If you could teleport gold from Tokyo to NY in a couple minutes, people would like it.

#Crypto

It's not digital currency. It's digital property. It's capital preservation for everyone.

Michael Saylor: Bitcoin, Inflation, and the Future of Money | Lex Fridman Podcast #276 - YouTube #Saylor

Inflation CPI understates the suffering inflicted upon the working class and on companies by the political class. It's a massive shift of wealth from working class to propertied class. Shift of power from freemarket to the centrally governed or controlled market, from people to government. Saylor

In an environment where you're infating the money supply and keeping assets constant, assets will appreciate in proportion to money supply, and the scarce desireable quality will determine value of inflation. Money supply expands 7% per year on average. Many houses have gone up in price more than 300x in 100 years, or around 6.5% per year. You're sucking 6% of the energy of the fluid that the economy is using to function. Currency moves economic energy around.

All government policy is inflamatory and inflationary. Any policy. It interferes with free market and prevents some rational actor from doing it in a cheaper, more efficient way.

Wars (and other policies) are never paid for with taxes. It's too transparent. If people understood the true cost, you will lose 95% of everything, you might reconsider a policy and vote for a politician. A lack of humility. People overestimate what they can accomplish. Experience causes you to reevaluate that. Our mistakes are our good ideas that I enthusiastically pursued, to the detriment of my great ideas that required 150% of my attention to propser. People pursue to many good ideas. There's a limit to what you can accomplish. Everyone underestimates the challenges of implementing, overestimate the benefits of the pursuit. Overexuberance. As the exuberance of the government expands, so must the currency supply.

Inflation is completely misunderstood. Inflation is a vector tracking price change in every good and service.

You can't blame them, because economists don't even understand economics. If they did, they would measure every price of housing, the full array of foods and the full array of assets, and they'd publish this every month.

The primary problem is ‘The government will try to do good.’ It will do more harm than good. They will try to pay for it by expanding the monetary supply. They won't realize this. They'll collapse their own currencies, and mismeasure how badly they're doing that. They'll say the dollar lost 95% over 100 years. Actually it lost 99.7% over 80 years. They'll overestimage their budget and means to pay for it. They're oblivious to the damage they do to civilization. The mental model they're taught, it's Ok we can print lots of money, is defective. ... Other countries lost 99.9% or all (currency failed).

If house prices are going up 20% per year and I say this is great for the American public because most people are home owners, I'm misrepresenting it because it's really a negative.

Look at the ship next to us. What if I told you your ship leaked 2% every year. It's rotting 2% per year.

MIT costs hundreds of years of many families earnings. Inefficient. The seats are uncomfortable, too. Now we have the same teachers you watch on your chair at home. You need PHDs. A PHD is $1m. There's 10m in the world. How many people COULD get a PHD if it were affordable?

If you try to solve this by throwing money at it, you can throw a trillion dollars. $10t, you still don't get there. Harvard can't educate that many.

Education can be infinite and for everyone.

Open, permissionless, not censorable. Non-sovereign bearer instrument. Property. Irregardless of anyone else or government. Twitter stock will never be property in China. It will never be trusted. Property is low-frequency money. If you wanna hold it for a decade, maybe you buy a house, maybe in a decade you sell the house and buy the property again.

What makes bitcoin ethical (to endorse) is no person can change it (well, but they can if they have influence or power). No one can do what they could if it were a security, print 1000 more copies tomorrow.

Bitcoin is the first time we created a digital property. Everything else is securities. Sending money digitally is an IOU.

An armed society is a polite society. If you disagree, you can always withdraw your resources from it.

You can promote a property to the extent that you don't control it, ethically. There's an interest still, but that's different from a conflict of interest.

8b people with mobile phones serviced by 100m companies doing billions of transactions per hour. The companies are settlings on the base level, and the companies are dealing with the consumers on proprietary layers like layer 3, and on occasion people are shuffling assets on layer 2 (moving $50 or something).

