-

-

OPEC cut [really around 900k] barrelsSA ok, but UAE and Kuwait seemed to be on board. Becky on CNBC asked why they didn't raise their hands if they're supposed to be US allies.

-

-

-

"A lot of the money in oil and gas stocks is sort of hot money and is New Money, and they're not familiar with the volatility we've experienced over the past number of years. The more volatility and the more pull backs, the harder it is for the sector to deploy capital, and the harder it is to attract capital the higher the oil price needs to be and the higher the return on that investment needs to be to get that capital deployed" - Josh Young

-

We need more capex spending, more pipelines built and more drilling, in order to transition properly to clean energy. The Fed can't change a supply problem (with hydrocarbons) no matter how it acts. It turns into much higher labor costs, energy costs, food.The US is begging SA to pump more while trying to remove the Iranian National Guard as terrorists, as well as the Houthi rebels.US is reducing restrictions on Venezuela (a 'known terrorist and funder of terrorism') at the same time as killing the Keystone Pipeline which would carry crude from the US's ally, partner and neighbor Canada to US refineries that can refine heavy crude.US politicians (Biden included, markedly) are vilifying Big Oil, threatening them (saying they would turn them off).Adding windfall taxes and things to energy is just saying we want prices a lot higher, Bass said, instead of getting behind them, as the highest energy producer in the world (way ahead of the second, Russia).In 7 years, the first nuclear energy will open in Wyoming.He thinks it's the golden age for private capitol investing in hydrocarbons for the next 10 or 15 years. Demand is inelastic and growing, and there's no alternative energy that could get there in time. There aren't enough minerals to put into the wind turbines and things.

-

-

Europe taking a lot of flack for recently switching to coal after long criticizing developing nations for using itRussia has cut gas exports to Europe 50% over the past week, reportedly.

Some say China and India are buying more Russian gas.Colombia increased exports of coal to Europe 50% (1.3m tonnes) this year. South Africa is now sending coal to Europe.Europe uses 20% of the world's energy resources, but has 7% of the world's population. -

-

-

$180 barrel is where demand would start to stop, said Mark Rothman, so we're nowhere near that

-

-

India and Russian energyIndia has appeared somewhat in Western news over recent weeks with a sort of insinuation that it shouldn't buy Russian oil. However, today an Indian politician noted that India's monthly purchase of Russian oil is less than Europe's daily purchase.

-

US will emerge as world's largest LNG producer this year, said Dan YerginHow much gas that was going to go to Asia is now going to go to Europe (for strategic considerations) (depends if Asia has a severe or mild winter)?

-

Indonesian coalHas seen prices rise from $100 per ton in April 2021 to around $300 (it was $400 a bit ago). It started a while ago, before the Ukraine war, but has been effected by Europe's new energy issues.The government of Indonesia requires coal producers to sell 25% in Indonisia at prices it decides ("domestic market obligation"), and the companies are making a good profit off the rest on the open market.

-

"Perversely, what is supposed to be the cleanest energy policy will turn out to be the dirtiest" - Samo BurjaHe said he thinks that because for the past 20 years (more?) the German government has been telling the populace nuclear energy is like the worst thing, dangerous, it would be very difficult to now say to them that they're going to start building new plants, "I think you're just going to keep burning coal, because you will be forced to disentangle from Russia eventually."

-

"One sanction that Putin fears, and that is ending the purchase of natural gas from Gazprom." - Yanis Varoufakis"... As we speak, Nordstream 1, the gas pipeline, is feeding the German industrial machine with 40% of its energy from Russian gas. They're not going to say anything about that, because this is a sanction they're not prepared to make."

-

US at 12m barrels of oil per day, 25% more than Saudis300% increase in rig counts since crash in ENP expenditures, because of the Covid recession.Will be up to 13m per day by end of year.US price per KWH is $15. The next cheapest is France at $25. Germany is $45.One reason for not producing more (esp in Europe?) is this raises the price, so the population becomes more ready to do things to adopt renewable energy instead.

