Hungary blocks €50bn of EU funding for Ukraine | BBC News - YouTube

#Economics

-

-

-

Silicon Valley has laid of like 100k people in the past 2 monthsSmaller tech companies maybe will have an easier time finding workers, since large tech used to be funded with cheap money and their stock price was at a high multiple, unlike now.Why has there been so few alternatives to the handful of big tech companies everyone uses but in general doesn't want to use?Small Business Administration funds small companies. Below market capital costs. For the first time, the labor is actually there to do so, noted Zeihan.

-

Anywhere but China (ABC) when looking for a factory nowadays. But 'Who lost America?' for China? They had the biggest lobby in America, the US business community. Advocating stronger, deeper ties with China.US and China are still intertwined though, and have 40 years of ties (sending kids to study in the other country, buying factories in the other country).It is thought that although they are competitors and peers, they do not share values. How true is this? Tom Friedman says this difference in values didn't matter while China was selling the US low tech goods, but when China started selling really important tech, that value difference became important.

-

Protesting because of their savings.One sign read, 'No deposits. No human rights.' Interesting to contrast the impetuses that cause Westerners and Chinese to protest.

-

World population might peak by mid-century and return to around current size by 2100 - Dr Darrell BrickerHe guesses 2040's will be the beginning of population decline, with the last of the boomers. 2030's will be a largescale retirement.We thought the pandemic would lead to a baby boom. Instead, fertility rates depressed. Counties that depend on migration for population also have growth disrupted as travel was more difficult.China, the world's largest country with 1.4b people, is projected to lose almost half its population size this century. India, which has 1.4 also, will lose 290m in the century. USA with 330m will rise about 11m.Urbanization has a major affect on fertility, and therefore on population. On the farm children are extra hands; in the city they're more expense. We'll have an older, less fertile population.Almost 60% of people live in cities, and that will be around 70% by 2050. This will be moreso in Asia and Africa (China will be 80% urban, it's presumed; Japan is currently 92% urban and might go to 95%). Less in North America and Europe (already quite urbanized).The changing role of women is a major factor. Women are the majority of university students in the first world (most countries), and so delay marriage or children till their late 20s or early 30s. It's said that the best thing to look at to guess a country's fertility rate, it's the education rate of women.Societies don't value large families nowadays either.The fertility rate in 1960 was 5.2, and it's 2.3 or 2.4 now. Expected to be 2.2 in 2050. Japan is 1.4 right now. Russia about the same. Deaths per year in Russia outnumber births by about 1m. Russia has a median age of 40 currently, and Japan 48. USA is 38, a year less than China's 39. African countries are younger, although their growth is also slowing (but much less than elsewhere).In the modern era, no country that has fallen below population replacement fertility of 2.1 has been able to get back above it.To put the US in context, though, compared with Russia and Japan, you have to consider that if the US didn't have largescale immigration, it would not be growing either. Note that US is still by far considered the most desirable country to relocate to, and is the population with the most immigrants.An older population is also more female (since males are more likely to die of just about every cause of death except for things men can't die from because they don't have the body parts). Over the age of 40, there are less men and more women. At age 100 it's 5 to 1.There might be a population bust by 2050. Less consumption (neither older people nor robots buy as much as younger). Less innovation (it is guessed).In the US and Canada, the most common household is a person living by themself. At the start and at the end of their adult life.Female cosmetic surgery, supporting money, transportation from countryside. Reduced pressures. More things for families. Robots as consumers.

-

CryptoMines/Eternal coin crash from $700 to $4 in a few daysThe devs issued a manifesto:"... the main problem is that NFTs have no additional cost or wear and tear causing an over-population of these assets and thus reaching a point where some investors do not have the need to continue re-investing."This same re-investment effect is necessary in order to continue with a healthy and collaborative environment of a P2E game as there must be movement of investment, reinvestment, and new revenue to maintain a sustainable ecosystem over time or directly more longevity, CryptoMines at its peak managed to make refill its reward pool with more than 1.2million Mints per day, after the fall, we started to see numbers hovering around 50k and even less mints per day, accumulating a debt due to lack of trust and re-investment in the game."

-

3% of black workers in US want to go back to the office, versus 20% of white workers... according to a survey by Slack

-

China looks to mega-company chiefsAnother Chinese property market giant is losing value massively (I think 75% for the year currently). Kaisa.China would like if the head of that company would offload some of his assets and make a dent in the companies financial issues. He owns $3b in stock, $200m in planes, $50m yacht, and $200m in houses. Most of his holdings are through a BVI company, so it's not exactly clear.Will Chinese billionaires behind these companies decide to give up their fortunes and continue being respected business people, and a part of what happens next in China? or will they say no, keep their wealth, and possibly move?

-

SEGA Ikebukero Gigo closed downAfter the building ownership changed hands. SEGA Akihabara also closed down recently."This was definitely the game center I visited the most. I played games, took purikura with my girlfriend at the time. And recently our daughter was born. I would come here to win plushies and things for her. This place was a big part of my life." - Random Japanese young manMany of Japan's game centers have reportedly closed down over the past year and a half.