You can't trade with a company in Nigeria. No amount of money or time. You get shut down at the banking level (you can't link a bank there with a bank in the US). At the credit card level (because they don't have the credit cards so they won't clear). At the compliance/FCP level your system is from a different political jurisdiction and it can't interface with theirs. You can do it with crypto, fast, cheap, with anyone.

Bitcoin's a universal trust protocol. So is English. No one's payment system works everywhere. US payment systems in Russia? But bitcoin also can't be done easily in these places.

No security can be a currency for the internet. Only a property can be.

If bitcoin goes up, because of how much he owns, Saylor could become the wealthiest person.

The Canadian trucker protest educated millions of people and made them start questioning their property rights and their banks. War in Ukraine was the second shock, Russian sanctions. Hyperinflation in the rest of the world a fouth shock and persistent inflation in the US a fifth.

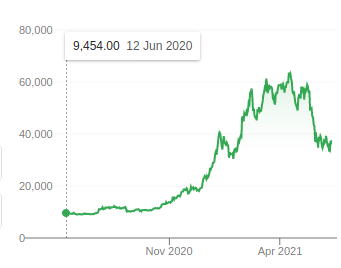

Bitcoin's volatility attracts all the attention, massive gains and losses, which sucks money into it. Also, it results in massive gains for traders, and that attracts capital.

Temu spent $1.7b in 2023 to advertise and got, in a year or two, 161m users, nearing what Amazon has. It might spend $3b in 2024 on Facebook, Insta, Tiktok, Suprebowl. Temu replicates what Ali did. In 2023 sold products at a loss of about $7 per order. But others say it isn't really losing money.

Temu connects factories with customers, cutting the middle man.

Temu gamifies shopping with games on the app to win prizes. They have countdown timers running on each product to show when a sale ends.

Temu shows that consumers are willing to wait (not fast shipping) as long as the price is cheap.

Morgan Stanley reported they think their growth is cresting.

The quality is low. Safety is a question.

There is a data risk.

China considering liberalizing household registration program. Currently migrant workers in cities can't access any social benefits because their household is registered back in their village. If they change this, they can buy apartments etc in the city.

China is buying ETFs, stimulating their market similar to US did.

If China changes just a smidge in the right thing, they'll attract tons of foreign investment.

China government has the money to spend.

China continues to clash with Philippines fishing boats etc. Some concern it could go too far.

There are hundreds of millions invested in Bytedance out of the US, which represents billions in value.

This week lots more headlines on China, not negative, some modestly positive.

China growth more in lower-tier cities. Tier 1 and 2 are 20 or 30% of economy, 6 or 7% of population.

China the companies that have outperformed have been doing outside markets. Growing rapidly overseas markets. Appliances and durable goods benefit from this trend, maybe.

Some China sectors in bull market of 20% off low. Materials, renewables, smaller cap tech.

Miniso CFO discusses company's plans to add about 1,000 stores a year over the next 5 years - YouTube

#Retail #China

In some countries (Nigeria currency) it's ‘staggering how much wealth was preserved.’ 'Until you get countries that run more credible fiscal policies, people are gonna wanna buy that story, and it's a story that's spreading.'

The monetary policy for this ecosystem was set in code by Satoshi whitepaper.

Chinese space company founders are coming in significant part from Finance (like America). Samo thinks maybe they're coping it from America, but that they don't have an Elon-tier person so it won't happen. But even if they did it would be, internationally, so controlled, similar to exporting nuclear reactors, where you better be on good terms from US or a similar Western country if you want to buy these instead of making them yourself.

Jack Ma may have been an example of the highwater mark of how much impact on Chinese society can a purely commercial or technocratic actor that's not aligned with the CCP have. The ceiling is pretty low. Not even critiquing their policy.

