- Apr 25, 2023

-

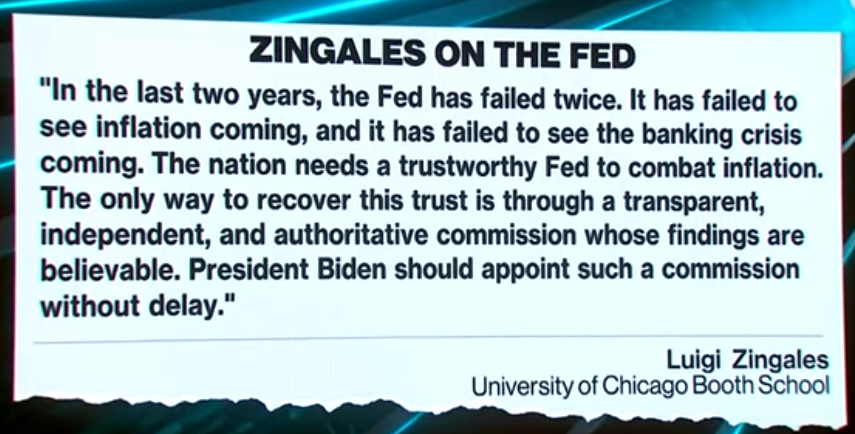

"When you raise rates so fast, you're going to impose losses on the bond market, and who's going to bear those losses? Insurance companies and banks. Then you have to bail them out.""They have 'all the tools' but the tools were not very sharp.""Clearly put a lot of softness in the banks, particularly regional banks, which are the ones who lend to small and medium sized enterprises. The bread and butter of the economy. ... They see deposits flowing out, and they don't want to make loans. If they make loans and then deposits flow out, they have to sell securities and then they make losses. The first thing they do is not make new loans, and then probably they divest securities where they can (slowly).This banking system doesn't work at 4% rates, he said. That would be all their profits.

"When you raise rates so fast, you're going to impose losses on the bond market, and who's going to bear those losses? Insurance companies and banks. Then you have to bail them out.""They have 'all the tools' but the tools were not very sharp.""Clearly put a lot of softness in the banks, particularly regional banks, which are the ones who lend to small and medium sized enterprises. The bread and butter of the economy. ... They see deposits flowing out, and they don't want to make loans. If they make loans and then deposits flow out, they have to sell securities and then they make losses. The first thing they do is not make new loans, and then probably they divest securities where they can (slowly).This banking system doesn't work at 4% rates, he said. That would be all their profits.

Show More

Show Less