-

BREAKING: Boeing Whistleblower FOUND DEAD After Stunning Testimony - YouTube

62-year-old Boeing whistleblower John Barnett found dead in his truck after he didn't show up for a legal interview linked to a case against Boeing. Barnett worked for Boeing for 32 years and retired in 2017. After retiring, Barnett spoke out about how Boeing was cutting corners on their airplanes. : StrangeEarth/

'If anything happens, it's not suicide': Boeing whistleblower's prediction to family before death - YouTube

How The Shadowy World Of Organized Retail Crime Works - YouTube

Boosters get a list from the boss, fencers list them on Amazon at discounts.

People trust Amazon to check these things, but then when you consider it you think How can Amazon check this kind of thing? Would Amazon even want to? when they're undercutting the price of TJMax where the goods were stolen from. Online marketplaces profit from this. In the video, the theft ring had been operated on Amazon for over 10 years, reportedly. Amazon, commenting on the story, said they had not received signals the company was dealing in stolen goods, and that Amazon doesn't profit from stolen goods.

This development is on the rise.

The closest to a science fiction government is Singapore. Large investments coupled with technocratic, technological literacy. UK in the 1940s, with radar and computers, speed of breakthroughs. Rest of nations, scientific spending is by consensus, cutting a check for superconventional non-obejectional things built in China.

#China

Anti-Airbnb vandals hit Montreal building as advocates push for crackdown - YouTube

Anti-AirBNB grafitti. Protests want total ban. ‘This new building could have been used for housing but instead it was used for tourists.’

The rush in the door for ETFs such as the new Bitcoin spot ETFs is probably not stable long-term holders, but people wanting to make a profit. Bianco.

If it is people putting in 1% and who have their money mostly in a mutual fund, they will be more tolerant of drawdowns.

International Threat Actors are Targeting Children to Steal Money from Banks & Major Corporations - YouTube

Because ‘automatic scanning doesn’t work.' -

If you could teleport gold from Tokyo to NY in a couple minutes, people would like it.

#Crypto

It's not digital currency. It's digital property. It's capital preservation for everyone.

Michael Saylor: Bitcoin, Inflation, and the Future of Money | Lex Fridman Podcast #276 - YouTube #Saylor

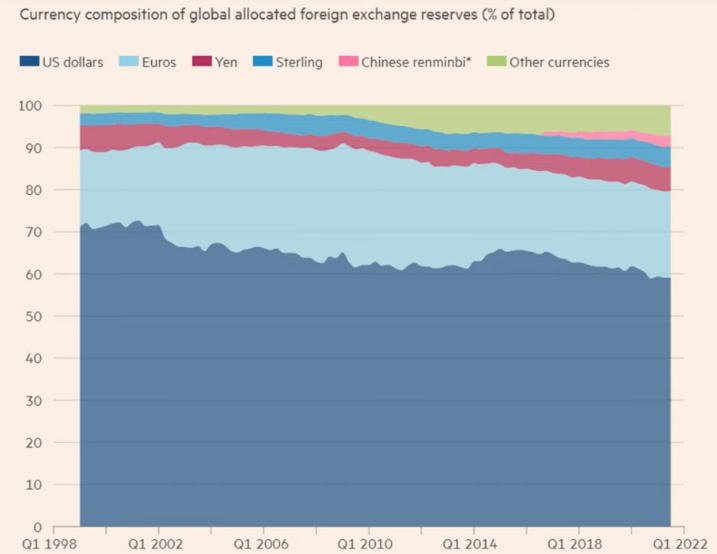

Inflation CPI understates the suffering inflicted upon the working class and on companies by the political class. It's a massive shift of wealth from working class to propertied class. Shift of power from freemarket to the centrally governed or controlled market, from people to government. Saylor

In an environment where you're infating the money supply and keeping assets constant, assets will appreciate in proportion to money supply, and the scarce desireable quality will determine value of inflation. Money supply expands 7% per year on average. Many houses have gone up in price more than 300x in 100 years, or around 6.5% per year. You're sucking 6% of the energy of the fluid that the economy is using to function. Currency moves economic energy around.

All government policy is inflamatory and inflationary. Any policy. It interferes with free market and prevents some rational actor from doing it in a cheaper, more efficient way.

Wars (and other policies) are never paid for with taxes. It's too transparent. If people understood the true cost, you will lose 95% of everything, you might reconsider a policy and vote for a politician. A lack of humility. People overestimate what they can accomplish. Experience causes you to reevaluate that. Our mistakes are our good ideas that I enthusiastically pursued, to the detriment of my great ideas that required 150% of my attention to propser. People pursue to many good ideas. There's a limit to what you can accomplish. Everyone underestimates the challenges of implementing, overestimate the benefits of the pursuit. Overexuberance. As the exuberance of the government expands, so must the currency supply.

Inflation is completely misunderstood. Inflation is a vector tracking price change in every good and service.

You can't blame them, because economists don't even understand economics. If they did, they would measure every price of housing, the full array of foods and the full array of assets, and they'd publish this every month.

The primary problem is ‘The government will try to do good.’ It will do more harm than good. They will try to pay for it by expanding the monetary supply. They won't realize this. They'll collapse their own currencies, and mismeasure how badly they're doing that. They'll say the dollar lost 95% over 100 years. Actually it lost 99.7% over 80 years. They'll overestimage their budget and means to pay for it. They're oblivious to the damage they do to civilization. The mental model they're taught, it's Ok we can print lots of money, is defective. ... Other countries lost 99.9% or all (currency failed).

If house prices are going up 20% per year and I say this is great for the American public because most people are home owners, I'm misrepresenting it because it's really a negative.

Look at the ship next to us. What if I told you your ship leaked 2% every year. It's rotting 2% per year.

MIT costs hundreds of years of many families earnings. Inefficient. The seats are uncomfortable, too. Now we have the same teachers you watch on your chair at home. You need PHDs. A PHD is $1m. There's 10m in the world. How many people COULD get a PHD if it were affordable?

If you try to solve this by throwing money at it, you can throw a trillion dollars. $10t, you still don't get there. Harvard can't educate that many.

Education can be infinite and for everyone.

Open, permissionless, not censorable. Non-sovereign bearer instrument. Property. Irregardless of anyone else or government. Twitter stock will never be property in China. It will never be trusted. Property is low-frequency money. If you wanna hold it for a decade, maybe you buy a house, maybe in a decade you sell the house and buy the property again.

What makes bitcoin ethical (to endorse) is no person can change it (well, but they can if they have influence or power). No one can do what they could if it were a security, print 1000 more copies tomorrow.

Bitcoin is the first time we created a digital property. Everything else is securities. Sending money digitally is an IOU.

An armed society is a polite society. If you disagree, you can always withdraw your resources from it.

You can promote a property to the extent that you don't control it, ethically. There's an interest still, but that's different from a conflict of interest.

8b people with mobile phones serviced by 100m companies doing billions of transactions per hour. The companies are settlings on the base level, and the companies are dealing with the consumers on proprietary layers like layer 3, and on occasion people are shuffling assets on layer 2 (moving $50 or something).

You can't trade with a company in Nigeria. No amount of money or time. You get shut down at the banking level (you can't link a bank there with a bank in the US). At the credit card level (because they don't have the credit cards so they won't clear). At the compliance/FCP level your system is from a different political jurisdiction and it can't interface with theirs. You can do it with crypto, fast, cheap, with anyone.

Bitcoin's a universal trust protocol. So is English. No one's payment system works everywhere. US payment systems in Russia? But bitcoin also can't be done easily in these places.

No security can be a currency for the internet. Only a property can be.

If bitcoin goes up, because of how much he owns, Saylor could become the wealthiest person.

The Canadian trucker protest educated millions of people and made them start questioning their property rights and their banks. War in Ukraine was the second shock, Russian sanctions. Hyperinflation in the rest of the world a fouth shock and persistent inflation in the US a fifth.

Bitcoin's volatility attracts all the attention, massive gains and losses, which sucks money into it. Also, it results in massive gains for traders, and that attracts capital.

Temu spent $1.7b in 2023 to advertise and got, in a year or two, 161m users, nearing what Amazon has. It might spend $3b in 2024 on Facebook, Insta, Tiktok, Suprebowl. Temu replicates what Ali did. In 2023 sold products at a loss of about $7 per order. But others say it isn't really losing money.

Temu connects factories with customers, cutting the middle man.