China is not like Singapore, which will use a sovereign wealth fund that will try to develop a totally new product, a novel solution to a problem. (Singapore working on insect protein, which is kind of what you need for a tiny city state to feed its population.) When China says they're going to invest in AI, it probably means close the AI gap by copying the US. What makes the individual threatening to the CCP is their popularity. If they offer something Chinese people want or like, they'll be liked too much.

Might be a spot ETF for bitcoin in HK, and there's a lot of interest.

To do this, you need a bunch of financial institutions working together. The stock exchange, regulated asset managers who can manage the product, licenced brokers called participating brokers, and depository services who support the running of the fund. In HK also asset custodians in cash and crypto sides. And good quality market makers to support a product after it starts trading on an exchange.

They've seen how the US did it and can use that roadmap.

The HK might have an advantage over the US product because you can actually pull Bitcoin out from the funds.

The HK fees have to compete so be as low as what they US ones were set at.

They can't launch too fast because they think most important is to have a product people like, a quality product.

Eth etf race. US hasn't approved any product yet, so there's a more global race for that. Being first to market is critical for players investing in that space.

China, reportedly the young are really spending, and it's their income that is limiting their spending.

S&P large cap around 15x the mag 7. While the Russel2000, looking at the profitable companies, around 12x. ... When rates cut there will be multiple expansion plus risk appetite growing, perhaps. Tom Lee

‘The fallacy of a 2% inflation target by the Fed’ - Bookvar

Because of technology, 'prices usually fall. Tech prices are keeping a lid on goods prices, and that's 0, then something else has to rise by 4% to get to the 2. So J Powell is actually rerouting for higher other prices to offset that natural decline in prices from technology, and that makes no sense.'

The reason why there’s a 2% inflation target is not for the best thing for the economy. ‘If the inflation is at 2, ideally we would have a Fed funds rate of maybe 4, and if we go into recessoin we’ll have 400 basis points to cut in a downturn.' ‘It’s right for their own policy.'

But they do also think 2% is good for the economy. It greases the wheels of the economy. You want a steady modest rise in inflation so people go out and spend. ... But there are a lot of people who would say the right level of inflation is 0.'

Restaurants don't have a lot of productivity levels to raise to offset higher wages. You only have one and that's to raise your menu prices.

VISA sees everything, every type of consumer. If the consumer is trading away from Macdonalds and going to Taco Bell, VISA sees the spend.

They see basically no weakness anywhere on last call.

There's also a shift in how people spend and pay. They pay with cards and don't even carry cash. They buy less for stuff around the house and go out to eat more.

BofA says there are still excess savings. The lowest savings accounts still have a few thousand in there. They have 4x than what they had saved pre-covid.

Cruise lines said they've seen no slowing in spending. Home restoration supplies are a little soft, because they've been booming for several years and that's already done.

Fed might have been suprised by QT not having an impact. Then the AI boom in 2023 and earnings recovery animal spirits. Fed might have been thinking they were sailing into a deflated direction but AI boomed, and tech companies buying from each other meant high revenues.

Nvidia's biggest customers today are trying to be its competitors. They're all trying to make their own chips.

When a stock goes vertical (on good news or whatever) you're pulling forward a lot of future returns. It matters what you pay. A stock parabolic move can pull earnings forward 25 years.

There's a pro-shareholder thing going on in hottest stock market Japan and hottest EM India. Whether they're actually doing this for the stock market not sure. Whether they're looking at US and saying Hey maybe there's something there not sure.

China's middle class, over the next 5-10 years, will go from 400m to 800m (add the size of US population). Chinese love to travel to Japan, Singapore, Thailand, Indonesia, Vietnam, India. Middle class stories. Chinese travellers sprinkled $250b around the world in 2019. Shopping luxury, eat out, experience things. The more they make the more they wanna buy.

China, even if grows 3% per year for 10 years, in terms of dollars that's still a lot of dollars.

Apple needs another China, but the whole (asia) region will be that. But they have to compete against $10 Chinese phones.

Netflix et all used to be like How do we get these movies to open big in China? Now it's all India.

