- Mar 31, 2023

-

Tech has a long runway of expected future growth, generally prefer deflationary environments with low interest rates, because of the low cost of capital and you can afford a long runway (10 to 15 years), let that compound.Energy and financials, inflationary environment, higher rates and higher cost of capital.To sell winners and buy losers, you need a thesis for why that's likely to change. Depends on cycles, rotating into things. Systematic framework to monitor it.

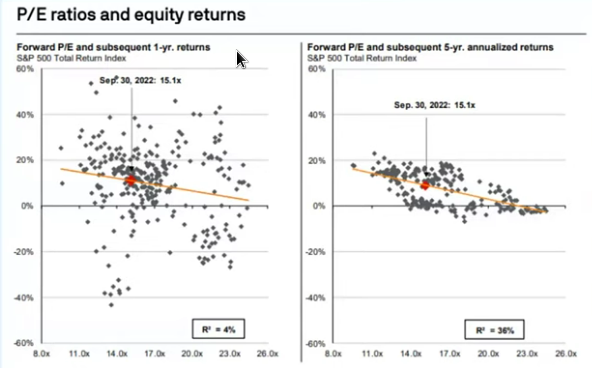

Don't gauge for one year. Rarely in one year is valuation the primary factor. It's sentiment and fund flows and liquidity conditions and tactical things like that. For one year, look at trading indicators and flows. The following chart shows 5 years, but longer amplifies this.

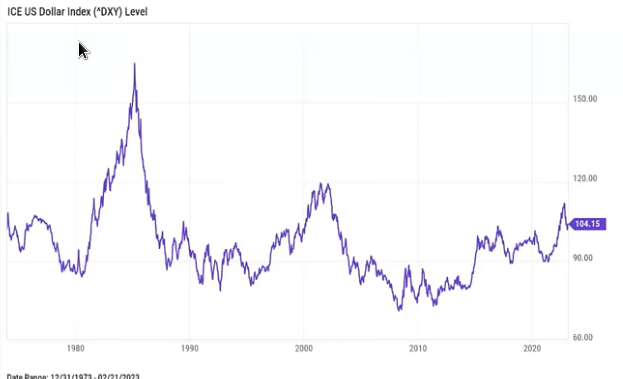

Don't gauge for one year. Rarely in one year is valuation the primary factor. It's sentiment and fund flows and liquidity conditions and tactical things like that. For one year, look at trading indicators and flows. The following chart shows 5 years, but longer amplifies this. EM inverse correlation with USD, because they have $dol denominated debt (not to US mostly but Japan, Europe, China), so if USD strengthens their liabilities get harder.There's really only been 3 cycles in USD

EM inverse correlation with USD, because they have $dol denominated debt (not to US mostly but Japan, Europe, China), so if USD strengthens their liabilities get harder.There's really only been 3 cycles in USD

Show More

Show Less