Temu gamifies shopping with games on the app to win prizes. They have countdown timers running on each product to show when a sale ends.

Temu shows that consumers are willing to wait (not fast shipping) as long as the price is cheap.

Morgan Stanley reported they think their growth is cresting.

The quality is low. Safety is a question.

There is a data risk.

China considering liberalizing household registration program. Currently migrant workers in cities can't access any social benefits because their household is registered back in their village. If they change this, they can buy apartments etc in the city.

China is buying ETFs, stimulating their market similar to US did.

If China changes just a smidge in the right thing, they'll attract tons of foreign investment.

China government has the money to spend.

China continues to clash with Philippines fishing boats etc. Some concern it could go too far.

There are hundreds of millions invested in Bytedance out of the US, which represents billions in value.

This week lots more headlines on China, not negative, some modestly positive.

China growth more in lower-tier cities. Tier 1 and 2 are 20 or 30% of economy, 6 or 7% of population.

China the companies that have outperformed have been doing outside markets. Growing rapidly overseas markets. Appliances and durable goods benefit from this trend, maybe.

Some China sectors in bull market of 20% off low. Materials, renewables, smaller cap tech.

Miniso CFO discusses company's plans to add about 1,000 stores a year over the next 5 years - YouTube

#Retail #China

In some countries (Nigeria currency) it's ‘staggering how much wealth was preserved.’ 'Until you get countries that run more credible fiscal policies, people are gonna wanna buy that story, and it's a story that's spreading.'

The monetary policy for this ecosystem was set in code by Satoshi whitepaper.

Chinese space company founders are coming in significant part from Finance (like America). Samo thinks maybe they're coping it from America, but that they don't have an Elon-tier person so it won't happen. But even if they did it would be, internationally, so controlled, similar to exporting nuclear reactors, where you better be on good terms from US or a similar Western country if you want to buy these instead of making them yourself.

Jack Ma may have been an example of the highwater mark of how much impact on Chinese society can a purely commercial or technocratic actor that's not aligned with the CCP have. The ceiling is pretty low. Not even critiquing their policy.

China is not like Singapore, which will use a sovereign wealth fund that will try to develop a totally new product, a novel solution to a problem. (Singapore working on insect protein, which is kind of what you need for a tiny city state to feed its population.) When China says they're going to invest in AI, it probably means close the AI gap by copying the US. What makes the individual threatening to the CCP is their popularity. If they offer something Chinese people want or like, they'll be liked too much.

Might be a spot ETF for bitcoin in HK, and there's a lot of interest.

To do this, you need a bunch of financial institutions working together. The stock exchange, regulated asset managers who can manage the product, licenced brokers called participating brokers, and depository services who support the running of the fund. In HK also asset custodians in cash and crypto sides. And good quality market makers to support a product after it starts trading on an exchange.

They've seen how the US did it and can use that roadmap.

The HK might have an advantage over the US product because you can actually pull Bitcoin out from the funds.

The HK fees have to compete so be as low as what they US ones were set at.

They can't launch too fast because they think most important is to have a product people like, a quality product.

Eth etf race. US hasn't approved any product yet, so there's a more global race for that. Being first to market is critical for players investing in that space.

China, reportedly the young are really spending, and it's their income that is limiting their spending.

S&P large cap around 15x the mag 7. While the Russel2000, looking at the profitable companies, around 12x. ... When rates cut there will be multiple expansion plus risk appetite growing, perhaps. Tom Lee

‘The fallacy of a 2% inflation target by the Fed’ - Bookvar

Because of technology, 'prices usually fall. Tech prices are keeping a lid on goods prices, and that's 0, then something else has to rise by 4% to get to the 2. So J Powell is actually rerouting for higher other prices to offset that natural decline in prices from technology, and that makes no sense.'

The reason why there’s a 2% inflation target is not for the best thing for the economy. ‘If the inflation is at 2, ideally we would have a Fed funds rate of maybe 4, and if we go into recessoin we’ll have 400 basis points to cut in a downturn.' ‘It’s right for their own policy.'

But they do also think 2% is good for the economy. It greases the wheels of the economy. You want a steady modest rise in inflation so people go out and spend. ... But there are a lot of people who would say the right level of inflation is 0.'

Restaurants don't have a lot of productivity levels to raise to offset higher wages. You only have one and that's to raise your menu prices.

VISA sees everything, every type of consumer. If the consumer is trading away from Macdonalds and going to Taco Bell, VISA sees the spend.

They see basically no weakness anywhere on last call.

There's also a shift in how people spend and pay. They pay with cards and don't even carry cash. They buy less for stuff around the house and go out to eat more.

BofA says there are still excess savings. The lowest savings accounts still have a few thousand in there. They have 4x than what they had saved pre-covid.

Cruise lines said they've seen no slowing in spending. Home restoration supplies are a little soft, because they've been booming for several years and that's already done.

Fed might have been suprised by QT not having an impact. Then the AI boom in 2023 and earnings recovery animal spirits. Fed might have been thinking they were sailing into a deflated direction but AI boomed, and tech companies buying from each other meant high revenues.

Nvidia's biggest customers today are trying to be its competitors. They're all trying to make their own chips.

When a stock goes vertical (on good news or whatever) you're pulling forward a lot of future returns. It matters what you pay. A stock parabolic move can pull earnings forward 25 years.

There's a pro-shareholder thing going on in hottest stock market Japan and hottest EM India. Whether they're actually doing this for the stock market not sure. Whether they're looking at US and saying Hey maybe there's something there not sure.

China's middle class, over the next 5-10 years, will go from 400m to 800m (add the size of US population). Chinese love to travel to Japan, Singapore, Thailand, Indonesia, Vietnam, India. Middle class stories. Chinese travellers sprinkled $250b around the world in 2019. Shopping luxury, eat out, experience things. The more they make the more they wanna buy.

China, even if grows 3% per year for 10 years, in terms of dollars that's still a lot of dollars.

Apple needs another China, but the whole (asia) region will be that. But they have to compete against $10 Chinese phones.

Netflix et all used to be like How do we get these movies to open big in China? Now it's all India.

India printed an 8.4% GDP number for Q4.

Tesla, multiple is still so fat. No margin of safety when fundamentals turned to the downside. Has to reach a bottoming in sales numbers for dip buyers to return, maybe. Hybrids are so hot, and that wasn't assumed years ago, they thought it was EV or not. The hybrid bridge. Toyota was in it, no one else. -

Compact Disks make Comeback: Memory could Exceed Petabytes - YouTube

Not yet. It's from research in China. Writing on hundreds of layers on a disk. Lasers can focus and write at specific depths of the disk. Another laser will target the writes and cause them to emit light.

They didn't write about how slow writing is, nor how much energy it takes, nor where you get the laser to write like this.

#China #Technology

Story coins. jj -

Private credit bubble. Chairman of UBS.

PIKs. We prefer less transparency, we want them to lie to us. Huge forward risk. Things are not being priced appropriately.

Streaming isn't profitable, people are saying.

Alibaba to Invest in China AI Firm MiniMax at $2.5 Billion Valuation - YouTube

Government regulator website featured(endorsed) Eddy Woo. Endorsing in what Alibaba seems to be doing (for now), which is investing in one of Xi's key initiatives, AI and cutting edge scientific innovation.

China looking to lift all foreign restrictions in manufacturing sector, they said, it's reported.

Investors Beware: US farmland to see historic price crash, amid soaring global ag productivity - YouTube

US paying much more for machinery than rest of wrld. EPA is part.

#China

Wall Street investment funds lose billions on Evergrande bonds gamble - YouTube

People outside China don't understand China. These things (property speculation gaming, Evergrande failure) aren't problems, they're solutions.

China wants 100s of m to move to cities.

We can't learn very much from China other than that the system/structure is very different, they're starting from a very different place. They can just build roads and infrastructure, but that can't be done in the West because you can't just kick people out of their homes. The West prefers our structure, so the things achieved in China can't even be considered in the West (to be done in the same way as China). Clifford Coonan

China's government doesn't have disputes. It just gets rid of oppositions.

Live: How China plans to resuscitate its economy | DW News - YouTube

You can't subsidize EVs or solar panels in Germany to the extent of China, where the company's DNA has the state in it. Theoretically the subsidies on Chinese imports to Germany ‘should be massive’ to protect an industry that will otherwise disappear, like Nokia, whose tech was absorbed and more cheaply produced and sold to into the market. Germany used to have solar panel companies but China subsidized theirs and they exported to Germany. Germany didn't combat this with subsidies/tariffs, and now German solar panel companies sell Chinese panels.