India printed an 8.4% GDP number for Q4.

Tesla, multiple is still so fat. No margin of safety when fundamentals turned to the downside. Has to reach a bottoming in sales numbers for dip buyers to return, maybe. Hybrids are so hot, and that wasn't assumed years ago, they thought it was EV or not. The hybrid bridge. Toyota was in it, no one else.

-

-

Court Orders Police to Give Man's Phone Back After 175M Failed Password Attempts - YouTube

In Ottawa, Canada. How long should they be allowed to keep it? How many passcode guesses? They wanted to keep the phones for 2 years. They use a dictionary of passwords, leetspeak, and numbers. Takes about days to test 30m passcodes, but depends if the password is in the dictionary. Software (Mentalist) allows them to generate passcodes customized to what's known about the suspect.

The judge is framing it as a property rights question, not a privacy rights question.

Proposed Law Would Block Use of Bodycam Footage on YouTube - YouTube

‘Seeks to protect women’ and ‘young’ individuals also languaged, ‘young women’. Open public records act requests. Leveraged for gains on SM.

State Court OKs Warrantless Searches Based on 'Nonverbal' Gestures - YouTube

Wyoming.

‘Based on believed’ consent. What if the person who opens the door is just a visitor? Good faith belief. ‘Believed authority to consent.’ A smart officer will now just not ask if the residence is theirs, but will just say ‘Can I come in?’ and on ‘good faith’ believe the person had authority to consent nonverbally. If a man shrugs his shoulders, they can assume that means ‘I don’t care go ahead and search' when actually he meant ‘Why are you asking me that? its’ not my place' when he shrugged. Things that before would have meant the police don't have consent now mean the police do have.

Court Allows Suit to be Served Via Bitcoin Wallet - YouTube

#Crypto

Canadian customs officers could soon be based in U.S. for the first time - YouTube

‘Preclearance.’

Canadian guards would arrest people wanted under US law.

Border guards and their lawyers didn't evne know about this until journalists at CBC just called them to comment on the story. They have a lot of concerns, and don't know anything about how it would work.

Are all laws in Canada passed in secret from anyone they might affect? because it seems to be this way a lot.

900 Wrongful Convictions in British Post Office Scandal - YouTube

#UK

Not accused. Convicted. Because of a faulty computer system. Left them ‘bankrupt and bronken.’ Fixed after a TV docudrama roused public support, not before, not even after then news published on it. The State owned post office maintained that Horizon (their software) was reliable and said the branch managers were guilty. Some went to prison, some were bankrupt trying to defend themselves, became community pariahs, accused of stealing, marriages fell apart.

Similar problem happened years ago in Michigan, Lehto said, to handle what they wanted to be an easy way to deal with unemployment claims, flagging people falsely of receiving fraudlently obtained unemployment money, and prosecuted them, saying they had to pay the money back. Class actions were served. Trusting machines to do our thinking for us, and make decisions for us.

Huge Civil Asset Forfeiture Win for the Marine - YouTube

#Nevada

How many civil asset forfeitures happen in the US?

Man Sues 27 Women for Comments on 'Are We Dating the Same Guy?' - YouTube

Apparently there are Facebook groups like this for regions/cities. Sometimes it's someone's husband or wife.

Relatedly, the state is looking at new legislation to prevent sharing of personal information online.

GREAT 2A DECISION: Federal Judge Rules Post Offices ARE NOT Sensitive Places! - YouTube

(Didn't watch.)

The current legislation limiting big tech is not meaningful. Of all the big fines handed out to the big tech companies last year, the biggest fine was paid off in 7 days. Andy Yen. You can't change those companies behavior unless you're forced to. DMA coming into force this year in Europe though.

Saskatoon passengers landing in Orlando told they 'entered the country illegally' - YouTube

A staff member opened the wrong door so they didn't pass through customs.

Madonna sued by fans in New York over late concert start time | BBC News - YouTube

Is the ‘Panemic Treaty’ the next ‘Patriot Act’?

