Nov, 2023

- Nov 30, 2023

-

-

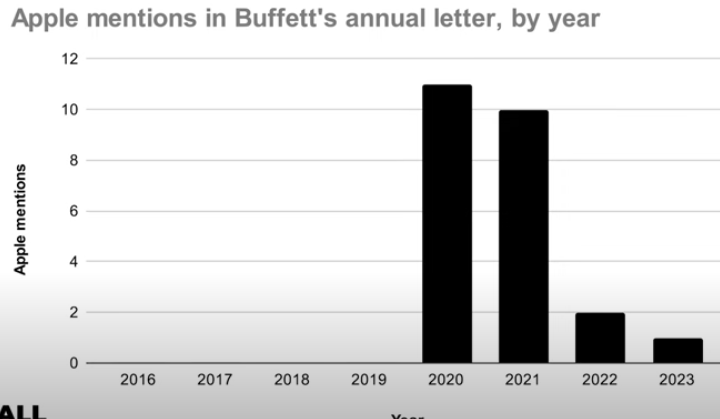

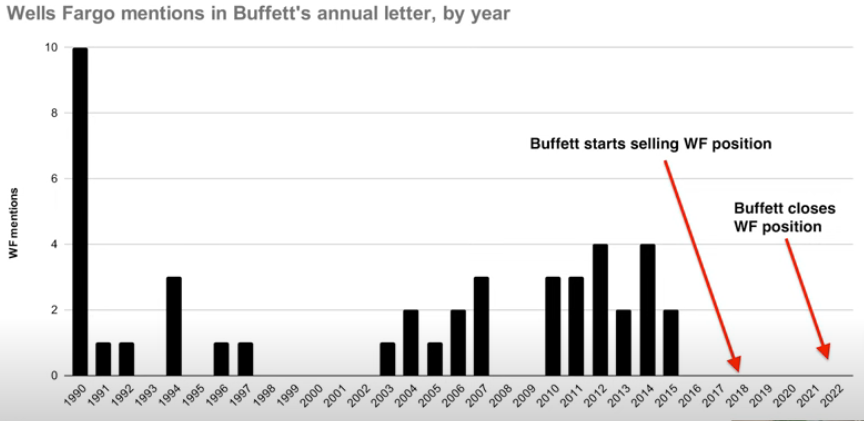

Berkshire is holding record cash, can't seem to find anything they value buying. They have it in short term security and buybacks.

Is there just a lot of money nowadays and a big investor is less useful? For example, all the new companies get bought at too-high prices, more fail than Buffet's traditional model (or even a model of overall viability), but some have success?

The economy was supposed to be much weaker. It's not. That's why when the market moves, the marrative shifts to fit that price action. - Misra

Fundamentals are holding up in Qs. Tax loss harvesting occurs everywhere except the megacaps. Buybacks will be strongest in megacaps. Megacaps have least sensitivity to cost of borrowing.

Retail traders aren't trading as much. Not great for RobinHood, Schwab, who had been pushed to highs. Can they build a base of wealthier, long term investors who want to use their product? Retailers have learned it's tough to earn on the market, and that this can eat away at their returns.

118 day Hollywood writers strike over (tentative deal still has to be signed). The impact of the strike will be seen rolling. Shows that they didn't write were put off, so will be shown later, next year. How will the industry be on the other side of this? There's a question about if you strike too much there may not be any place to strike from. Writers will get bonuses for hit series though now.

Disney cut back production costs $27b to $2b, so the cost of several projects. Others doing the same. End of content bubble. It's hard to screw up sports, some say, but you gotta figure out how to do it.

Disney parks are more expensive now so sort of target more affluent customers.

European gas inventories are almost 100% full.

Berkshires costs are up 40%.

https://www.youtube.com/watch?v=TvE9hsCb4V0

Same quarter or quarter before Berkshire moved stocks.

Buffet's taxes were stolen and leaked.

This was done by ProPublica, whose business model seems to be significantly just going after wealthy people who have made money (legally). Buffet has a long resume.

More tech layoffs announced.