On the other side of things, China could theoretically grow in lots of areas but it's limited by the structure of control by the Party. Internet, journalism, communicaitons, privatization (insurance), tech companies. All are part of the broader picture of economic well-being. The West can do these things. The internet in China is just buying and selling goods.

And the Party can't really reform. It can't make a lot of these reforms. They would be fundamental reforms. It would require levels of freedom that it cannot tolerate.

Cash for clunkers policy in China. They buy your old car or home appliances, and want you to buy a new one. In the past people would just save the money to pay for education etc. Now the money goes straight to their phones and they have to spend it. (Smallish effect.)

China big focus on exports. State subsidies, loans for EVs, probably will be for chips.

China has no green party, so climate change is not an issue in that way.

China, because lockdown was so severe, is perhaps still reeling from that. Could this mean growth for another year just from continued unfreezing (they did 5% last year in whatever part because of this)?

China has deflation. You won't buy a big ticket item if you think price will go down.

Making difficult decisions to protect national brands, not shortterm sales.

China property markets represents savings for a lot of Chinese. Is destruction of these savings a tacit goal?

A porsche, a lakehouse, first class.

China will export components, parts of manufacture, in their move to circumvent tarifs and sanctions in export, relocating manufacture to other places.

2017 China started cracking down on unsustainable growth in banks. Depositors have become cautious in investing in high-risk products. Leverage.

State owned banks lend to domestic businesses. State funded.

Insuring project completion. Banks will be selective in property development. Safeguard asset quality. Not just affordability but confidence the projects will be delivered on time.

China mainland stocks. Fundamental investing is not quite working because there's a lot of structural outflow. Policy and regulatory uncertainty, people are just giving up. Low return on effort. But the reset might be largely done.

Look for companies that can help themselves, reinvent themselves, improve operating efficiency, find new markets, be winners of industry consolidation.

China macro is quite unpredictable.

Musk Vs OpenAI. If people can form a company as a nonprofit (lower tax) and then make it public and make profits, why wouldn't everyone do this?

Microsoft bought 49% (estimated Microsoft invested $10b in OpenAI). Microsoft has gone up $63b since OpenAI, putting Microsoft at $3t, the largest company in the world now.

It appears OpenAI started opensource, with the stated concern that one company (then Google but now Microsoft appears the same thing) would get all the benefits of AI. Elon was a big investor, the biggest investor, on tihs goal. They got other investors, on the idea it was opensource and would benefit everyone. Then it was closed. (Did they also remove all the opensource people?) Then they raised money on the idea of profits and employees sold a couple billion of stock into their pockets. If it had been opensource, Microsoft could have just used the models for free and not had to pay OpenAI.

There's also consideration Altman may have used the openAI name to do other deals not for OpenAI which might be in the region of taking the corporation's opportunities. (Alman may be getting corporate opportunities as a form of compensation when perhaps he should just be getting compensation in the corporation and the corporation should own all its opportunities. He can monetize the ecosystem. He ‘famously’ doesn't get compensated at OpenAI directly.)

Musk put in the first $40m, most of the money. Elon would own half the company if it had been initially private, maybe. So maybe you could give him 20% to make him whole (but Elon doesn't want money it seems)?

You would think it was more valuable in 2020, nonsovereign, decentralized, the fundamentals seem good but the product wasn't valued. ... 98% doesn't understand it, it's a bit too complicated, they're afraid of it. Saylor bought Amazon, Apple, Facebook and Google. ... Just because you don't understand it doesn't mean it's not true. ... Then, in 2020, 20-somethings know they should buy Amazon, every Uber driver knows that. Get off the mobile wave, get on the crypto wave and think that through. It wasn't without risk but the alternative was throw in the towel pretty much.

Companies forget what it means to make great products.

Rebecca Patterson says China is biggest factor driving gold prices higher - YouTube

From 2k to 2200. China government has been buying reserves 16 months straight, not expected to stop. Chinese people putting money in gold because where else?

Gold's not a story until it is.

I haven't seen gold in economics news for months, not even one headline.

The Downfall Of Amazon Has Started - YouTube

New fees (which theoretically should have been there before but Amazon bore them itself to win over sellers). Fees for carrying low inventory (so Amazon can't easily store it everywhere and deliver it in a day like they want to to maintain their value proposition of fast delivery). Fees for returns if a product gets a lot of returns. Cost subsidy. (This reminds me of what we might expect from Uber at some point, because other than removing number-of-cars limits for cities, it's basically taxis, which was already a long-settled cost/profit system.

This particularly affects low-margin sellers.

Anectodally, some shipment costs rise from $10 to $100. 20-30% cost increases.

These fees are to use Amazon's own shipping, Amazon Prime. Sellers can use FDM if they want, and this is expensive.

Twitter spoke up, then reddit, then MSM.

FTC now probing Amazon. Chain Lina Khan has been writing about the Amazon ‘antitrust paradox’ since college. Now there are public complaints, whereas before going after Amazon would have provoked large criticism (from market entrants not from established businesses which were put out of business by Amazon, Walmart, etc).

All of Amaon's profit since 2017, presumably, is from AWS, Carlson said. Amazon has actually been losing money on retail for years.

Amazon still offers customers their (?artificially) cheap shipping, fast shipping, trust (this is under question), consistency. Amazon customers are considered wealthier than average, and sticky, not likely to switch to a third party to save money.

For regional banks, once they reach $100b, they get extra regulations without the benefits of scale. Marketing, technology, regulating ability to spread across banking market. More mergers? Even if smaller banks have billions on the books and appear safe, compared with what JPM has, just scale makes them look less secure.

It's been 30 years since law allowed interstate banking in the US. Diversification.

Big Tech has been deteriorating in relative standing for 6, 8 months.

China is world leader in EVs, low-cost photovoltaics, wind turbines, fast rail, 5G.

A lot of these are global directional trends. Low cost supplier to core infrastructure.

Europe and US protectionist fighting against import of Chinese EVs, but rest of the world wants them bad. ... American business is not in line with American politics. American business people applaud Chinese when they visit. -

China's Crackdown on ‘Hedonistic’ Bankers Fuels Industry Brain Drain - YouTube

Where are they going though? Some to Hong Kong, some from banking to crypto, to digital banking. 78% of banks have reduced personnel or something. Some big jobs pay have been cut in half.

People don't want this many people in the sector, they want the sector to serve the people rather than lavish lifestyles. Government wants other sectors, like manufacturing. They want sectors to be self-regulated, so China doesn't have the corruption (which they have now).

#China

This P.E.I. senior has no fixed address. He says there aren't enough services for people like him - YouTube

#Canada #Technology

Has AI made it ok to say the economy is sort of stagnating (considering inflation)? -

If you look at the point in the past 50 years where America had the most challenges, the weakest leadership, 2024 might be one of China's strike points.

"It's An INVASION" - Immigation Is Officially The #1 Issue For Voters - YouTube

About 15 or 20 years after it because the obvious issue to the substantial minority of thinkers.

Arizona GOP chairman Jeff DeWit resigns amid bribe allegations involving Kari Lake - YouTube

'These [Five Eyes, or US Canada Aus NZ UK) are not separate governments. They are one government.' - Tucker. What defines the boundaries of a government?

China may in the future be ruled by lawyers (like the US now) instead of peasants fairly ruthless politicians plus some educated engineers, because of where virtued classes are coming from (it's valued as virtue siganalling coming from Harvard or MIT). Samo. Educated in universities rather than political circles.

Both China and US are gerontocratic. A generation war aspect. But China is homogenous.

If you have econ conditions where a college degree is most valuable, and women do better at college, and the default idiology of the college is somewhat feminist, you can have diverging politics then between men and women. Samo. So if China had woke, it would probably be gender-focussed rather than race. ‘The rise of Chinese feminism’. ‘Actually low fertility rates are the fault of patriarchy because they violated the autonomy of womens bodies by forcing abortions on them during the one-child policy’ could be a 10 years from now slogan. ‘As a result there are not enough of us women.’ China doesn't have many women top government officials or CEOs. They do have, like Iran has, many women in STEM, women do well in hard sciences. Lots are educated as engineers.

Along pathological lines like in SKorea, could happen in China?