Reports Ireland govt is trying to make new hate speech laws so citizens can't complain about immigration, which perhaps they majority oppose?

Will Sin Fein become increasingly the nationalist party?

Police Called To Stop Filming During Piano Livestream - YouTube

This is something legislatures are going to have to decide. Should people be unrestricted in where they film/livestream? Do public spaces belong to people who don't care about others who may not want to be in their videos? or does it belong to people who would limit the ability of others to film?

#CivilRights -

-

-

During the past week of days when the market was bearish, bitcoin has risen significantly, like gold and treasuries, as a 'safety' move.25% of American adults own Bitcoin according to some sources.

-

Stable coin scamsIf they say the value is pegged to the dollar, and they don't have the capacity to keep that value there.They also 'defeat the whole purpose of crypto currencies', Yanis said.

-

Bitcoin so far has never been macroeconomically significant - YanisCentral banks can create tens of trillions of dollars. The crypto market cannot destabilize that.Capitalism is unstable by itself.

-

$100 or 300t problem, potentially the biggest ... that the price of money is centrally planned - Dylan LeClair50 years into global fiat currency experiment. Reaching a point where global debt burdens are so bloated that the only way out is monetary debasement.

-

In crypto, some are calling for setting up emergency liquidity procedures, creating pools of money to help firms when they struggle with liquidity issues when people start to pull money out. Like with banks.Is this the same as ‘centralizing’ this decentralized thing?

-

Crypto (after FTX)'Sometimes you need to battle-test the infrastructure and the thesis (and see who are the survivors)' - Kathy Wood on crypto"Cleansing bad players" - Tom Lee. 2023 if there's more fraud, Bitcoin will probably have another bad year, but good companies will emerge out of it, like how JPM came out of 08. Similarly, from the old internet, there were lots of software and media companies (Yahoo), which most people today have never heard of. Many went bankrupt. A few are big now.There were 2 big 'white knight' players in a supposedly-supposed-to-be decentralized industry, FTX and Binance. Now there's just Binance. Binance is bailing out FTX and others. What happens if something happens to Binance. Who's going to bail out Binance?Mix of lots of customer money, non-disclosure, and leverage (borrowing against it), and inside these companies trading.The public, around the world, has got hurt by this. Laws can protect investors. Going into courts, telling judges the facts and the laws.Celebrities. People can fall prey to their promotions, their marketing.Education ('this is speculative') is part of the SEC strategy.Of all the cryptos, Solana, etc, only 2 or 3 or 10 will survive. The next coins will be gen 3 or 4 or 5. Zuckerburg saw what was there at the time, learned from it, and improved it. Google saw other search engines at the time. Shkreli talked about this stuff.

-

FRED, Central Bank digital currency, biggest holder of mortgages, Citi, BNU Mellon, US Bank, Wells, etc. France, Switzerland, Singapore cross-border CBDC.BIS is a private institution overseeing government things. Control over purchases, no cash, government can freeze accounts like Canadian Truckers participation and support. Events can also be faked while backdroors are pushed through. One digital identity mapped across all bank accounts, KYC. Carbon scores, social credit.

-

What's the difference between bitcoin and the USD?(If bitcoin is just fake money, with nothing of real value behind it, what is USD?)$30t economy, full faith in credit, and Federal Reserve is behind the dollar, interest-bearing securities in which you can place your dollar with a relative degree of safety, USD still a very highly-rated credit despite debt to GDP levels. ... Ron Isana."It's a real thing." Comprises 65% of global trade. 95% of global exchange transfers. It's a reserve currency (bitcoin isn't, and "doesn't exist in any form except in the minds of those who created it.")"We've done this a million times in the past, whether it's tulip bulbs, railroad bonds, electronics companies or bad internet companies. The underlying internet was important but a lot of the players like CNGI disappear because they had no functional use case"Blockchain technology is useful though. (It is the underlying tech, and crypto is the overlay.) Cheaper, frictionless transactions, more secure, transparent.