-

"I'm not willing to say that all corporations are autocratic, but certainly they do not have their own rule of law or social contract with the citizens."Increasingly the US is becomming a hybrid system, where if you exist in the physical world you have laws that apply to you and you have a judiciary that metes out whether it's being broken by the US government that you vote for, or vote against, but you're part of that process."Where in the digital world, the virtual world, which is increasingly a large part of the economy, increasingly a large part of our social interactions, where we get information from, increasingly a large part even of our personal and national security, actually the government doesn't exercise sovereignty over that space. These corporations do. And the rules that the corporations apply to those virtual spaces are determined by those coprations. ... a radically different place than we've ever existed before, either as citizens or consumers." - Ian Bremmer

-

San Jose police officer quits to speak out against vaccine mandate"When we received a email saying that you're gonna have a vaccine by a certain date or face discipline up to and including termination, I took it as a threat. Because I don't plan to be vaccinated. And I decided to turn in my badge so I could speak up cause others can't for fear of losing their job," David Gutierrez told Fox News.In Gutierrez's case, he didn't want to put the thing in his body for religious reasons.

-

France recalls ambassadors from Aus and US over submarine dealThey also cancelled a gala to celebrate France-US relations, and is now reportedly trying to convince other EU countries to pull out of talks with Aus over a proposed free trade agreement.The original 2016 deal for 12 French subs was to be estimated $25b, which grew incrementally, finally to $90b, and was behind schedule. $300b would have been the total cost including maintenance for subs not ready till between 2035 - 2050, and there are questions how outdated they might be then.Something about China stepping up aggression in the oceans, and Aus looking at buying from the US/UK.

-

$2t is how much US spent on Afghanistan war$300m per day for 20 years.$800b in direct warfighting costs. $85b to train the Afghan army. $750m per year for Afghan army salaries.This money was borrowed as loans, reportedly. Cha-ching for those banks. "This country is unconquerable, you say? so we can just fight it indefinitely?" Thanks, taxpayers, we'll service those loans.

-

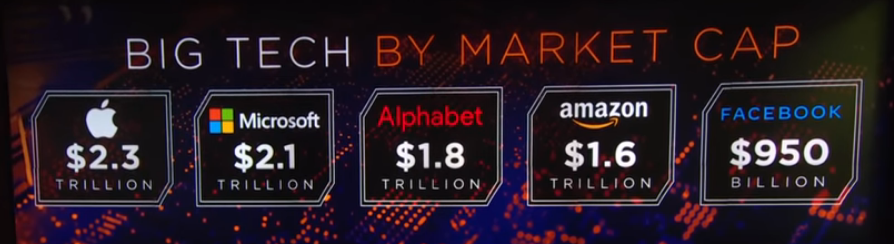

Future political change in US, taking apart Big Tech - Stoller's guess(Matt Stoller, Director of Research at the American Economic Liberties Project)'The pace setters of our ideology right now, of these dominant centers of power, and ignoring that power to just sort of focus on other questions that matter but that don't touch power directly, that don't touch concentrated commercial power. This is big tech. It's Amazon, it's Facebook, it's Google, it's Apple, it's Microsoft. These are the pace setters of our economic order. And I think that we're going to be taking those apart. And as we take those apart, because they are too powerful, and the Right and Left have both kind of come to that conclusion, there are going to be so many other consequences of that choice.'To take apart the most powerful firms in your economy means that you're really restructuring how you think about political philosophy and political economy, and that's going to have lots of consequences in every industry across the board, and you're already kind of seeing it.'

-

China '3 mountains'Education, health care, and property. These are burdens for the common Chinese person.China has announced some new areas for new regulations: Education tech, internet, property, and food delivery. Those four.Also e-cigs, growth hormones, liquor and online insurance.It's the first time any of these sectors have been regulated in China.Next year is an election year, and commenters say China sees the big companies that are profiting in these sectors as being in the way of the government reaching its goal of common prosperity and elimination of social unrest.

-

Chinese government aiming at wealthThe CCP has been cracking down on all fast-growing sectors. Any sector or company with large growth over the past years.They don't want too much wealth accumulation or wealth inequality, reportedly. They're seeking an equality in the society.It makes it more difficult for investors, because they don't know what to price in to their estimates.No one knows what other regulations will be coming from the party.The thing started with Ant group a few months ago. Recently, the whole tutoring sector. Some investors think the next sector might be health care. Large US investors are starting to pull out of investment in China, it has been reported.'The Chinese party has shown you who they are and what they care about,' said Kyle Bass of Hayman Capital, who thinks China is hoping people will stop investing in Chinese companies in the US and start investing in Chinese companies in Hong Kong, as China says HK will adjust it's listing requirements to make it easier for Chinese companies to list there.