#China

Might see greater respect for laywers in China. Maybe even for journalists, who also work with words.

Shift from tech founders (who are bootstrap peasants) to more educated people, a possible negative for the country.

Chinese Harvard will dominate. When universities as such are empowered.

The difference between the American student and the Chinese student won't be so great. Chinese universities prestige is currently rising. Less of the brightest students will go to USA.

China's schools may also then degrade, hardening into disfunction, where credentials are divorced from real competance, and the government will become incompetent.

#China -

...He thinks 2% in 6-9months possible.......Valuation ceilingsCompanies early reporting, doing fine, but their stocks didn't go up....Cash Stuffing Envelopes Money Trend is Going Viral - Should You Do it? - YouTube

-

-

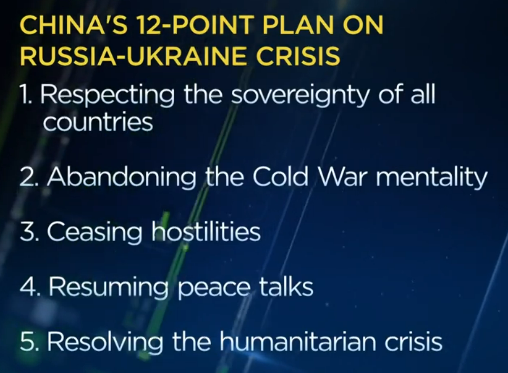

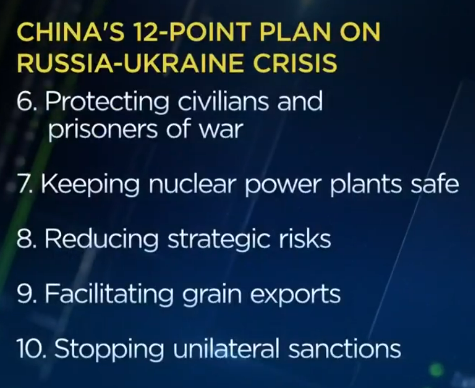

China's suggestions for ending Ukraine WarIncludes points that will be of interest to much of the developing world (dealing with inflation and lack of supplies).

China has experience with NKorea. China has perhaps been a brake on NKorean rhetoric.What Putin wouldn't have liked: reference to Human Rights.Doesn't reference Ukraine's territorial rights, so a non-starter.A ceasefire would buy time for Russia (which is low on weapons and trained soldiers), so Ukraine wouldn't favor a ceasefire probably.

China has experience with NKorea. China has perhaps been a brake on NKorean rhetoric.What Putin wouldn't have liked: reference to Human Rights.Doesn't reference Ukraine's territorial rights, so a non-starter.A ceasefire would buy time for Russia (which is low on weapons and trained soldiers), so Ukraine wouldn't favor a ceasefire probably. -

-

China, relation of State and Big Business, versus relation with small companiesCrackdown on Tech Sector seen as an anti-private sector movement. Trying to weaken the private sector.Pushback against the Private Sector when it gets too big, when it no longer serves the State's interest, but at the same time, when it comes to small private sector firms, the government keeps talking about just how important they are to its vision of longterm prosperity.Not particularly in favor of large private firms because State loses control, the companies do things that we don't think are in the national interest, they exploit the effective monopoly that they have over the industries they've built up, but small private firms on the other hand, they are innovative, they are the ones that are responsible for driving employment in urban areas, they generate economic growth and specifically household wealth. Common prosperity. We need to give small firms the economic opportunity to succeed and to generate their own wealth.Big companies have become large land owners one way or another, and when the State says you have to give a rent holiday, they haven't been doing it enough. Vested interests.How wealth is allocated throughout the System.

-

-

Hundreds of people.China said they were migrant workers, reportedly.Rising numbers of cases of Covid in China recently.

-

Anywhere but China (ABC) when looking for a factory nowadays. But 'Who lost America?' for China? They had the biggest lobby in America, the US business community. Advocating stronger, deeper ties with China.US and China are still intertwined though, and have 40 years of ties (sending kids to study in the other country, buying factories in the other country).It is thought that although they are competitors and peers, they do not share values. How true is this? Tom Friedman says this difference in values didn't matter while China was selling the US low tech goods, but when China started selling really important tech, that value difference became important.

-

High end semis: Taiwan, Korea, Japan, US. All are designed in US, Japan, etc.Mid-range (aerospace, automotive, thermostat control): Malaysia, Thailand.New restrictions mean China can't import these without a special dispensation. China can't anymore buy the tools to make the high-grade (so they never reach that level). Method: requiring export licenses to send semis to China. Biden is using the Foreign Direct Product Rule (first used under Trump versus Huawei. ... Chinese plans for technological self-sufficiency.Lower-range (watch, IOT, calculator): Chinese made.China might be melon-scooped out of the semi business, said Zeihan.Zeihan said "We're not at the end of Chinese technological rise." Counter-argument, please.UK has a new National Security and Investment Act, which it used against a company that sold to a Chinese company (which started selling all it's products to it's new owner), causing the UK to fear a tech transfer from UK to China. (Newport Wafer Fab sold to Wingtech.(

-

China has a lot of energyRunaway energy usage on crypto-miners. Some think China made a mistake, and there should be more freedom to do crypto-mining in China. But what is the production? Once mines are set up, they only need a few people to run them.Why out of China? Capital controls, it can be challenging to tax, can leave borders.

-

A couple destroyers in the Indian Ocean basin would be enough to end China's energy imports.(Because China's warships can only do 400 miles under combat situations.)

-

"China is probably the biggest loser in the Ukraine war after Ukraine itself." - Zeihan"Because they're the last country in the kick line, everyone else gets their stuff first." (Energy, Food from the Russian space)

-

-

-

$92b market for inexpensive ($150 usd) cell phones.

-

Another example of how things go along (although philosophically opposed by many) until there's an actual contention, and then true colors are displayed.

-

Kissinger, Nixon, anyone?

-

Protesting because of their savings.One sign read, 'No deposits. No human rights.' Interesting to contrast the impetuses that cause Westerners and Chinese to protest.

-

-

-

-

Attention and brain waves.

-

China going for global currency status, reaching out to 5 countries: Indonesia, Malaysia, HK, Singapore and Chile

They can build a yuan reserve and a yuan pool (15b yuan each country). A global financial system. -

Any direct transactions will trigger Western sanctions. This is being called a 'hack' so India's biggest cement maker can buy from Russia. 157k tonnes worth $25m (172m yuan). The sale was arranged from Dubai, reportedly. The mechanism isn't known.Coal is the main fuel to manufacture cement.13% of Russian reserves are already in yuan. Indian companies must be trading USD for yuan in a Chinese bank in China or HK. There are no sanctions if you don't use USD.Yuan to Ruble trade has increased 1000% since the invasion of Ukraine.

-

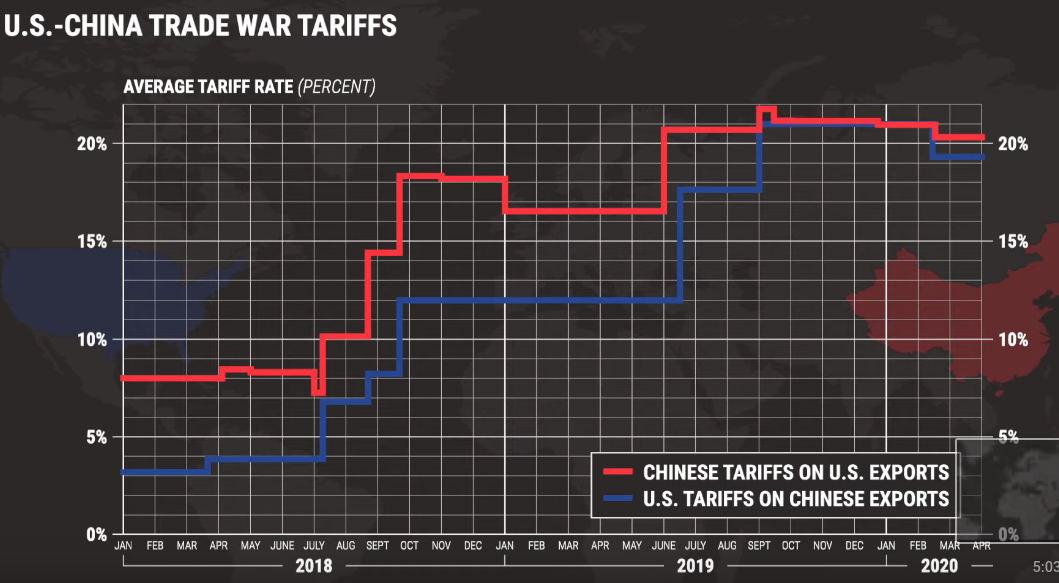

Example: US has tariffs on China for steel and aluminumChinese state actors were basically giving free electricity to aluminum smelters in China to undercut price in America, that took US's capicity utilization of US's aluminum smelters from high 80s to 70 in one year. And when you drop below 80% capacity utilization you end up losing money as an industry. China was acting in an uneconomic fashion to try to put the US's industry out of business so the US would have a further reliance on China's ability to produce aluminum (strategic values for military and industry).So Yellen saying "You could save 8 basis points of inflation if you took those tariffs off" is ignorant of national security. He mentioned that if wall street was making decisions we'd all be speaking Chinese immediately, because they make short term decisions for specific profits, and politicians are required to think long term and consider national security.Kyle Bass' take