-

Economic booms give rise to weird money industries, when interest rates at 0 ('money is free'), past 15 yearsChinese boom, Japanese boom, subprime, crypto (this boom).

-

Overlevered.

Reputational effects. -

Crypto lost $1t over the past few months, and people say a big part is because they can't attract new buyersThe space operates like a ponzi scheme, where it takes new money to pay out old money. Crypto still has no inherent value (use). It's still speculation rather than utility.

-

-

Crypto, and some stocks, within their nicheSo if you have the best crypto (or company), but there's a ton of crap cryptos and they're all going down, some to zero, your good one will go down too as a part of that. Part is news, part sentiment, part that the people who bought those bad ones also bought the good one and they sell them at the same time, bringing prices lower.

-

-

-

Is crypto democratized or democratizing, really?Vice actually did something people said was OK again with this video.

-

Biden issued an executive order on crypto... and Bitcoin went up. His order was to look into it and come up with what to do about it, it looks like.It's being seen by many in the asset class as a defining or watershed moment (just because it's getting this kind of attention and treatment, not because there's anything concrete, which of course there's not).There had been questions about crypto. How to regulate it? Who's going to regulate it? What kind of posture should the US have in terms of competitiveness and innovation in this technology?People say the markets like certainty, even if sometimes it's something not positive, it's the certainty that the markets react positively to.What does this mean as a new competitive infrastructure for the US? How does the US stay strong in this industry, while still addressing the risks?How does the dollar work in this new world? How is it kept safe and sound, so this can grow and flourish?

US dollar competitiveness on the internet is a strategic national issue.Bipartisan engagement about this issue.One of the questions is whether the US should do a central bank digital currency.China has a stable coin, but it has a lot of surveillance in it. -

Ukraine has put up cypto wallets for people to donate... saying the money would be used to destroy as many Russian soldiers as possible, it was reported.They've received several million into these wallets.

-

Idea of Russia using crypto in the face of sanctions not so easy, reportedly... because crypto trading isn't that high. There just isn't availability for the amounts he needs, people are saying.Also, some endpoints are controlled.

-

IMF is urging El Salvador to not use Bitcoin as legal tender

-

CryptoMines/Eternal coin crash from $700 to $4 in a few daysThe devs issued a manifesto:"... the main problem is that NFTs have no additional cost or wear and tear causing an over-population of these assets and thus reaching a point where some investors do not have the need to continue re-investing."This same re-investment effect is necessary in order to continue with a healthy and collaborative environment of a P2E game as there must be movement of investment, reinvestment, and new revenue to maintain a sustainable ecosystem over time or directly more longevity, CryptoMines at its peak managed to make refill its reward pool with more than 1.2million Mints per day, after the fall, we started to see numbers hovering around 50k and even less mints per day, accumulating a debt due to lack of trust and re-investment in the game."

-

Bitcoin tumbleIt went down about 20% in an hour or something, amidst it's few-day drop and small rebound to $42k. It was around $57 before I think.The whole market dropped significantly several days last week, on news headlines about a new strain of the virus. Rebound today for most stocks.On bitcoin though: 'These cycles will continue to play out for three reasons. The first of which is there's higher volatility in crypto; there aren't circuit-breakers that we have in traditional finance, so nothing that can keep a floor after things start going down really fast; and the market never closes, so there's not really an opportunity for information to be digested once this cascading effect takes hold.' - Frank Chaparro

-

Squid Game cryptoWent up like 2800% before, most assume, the owners of the scam converted their holdings into other currency.Buyers were not able to sell. There was an element of this where they said they were going to make a video game, or something.Fun fact: Devs, on the website, had profile photos from ThisPersonDoesNotExist, it's thought.