-

"It's really difficult to engage with [global] partners" - Kyle Bass (a monitorist at heart)... "like China, like Russia, like Iran, like North Korea. China mostly. It doesn't share the same value system. They don't share the same legal system. We have a rule of law, they rule by law. And when it comes into times when there's global conflict or friction you see that globalization can lead you down a path that puts you in a very difficult position from a national security perspective.""It was probably a real bad idea to let 95% of the pharmaceutical ingredients for our antibiotics to be made in China. And have the global chip shortage around the world that really emanated from Taiwan, which makes 40% of the chips we need for just about everything."Various things being outsourced has to be thought of in terms of risk assessment, he said. 3-5 years away still from being self-sufficient on the chip side. Antibiotics and supply chains aren't rocket science, they just need to be reshored. While we watch the friction increase almost daily between the US and China. Xi, the most leverage China has is now, and every day that goes by they have less leverage, so things might happen sooner than later. China's media is really pushing the Taiwan issue.With Ukraine. For a long time things boiled, and one day war happened. Russia's control over Europe also could be said to be decreasing with time, as their supplier of energy.Because the White House changes every 4 or 8 years, the US needs a team that transcends administrations and needs a better grand strategy, he said.

-

Will Russia continue to be a reliable supplier of arms to India, as Russia becomes involved with China?"A weakened Russia, with a degraded military industrial structure, is not going to be the major reliable, efficient partner we were counting on before the war." Indian congressmanIndia is considering closer alliance with the US but is not impressed with the US's history of alliances (it hasn't always fared very well for the US's alliance partners, some say).Some say India is coming to resemble China and Russia more than it resembles Western democracies.2 months before the Ukraine invasion Putin visited India on a rare trip abroad.In 1971 both India and the Soviets were concerned about China and made a strong pact. Russia became India's #1 arms supplier (against China, India's longstanding adversary).Recently, the US threatened to sanction India for an arms purchase of high-tech Russia weapons.However, India buying arms from Russia seems to have been declining anyway over the past 10 years. India buys more now from US, Israel, France and other countries.Russia has historically voted against and even vetoed UN movements in support of India, particularly in India's sensitive issues like Kashmir.

-

Shein, growing fashion brandShein launches 3,000 to 4,000 new (fast fashion) female apparel products every day, reportedly. $2 to $30 per item.Their product line is updated much faster than any other fashion brand (Zara, ASOS, H&M).Shien is valued at $100b, more than H&M and Zara combined. However, H&M did $24b and Zara $19b last year, and Shein did $10.They're private and don't give interviews. The CEO has only been seen a couple times.They say they were founded in 2012, but others say in 2008 with Dianwei (knock offs and stuff, reportedly). So they developed along with mass adoption of smart phones (helps with product discovery). Also collected user info, algos, and the continuing development of Chinese manufacturing and distribution, as well as China-friendly global community.Shein within China doesn't have the advantage it has over other world brands in the global market, because China is a more saturated market. It can't compete for speed and price like it does against the US.Shein also made timely payments to suppliers (a rarity in China, reportedly) made it able to get smaller production orders. Small order, quick response. 100 to 500 items as the first batch (3 to 5 days), versus Zara's 100k items. No middle man or import tariffs because they're shipped straight from China to customers (not to retail chains).Shein pays quite a bit for marketing. It pays influencers and celebs. They do a thing called a 'haul,' in which a tik-toker or instagramer buys/receives a big box, like $500 or $2000 worth, and they try it all on and stuff. This goes viral and creates its own marketing campaign. It's an algo that works through influencers and young women.Shein was the #1 downloaded shopping app in 2021.Shein's growth has recently slowed with the China city lockdowns.Several independent fashion designers have gone on social media alleging Shein has knocked off their design to the tee. Exactly the same, and they sell the things for way less. Doc Marten's and Levi Strauss have sued them. I think to do this you have to be registered in China.Shein contracts a lot of work to small factories and there are workers who are not in the social welfare system there, whatever the relevance of that is. This is the key to cheap, fast products like this. It's simply finding ways to pay workers less than other places.An issue lots of people talk about with these fast fashion mass sales brands is waste. 100m tonnes of clothing are dumped in landfills every year now. These products are made to be used once or several times, and they are not good for a second-hand market (for example, a lot of first world used clothing is sent to Africa, and it still is, but they say the fast fashion stuff is not useable, it's basically garbage shipped to them).Producing textiles is energy intensive, and is often done where there are less regulations which consider the environment. It's been interesting as an example of how the young generation, which has been perceived as more environmentally conscious and critical of past generations waste, doesn't really care because they seem to prefer the less expensive product regardless, because it's what they can more easily afford.

-

Taiwan 2022 Q2US and Chinese defense ministers have held their first face to face talks in Singapore.China's MoD spokesperson was quoted 'If anyone dares to split Taiwan from China [ie independence?], the Chinese army will definitely not hesitate to start a war. No matter the cost.'India recently entered the South China Sea theater by supplying the non-China side with weapons. France recently sent a diplomatic mission to Taiwan. Taiwan is one of the main issues between the US and China. Recently Biden stated he would defend Taiwan militarily if it was attacked by China.On the street and among commenters, people speculate China may invade during the current Ukraine invasion or perhaps after it concludes.

-

UK bought order of drones from Chinese company DJI, first public purchase since US blacklisted the company for sales in the US in 2020 (US said the company posed a potential national security threat)15k distance range. 55min use. Temperatures -20 to plus 50.

-

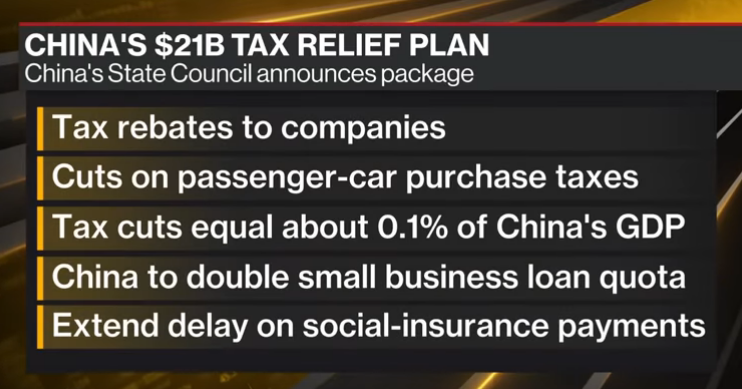

The Chinese likened the tax cuts to 'fertilizer' applied directly to the 'roots of the economy.'

The Chinese likened the tax cuts to 'fertilizer' applied directly to the 'roots of the economy.'

The numbers are added to tax cuts already implemented this year.

#China

-

China and decoupling from 'factory China'Said that China is indispensable to global supply.China makes way more stem graduates (now needed by others). So many production facilities (Japan also has quite a lot). Apple's supply chain. China wants foreign firms there (like Apple). Provinces compete for this business.

Per capita disposable income is way up steadily in the last 10 or 15 years."China plus one" strategy. Vietnam, India, Mexico, Indonesia, Malaysia. But no country can do what China does.

-

Recently the US, which has never recognized Taiwan's independence (for the sake of its relationship with the CCP) deleted a sentence on the State Dept website that said the US "does not support Taiwan independence." It changed wording that had referenced Taiwan as being part of China.Is the US going to spend some more money on arms for Taiwan?

-

This video gives an idea of how China is managing its cities during the pandemic April 2022 (2 years after the start, but after the latest Omicron strain, when China locked down Shanghai again). Lots of images.Lower immunity from natural infection - uniquely vulnerable. It was a source of national pride for Chinese that their case numbers had been so low, and they had so 'successfully' weathered the pandemic relative to other countries, although their strict lockdowns of cities caused economic and other problems (such as other health problems due to lack of diagnosis and treatment, access to medicine, etc, psychological problems from isolation, social issues from lack of socialization - it has been said (by Mill in the following terms) that the necessity of the mental wellbeing of people (on which all their other wellbeings depend) lies in freedoms) as well as extreme tracking and monitoring through electronic devices and registration. Some say the Chinese see the issue politically, as the Chinese system versus the West, so it may be less likely China would now permit opening the cities and having more infections, because of the images that would be shown to the world.

-

China makes security pact with Solomon IslandsReportedly just before a US diplomat was supposed to go to keep this very thing from happening.

-

Shanghai residents forced from their apartments so State can use them as temporary quarantine facilitiesVideos of this are viral. (A few dozen it looks like) citizens clashing with police (police in white non-contamination suits). Wrestling as the police take away people protesting (I don't think you can even call this 'protesters').In another video a few dozen people assembled on a street in a protest against the closure of a school to be used as a quarantine facility. Police broke them up and forced them off the streets.Frustration and anger, leading to violence.

-

Chinese city residents are organizing in group chats (on their phones) to negotiate and buy food bulk from vendors they know

-

Economists revising expectations for Chinese growth rateWas at 5%. But now (strict lockdowns) aggregate demand will be lower from less economic activity. Expectations now about 4%.Questions about supply chain issues stemming from Chinese manufacture, and the effect on global inflation rates, which is already affecting interest rates in US.It's already brought oil prices lower.

-

Chinese government facing criticism inside country for:- efficacy of Chinese-made vaccines- refusal to use mRNA vaccines provided to them by US200m people (20% of population) are locked down in China right now. 13 of their largest cities and some other cities.

-

Shanghai has been under (strict) lockdown for a couple weeks now, as part of a zero Covid planThere's no food on the grocery store shelves now, reportedly. The government is deploying food packets. Reports that wealthy people had hoarded the food from stores.Truck driver restrictions/refusals to enter Shanghai disrupting supply chain.

-

"Globalization, which historically was viewed as a barrier to conflict due to the interdependent nature of global trade, has now become a new battleground." - Patrick BoyleChina recently stated that the US's use of weaponization of global finance (sanctions on Russia [after doing it to Iran's central bank a few years ago]) would be the downfall of it's status as world reserve currency. Ie integrity.China has a version of Swift, and India is considering (so far just considering) doing a Ruble-Rupee exchange or working in barter.Most of the West is on side, sanctioning Russia, and that makes up the bulk of currency action, but there are still 100 countries or something that are not sanctioning Russia. Brazil is another country that might help Russia work around the sanctions. Boyle said the use of sanctions in the way the US is doing will have many countries wondering if they can still trust the US.

-

Parents and children had been separated by force (no choice), if one was found to have Covid. They are now allowed to be together again.Only supermarkets and pharmacies are open. Images of China's biggest city look the same as the 2020 beginning of the pandemic.State-owened banks are loaning businesses, which have no revenue now, money, in some cases.In other cases, people are working, traveling in a closed loop between home and their factory. Factories set up tents during the pandemic, which allows them to do this now.China uses drones to go around telling people not to go out or doors.The hope is to reduce new infections to 0 in two weeks.This lockdown is expected to cost Shanghai 3.5% in economic growth.

-

LME halted trading in nickel, but also cancels all the days tradesThe London Metal Exchange said it was what was best for the market, the exchange didn't keep to its neutral position, but "picked winners and losers." Cancelling orders (after the event - the held a meeting and decided to let trading continue, but then after the day they decided to cancel all that had happened) is basically unheard of. 500 nickel trades had been executed that day, worth almost $4b.Nickel was up like 240%, a huge short squeeze.When LME cancelled the trades that had already taken place, it wiped out an estimated $1.3b in profits and losses.It has been said that the entity who would have benefited most from the trades being cancelled is Tsingshan Holding Group, the world's largest stainless steel producer, who was estimated to have lost $8b on their short position. Tsingshan's biggest lender and broker is China Construction Bank.It was pointed out (most vigorously perhaps by those who lost on the cancelled trades) that the LME is owned by the Hong Kong Exchanges and Clearing.The LME CEO said the owner of the LME had nothing to do with it.This story is much more complicated, with the various companies involved, as well as the China being state controlled having some effects, and the Russian 'blood diamond' nickel issue: Cancelled Nickel Trades on the LME - YouTube

-

SA holding the cardsXI is reportedly going to make his first overseas visit in 2 years to SA. Recently Biden asked SA to increase oil production and they said no.US is energy independent (biggest oil producer) and China is the biggest energy consumer (currently buys 1/4 of SA's oil exports). SA is the biggest crude oil exporter.US published documents on Yemen or something and linked SA royal house to Kashogi killing. China has it's think in Xinjiang.SA and US have an old relationship. China has leverage over Iran, something US may never have.How much weapons will China provide for SA?Reportedly China is talking about using Yuan instead of USD to buy oil. SA made a deal with Nixon to trade oil only for USD in return for security guarantees.

-

"It's not in China's interest to have Russia collapse. So I think a coupling of Russia to the Chinese system feels like the default outcome right now." - Samo BurjaResulting in high energy prices in Europe, slow de-industrialization and impoverishment of Europe.China is the only winner of a conflict between Europe and Russia, Burja said, although he said the US could benefit long term from the goings on (because the US can be energy independent and produce oil, in addition to other reasons).

-

"Among the 248 armed conflicts that occurred in 153 regions in the world from 1945 to 2001, 201 were initiated by the US, accounting for 81% of the total number" - Chinese embassy in RussiaThey posted a list on their website.Victor Gao of Soochow U said China believes Ukraine has been used by the US and Western countries. He said what the US and Europe were doing with sanctions were destabilizing for the region.He said US benefits because they want to sell L&G to Europe without competition from Russia, whose LNG is cheaper and more sustainable.

-

Some people say China is winning over US in LatAmThe countries are simply taking the best deal offered them, even if it's something like Huawei, which the US tried to get Brazil not to deal with because of Huawei's alleged spying. China is reacting to the local need, some sayChina's BioTech vaccine was the first vaccine available to Brazil. Some say LatAm countries are not happy with the way Washington handled the pandemic.

#China #Brazil #LatAm #InternationalRelations #Diplomacy

#China #Brazil #LatAm #InternationalRelations #Diplomacy -

'When a member of [US] Congress goes to Taiwan and declares that she is now in the Republic of Taiwan, that's terribly provocative"... and who ends up getting hurt in that situation? It's the people of Taiwan. If there is ever a military conflict there, even if it's turned back, thousands of people in Taiwan will die. And members of Congress ought to be aware of that simple truth. - Joseph Fewsmith

-

-

US won't send officials (diplomats) to Beijing Olympics... because, it says, of China's genocide (Uighurs not Tibetans), crimes against humanity, and other human rights abuses.Support came from both sides of the Congressional isle.US Athletes are still going.In 1980, US officials AND athletes weren't allowed to go to the Moscow Summer Games, due to, the US said, the Soviet invasion of Afghanistan. Russia refused to come to the Summer Games in the US in 1984.

-

$207m loan default makes Uganda lose only international airport to China, possiblyChinese debt trap success if true, but Ugandan and Chinese authorities have denied reports.The loan, signed in 2015 between the Ugandan govt and China's Exim (export-import) bank, had a 20 year maturity period and 7 year grace period.Uganda's largest commercial and military airport. Entebbe airport.

-

-

Mysterious blasts in China?WION reported that there have been 10 high-intensity blasts in 7 days across China. No real info from China on the blasts.Why is China not talking about the mysterious blasts?

-

China looks to mega-company chiefsAnother Chinese property market giant is losing value massively (I think 75% for the year currently). Kaisa.China would like if the head of that company would offload some of his assets and make a dent in the companies financial issues. He owns $3b in stock, $200m in planes, $50m yacht, and $200m in houses. Most of his holdings are through a BVI company, so it's not exactly clear.Will Chinese billionaires behind these companies decide to give up their fortunes and continue being respected business people, and a part of what happens next in China? or will they say no, keep their wealth, and possibly move?