-

Bitcoin ETF

The first one the SEC let pass. Gensler hinted he's more comfortable with trading on an regulated futures exchanges like NYSE (where the Bitcoin ETF 'Proshares,' BITO, owned by ProFunds Group [$58b under management] is listed) than on Binance and that type of exchange.BITO is not based on actual Bitcoin, but rather on futures contracts, and filed under mutual funds rules that provide significant investor protections, according to SEC. The product already exists, and this is just a repackaging, and if something goes wrong the SEC knows how to deal with it and knows how to intervene.The futures in BITO are a bet on the price of bitcoin, without having to actually store bitcoin, so there's no risk of theft of coins or loss of passwords. If bitcoin goes down in price, your money goes to pay those who took the other side of the bet.The risk is taken by the arbitrageur who holds bitcoins he buys for full price plus a margin of 1/3rd. Ie a bitcoin which costs $60k means $80k for him. They do this because they charge for this service.The return for you of buying BITO is less than buying Bitcoin. It will tend to trade about 8% above the price of bitcoin. (Right now this premium is about 15%.) The ETF's management fee is about 1%.So why is this product even necessary? Some experts say 'institutional money.' Boomer investors who will never get a crypto wallet even if it's easy to do, but who have money to invest and want to put it in bitcoin. Josh Brown recently said Chicago investment culture is such that they would approve an ETF for anything as long as they thought people would put their money into it, or something like that.Bitcoin up steadily over the past months from it's 25k low (or 30 I forget) and is now at $55k (up several percent since BITO dropped). -

China banned crypto, nomatter where trading takes placeUS regulators are also looking at doing something. Notably DeFi (Gensler).China is experiencing energy shortages (Goldman downgraded China's growth forecast for this), and it might last months.Still, any Chinese with a wallet could trade on permissionless decentralized exchanges where there is no KYC.There are also VPNs and many Chinese live and work overseas where it could be impossible to prevent their trading crypto.

-

WIll general purpose blockchains that have greater utility eclipse finished products like bitcoin?This question was posed by an Indian-looking fellow at Codecon (who didn't give his name), to Elon Musk.

-

Hackers don't want Bitcoin, some now like Monero... which hides virtually all transaction details, and is considered a privacy token. With Monero, it's more difficult to see who the sender and recipient are, and transaction amount. 90-95% of ransoms are still paid in Bitcoin, but Monero is increasingly popular.Bitcoin is public ledger and stores all transaction history. It was headline news this month how the FBI recovered payments made with Bitcoin to the Colonial Pipeline hackers.Difficulties with using Monero include that many regulated exchanges have chosen not to list it to to regulatory concerns, meaning it's less liquid and can't be cashed out as easily as Bitcoin.

-

El Salvador adopts BitcoinThe country doesn't have their own currency and uses USD. This means they can't print money, and that can be an issue when you're a net importer like El Salvador is (they could run out of dollars without the ability to print).They also have high unemployment, and 70% of the population doesn't have a bank account, and many Salvadoreans receive money from relatives working in more prosperous countries (about 25% of Salvadoreans live outside the country, and the money they send accounts for 20% of El Salvador's GDP). Money transfers are always a challenge with conventional institutions, and can involve high fees for each transfer (sometimes as high as 10%, which is of course good for banks).The bill passed Congress (62 out of 84 votes) to make El Salvador first country to accept crypto as an official method of payment ('unrestricted legal tender') beside the USD.

-

Bitcoin drops 30%Basically all crypto dropped significantly, after months of increased speculative buying.

Other factors in the drop: further talk of regulation, ESG (energy use) concerns regarding mining, and China cracking down on crypto.In somewhat related crypto news, Bitmix reportedly ceased operations, not long after the tentative conclusion of the DarkSide pipeline hack. Bitmix was a crypto money laundering service used by ransomware hackers.Musk tweeted a "diamond hands" image, signifying he wasn't selling.About a month later, Musk tweeted a more positive comment on energy concerns with crypto mining, causing Bitcoin to rise from around $35k to around 40k.