-

China making more moves toward unification with TaiwanLast week China flew a bunch of war jets over Taiwan.Xi made new comments China would unify with Taiwan, the day before Taiwan's national day. In the past, Xi has threatened he might take Taiwan by force, but the recent statements were considered to be much softer than that.One way to view Taiwan is as another province like those that have already been returned to China (Hong Kong and Macao in the 90s). A breakaway province.

-

China's risk in thinking about conquering TaiwanFairly risk averse gov. Potential of losing is quite deterrent.Not much war experience, even to take on the Taiwanese.US and Japan are close. India and US are closer than before, increasingly seen as an ally. Aukus and Quad alliances. China increasingly isolated. What diplomatic options?Xi's foreign policy is not considered a success over the past 10 years.

-

At some point, Chinese crackdown on companies will be more or less finished, and from that point there will be a more stable operating environment for a lot of companies.The next catalyst for Chinese stocks.CCP wants to see 'no further monopolistic behavior.'

-

Fantasia, a second big Chinese real estate firm, missed a big key payment

-

China power crunchAs China came out of the pandemic, the economy recovered fast, which led to energy demand, which led to really rapid production of coal, which led to some mining examples. As a result, the gov put some safetly regulations on, which constrained coal mining production this year. Prices went up.Over the summer, local officials were really conscious of these issues and tried to coordinate with power companies to make sure power supply and demand would be balanced. But in September, demand was higher than expected.

Also, wind and hydro were lower than expected in some areas.In some areas also, local officals were not meeting their energy intensity targets.This led to the CCP unilaterally deciding to cut power supply to certain sectors of the economy.At the heart of it is really 'local officials' decisions,' it was said.(Coal has been the best performing commodity this year price wise.) -

China banned crypto, nomatter where trading takes placeUS regulators are also looking at doing something. Notably DeFi (Gensler).China is experiencing energy shortages (Goldman downgraded China's growth forecast for this), and it might last months.Still, any Chinese with a wallet could trade on permissionless decentralized exchanges where there is no KYC.There are also VPNs and many Chinese live and work overseas where it could be impossible to prevent their trading crypto.

-

-

Hostage diplomacy worked for China... The Huawei exec who's been under house arrest in Vancouver for a couple years on request by America (they said she bypassed their embargo on Iran, I think, and wanted her deported to the US. She's been arguing against deportation from Canada since then).Shortly after the exec's detention, China detained two Canadians, saying they were spying. (It sounds like they were never charged, just detained until now).Shortly after the exec recently made a deal with the US and was released by Canada to return to China, China released the two Canadian men."Because it was so blatently a form of hostage diplomacy I think people are going to start thinking about how they deal with China. ... a major emerging power that doesn't really follow international law, so there's a lot of implications that need to be addressed." - Clifford Coonan

-

China told local governments to prepare for fallout from EvergrandeThey're tasked with things like preparing to take over and continue building projects, monitoring civilian protests, and paying migrant worker salaries who are working on Evergrande projects.

-

Evergrande crisis causes global markets to drop a bitChina's second largest property developer (and world's most indebted one, with $300b in liabilities after years of borrowing for funding of rapid growth amid recent real estate frenzy). Seems the company is insolvent. But some analysits say it might be 'too big to fail' because a failure would undermine the CCP's stability.Evergrande's been trying to sell properties for 25% off to deleverage. So much property on the market to sell off quickly is maybe not great for the Chinese property market. There are other companies in the same position as Evergrande as well.CCP signaling there won't be a bailout, but as mentioned above this might not be possible because the company accounts for something like 2-3% of China's GDP. Because the majority of financial institutions involved are state-owned, China might use these to do a bailout without appearing to do so directly. However, the CCP seems to want to change the problem they have in their housing market: for years, people have bought homes as investments, and just left them empty, not even renting them out, to keep their quality for some future resell at at a profit, because values have gone up so much in recent years and were expected to continue. This means that the economy gets no real value from the production of these homes. So the CCP wants to move away from unproductive growth to real growth. You might see here why the CCP might be willing to let Evergrande fail so that the traditional moral hazard in the market is reduced. However, real growth alone wouldn't be enough to generate the economic activity for China to hit its GDP growth targets. The way China hits its targets is malinvestment by the real estate sector and local governments building unnecessary infrastructure. The government does more malinvestment when the economy slows down and reduces it at other times. It fills the gap.(Malinvestment refers to ... from the 90s until mid-2000s, Chinese debt funded necessary and productive investment, which means the return on these investments grew faster than the debt did. The investments boosted the economy more than the cost of the debt. After the mid-2000s, debt began to rise faster than GDP, ie the cost of the debt was greater than the returns on investing it.)People referring to the Lehman collapse (filed for bankruptcy Sept 2008), but China has the advantage of having seen America go through that and how the AIG bailout was unfair to the taxpayer.Evergrande also is different in that it has wealth management unit, so depositors are earning interest, but now Evergrande is trying to offer them property (not good property, but things like parking spaces in ghost cities, since all the good stuff they had which could be sold has been sold or pledged against specific debts) if they want.In China, some protests on the streets. Some are by employees who haven't been paid.Investing experts have said that although this is just now a big global story moving markets, it's been known for a long time. Commodities were ahead, with iron ore halving since July, for example. China's share of commodities consumption globally is somewhere between 40 and 70% of global supply (20% of global supply just to Chinese real estate).$310b in obligations globally owed by Evergrande. They have a crucial payment on their offshore bonds in a few days, and people think they might miss it. This debt is held in large amounts by Ashmore Group, BlackRock, UBS, and HSBC, among others, lots in bonds held in vehicles that focus on riskier EM or Asian credits.A risk is that if all these property owners cut their prices, it will affect also mortgages, and could cause a chain reaction. Late payments of this size could trigger cross-defaults.Evergrande also has a business model where it relies on customers paying for properties before construction (which this finances). Hundreds of thousands of Chinese have put down downpayments for things that possibly might not now be built.Real estate is responsible for 30% of China's economic output.Real estate investment is a large part of investment for Chinese people, due to the expectation values will continue to rise as dramatically as they have done in the past decades. It's been reported that houses costs about 45x average annual income, which is very high globally. Part of the interest in investing in property is due to lack of options in that country, where there tend to be significant levels of scams, and Chinese businesses haven't panned out as great places to invest either. There's also a social pressure to own a house in China. Chinese men reportedly can't get find a wife without having a house.If Evergrande isn't bailed out and Chinese are caused by their government to rethink property values, it would change the values of loans on the books currently, since they were all (last 30 years of loans) based on assumptions about how the government support them rather than on the borrowers ability to pay back.Most of Evergrande's debt is held in China which people think can absorb the loss, and the overseas debt is trading currently at about 30c on the dollar (US denominated debt at around 80c). Some think the CCP might cause Evergrande to pay back Chinese lenders first (there will just be more political will to pay the small wealth management investors in China than foreign lenders, regardless of seniority and capital structure), but that would cause an interesting situation where Chinese companies seeking outside investors going forward might not have as easy a time.S&P was down like 1.5% the day the news hit.Another issue is that while the Chinese have allowed the CCP to rule authoritarianly, they may be less likely to support the CCP if the country is no longer growing and making people all more wealthy. Combined with slowing population growth. Also, while Chinese exports continue to increase, this is due not to genuine productive potential, but rather to the price growth of commodities, it has been said.

-

China, famous 'MeToo' case thrown out3 years ago, a TV station employee alleged a prominent TV host groped her and used force to kiss her when she was an intern under him. She sued him for damages, and he countersued for damage of his reputation.The trial she initiated ended today with the finding that she had not shown enough evidence to prove her boss had done so. The accused was not 'even' required to come to court to testify. Some feminists and others considered the trial something of a Chinese MeToo thing.The woman, Zhou Xiaoxuan, said it was worth it either way, and she knew the outcome could have gone either way. "I am very honored to have gone through this together with everyone.'She will appeal, she said.

-

China's regulations versus celebritiesIn May 2021, fans of an idol threw away 270k cartons of milk because they were buying the QR code on the carton to 'cheer on their favorite trainee' for an idol group ("the milk incident"). The milk waste was taken seriously, partially in light of the CCP's Food Waste Prohibition Law. After this incident, China's National Cyber Info Office (CAC) said idol fandom would become regulated heavily for irrational behavior. "Irrational celebrity worship."Weibo has deleted countless posts and closed real and fake accounts for idol fan clubs online. They banned the BTS fan page (maybe the biggest K boyband currently) for 60 days and then banned 21 other fan groups for a month).China used to post a lot of idol fan rankings, and Chinese spend a lot of money to support (sometimes smaller) celebrities. There are paid voting programs, but these have all been banned now.Tencent (largest music platform in China) banned accounts from buying the same album or single more than once.Chinese people paid $8m last year for K-pop (digital music only, or including merch?), the highest amount from China, reportedly. Total K-pop exports rose 3.6-fold yoy to $26m. This is considered by the CCP to be a trivial use of citizens' interest and money. China says this is a problem, a sick 'fan circle' that has become too prominent, with various fan bases abusing and slandering each other, engaging in 'malicious marketing,' and forcing fans, including young people, to raise funds to support the stars or would-be stars. A Chinese spokesperson put it that all this "seriously hinders the healthy development of the entertainment industry."Another related issue is big famous celebrities who China sees as having "excessive incomes" or "false political positions," as well as non-masculine men. Some celebrities (who have passports from other countries) have said they'll give up their foreign passports. (I'm not clear on exactly what the issue is and which passport they said they'd give up.)The K-pop style of attractiveness is considered to be imasculine, and China said they'll establish a correct beauty standard for Chinese as well, reportedly. Cosmetics will be among the things focused on. Many reality talent shows were banned for reasons in this vein of central planning. Effeminate boy bands are prohibited from being on idol talent shows.Should we expect a somewhat extreme manifestation of the androgenous sexy "forbidden boy" style type we saw in America between the 50's and maybe 80s?Another issue is celebrities who have caused controversy by committing immoral acts. Recently, Chinese stars have been in the news for sexual incidents, drugs, and tax fraud. One star published photos or something on his repeated visits to Japan's Yasukuni Shrine and was boycotted (by the Chinese public?).I also read passing mention of 'foreplay programs.' What is that?

-

China's cultural rules 2021Most recently TV talent shows have been banned and TV broadcasters aren't allowed to promote 'effeminate looking men' (K-pop issue). Actors accused of tax evasion and misbehavior have had their work taken off line.Minors are allowed to play video games even less than before.Tencent and NetEase Games have to remove content that promotes 'incorrect values' like money worship.Rideshare company Didi had to be removed from the domenstic app stores for illegally collecting and using personal info.The multi-billion dollar private tutoring industry has been banned from making profit or raising capital.Some celebrity fan clubs have been banned for promoting 'chaotic culture.'One commenter harkened to Xi's 2014 comments on Beijing Forum of Literature Arts where he spoke of 'the good, the true, the beautiful' as the essential values that China needs to cultivate. She said actors and other public figures have greater social obligations to set examples for the moral direction of the society. That celebrities are important not only because the produce excellent works and very entertaining shows but the government has expectations of them as a person.Some say that the CCP does not think of these popular apps that just do things like ride hailing or sharing social media posts as real technology, so they're not important to China in terms of being part of the 'tech sector.' Instead, China considers tech to be things like semiconductors, chips, 5G (hard tech).

-

Chinese govt erases rich actress from internetZhao Wei fled to France.From News.au:

On Friday, Beijing’s Cyberspace Administration agency issued a set of instructions to social media and internet operators aimed at “rectifying issues” with fan communities.

The purpose was to ensure “political and ideological safety in the cyberspace as well as creating a clean internet”.

Celebrities can no longer be ranked in order of popularity.

Talent agencies must submit themselves to Communist Party oversight.

Fan clubs must be licenced and officially authorised.

Any disagreement between fans of different high-profile personalities must immediately be censored.

The regulatory crackdown follows the publication of a policy guideline, Implementation Outline for the Establishment of a Rule of Law-Based Society, which mandates the establishment of “moral norms” as “legal norms”.

China is reportedly banning stars who are considered immoral. Zhao has been in various scandals over the years. She has also been in conflict with the CCP for her friendly relations with Taiwan and Japan, it seems.She was accused of tax evasion Friday. If she pays the $A63m fine, she might be able to return to normal life in China.https://www.news.com.au/technology/online/internet/china-erases-billionaire-actress-zhao-wei-from-history/news-story/94100f6569377078cfeee411f5fc3538 -

China bans playing video games more than 3 hours per weekFor children, anyway. They can only play games online between 8 and 9pm Fridays, Saturdays and Sundays and public holidays.This is down from the 2019 limit of an hour and a half per day and 3 hours on holidays..AP: "Regulators said in Monday’s notice that they would strengthen supervision and increase the frequency of inspections of online game companies to ensure that they follow the regulations closely."Notification from Xi through the National Press and Publication Administration

-

Luxury brand loss, China45% of luxury spending is by the Chinese consumer, ahead of the US.More purchases are within China than before and this trend is expected to continue (rather than go abroad to buy them cheaper).The government may be making it sort of culturally taboo to flaunt wealth with luxury purchases. China is cracking down on wealthy spenders.4 big luxury stocks, LVMH, Richemont, Kering and Hermes, have lost $85b together in last 2 weeks. Arnot was the world's richest man at the beginning of this month, but his $200b went down $22b and he's now 3rd.

-

New China data privacy law... goes into effect Nov. 1.It targets digital companies. Collecting a lot of random info on users in order to 'provide a better service' seems it'll be not as available to businesses. The restrictions in the bill target businesses and don't really apply to the CCP.Under the law, companies are required to only collect the minimal amount of data for a service, and must obtain consent for collecting sensitive info (like biometrics), offer easy opt-out options, and if they want to transfer data overseas they have to get govt approval first.Does this put China ahead of the West in internet privacy?

-

China's sponge citiesInstead of building barricades to water, they want to absorb and release the water when needed.How it's done usually is combining grey infrastructure like drainage and water treatment with green spaces.People also like to go to the green spaces to use them. Trees, elevated walkways, etc.They also use some bioswales, which are several KMs in length now. They're grooves water can seep into and go down into the earth rather than enter drainage systems.They also use permeable road surfaces. Polyurethane binders combined with gravel or stones let water through.These are all designed to deal with regular heavy rain, and aren't as useful for extreme weather events.The US and Russia have also done sponge city stuff, but not to the same level as China.

-

China repositions government philosophyBefore, China was allowing some individuals to 'get rich first' with big companies, but now is shifting to 'proserity for all.'It's expected the CCP will have more say in companies and companies will have to fall in line.Xi recently said people should shun 'unreasonable' or 'excessive' income, and that the rich should 'give back to society more.'This means lower education costs, caps on the commission ride share companies can take (done through transport ministry) to keep transportation costs lower, and higher wages for workers.China is also going to do a 'consumer data' data privacy internet bill.

-

China '3 mountains'Education, health care, and property. These are burdens for the common Chinese person.China has announced some new areas for new regulations: Education tech, internet, property, and food delivery. Those four.Also e-cigs, growth hormones, liquor and online insurance.It's the first time any of these sectors have been regulated in China.Next year is an election year, and commenters say China sees the big companies that are profiting in these sectors as being in the way of the government reaching its goal of common prosperity and elimination of social unrest.

-

China economics, summer 2021We have got more info from the CCP on which sectors they really want to promote, as opposed to those whose recent growth has been seen to cause them problems (as usual for closed, authoritarian governments, this includes industries that control information).EV, clean energy, and industrial upgrading have policy tailwinds, according to JPM's Julia Wang.

-

Hong Kong man jailed 'under national security law'The man, during pro-democracy protests in HK against the Chinese government, purposefully rode his superbike at a line of police. He carried a flag which read 'Liberate Hong Kong.'Western media is headlining this as the first person to be charged under Hong Kong's new national security law, and highlighting the law's restrictions on protest slogans that are 'capable of inciting others,' on secessionist activity, and that without a guilty plea there should be no leniency.... despite this man's actions being clearly not just protest oriented.This may logically make China appear unfairly presented, and give China a valid claim to such. American commenters on the story noted that the man would probably have been gunned down by US police if he tried that in NY. ... However, China may follow this trial of what many consider an aggressive act with trials of peaceful protesters, journalists (which reportedly it has lined up about 30 of them), etc.9 years. He will appeal.(following this video clip, the motorbike was on the ground with police surrounding him. It appears he slowed and turned to the side and did not hit any police once he charged up close to them.)

-