-

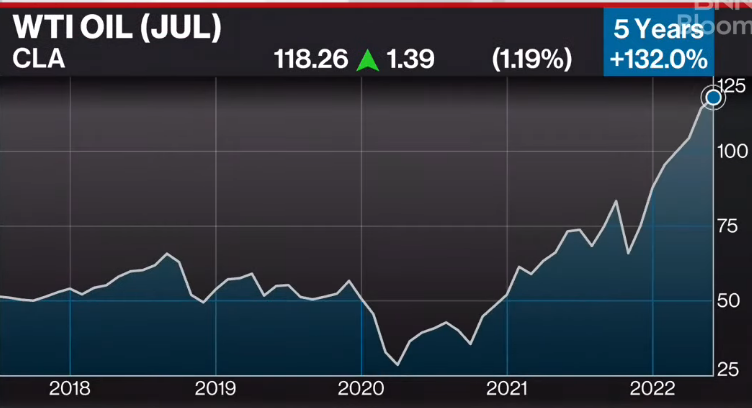

'We're in an era of post-US shale hypergrowth. US shale is no longer growing more than global demand, and so there's a call on global super majors, but they can't pick up." - Eric NuttallCountries (like Nigeria, Angola) are underproducing, forsaking 100's of million of dollars per month. Because they have had the inability to invest new productive capacity. So there are very few members of OPEC that can actually meaningfully grow oil production. Many, including maybe Russia, are near their productive capacity.We might see OPEC fair capacity exhaustion by the end of this year, which would be very bullish for the oil price, said Nuttall. But only energy producers and investors want higher prices. Therefore, even if Russia were to actually invade Ukraine, it is thought there wouldn't really be sanctions. Politically, democratic leaders maybe can't allow the oil price to go up much further. This might mean relaxing on Iran (the last suppressed producer which could easily come on line), also.What allows oil producing companies to return the most free cash flow back to investors is long-life reserves, low corporate declines, and strong balance sheets. Canada has the best of all 3 of any jurisdiction in the world, but has among the lowest stock prices, according to Nuttall.If there is $100 oil, they can privatize themselves, they can buy back every single share that is standing in just 2.6 years, while they are sitting on 15 years of inventory.He said we're not 'high' in inventory, we're 'normal,' we're back to like the period 2010-2014 (in that 4-year time period, oil averaged over $100 and yet demand continued growing). We're not at the point where high price leads to demand discretion yet, he said, and won't until we see $130 or $140 oil, if like academic history it happens when oil hits 5-6% of global GDP. Nowadays, exhausting capacity plus end of US shale hypergrowth, the fundamental setup is more bullish than 2010-2014.Because investors want returns (not growth of production), oil companies will continue to pay down debt, do dividends and increase dividends, moderate growth, moderate corporate decline (a company doesn't have to spend as much to keep their production up), rather than start new projects (multi-billion cost and then 4-6 years to come on line and then another 4 years to reach project payout). That means meaningfully higher oil prices.He thinks demand will continue to grow for 10-15 years.The perception of 'bad, dirty' oil has over the past years taken investors out, but now they're being 'dragged back in.'

-

Nickel-based cathode has higher energy density for longrange vehicles, for TeslaStandard-range vehicles and stationary storage will move to iron-based battery cathodes, Musk thinks. He thinks the majority of batteries in the future will be iron-based, so there won't be any shortage. It's just a question of making the equipment to process the iron into a cell and then into a pack.Nickel isn't rare, but there's about 10-100x as much iron as nickel.(Cobalt-based for phones and laptops.)Lithium makes up about 2% or so of a battery cell, but lithium is also not rare (basically its a salt, and there's a little bit everywhere).

-

India's coalCoal is 70% of India's energy mix (most mined domestically).India keeps adding lower and middle class energy consumers, who are buying goods like fans, lights, and TVs.Mines were flooded recently by monsoon rains.There is only a few days of coal stores. But it doesn't look like there will be a power outage.It's more a fear for businesses than homes.India has some solar, but solar outputs are reportedly declining.

-

Energy crisis in Europe?Some (especially Northwestern like Austria and Germany) nations keep low stocks of natgas, buying is on spot. These will drive the price up.This is based on capacity and ability to stock up over the past summer.Exposure to spot market rates.Asia is winning bidding wars with Europe for cargos.There is a question whether Russia really can deliver as much as it says it will. Russia is also looking to fill up its own storage.Spain suggested to the EU a shared reserve of energy for emergencies.

-

China power crunchAs China came out of the pandemic, the economy recovered fast, which led to energy demand, which led to really rapid production of coal, which led to some mining examples. As a result, the gov put some safetly regulations on, which constrained coal mining production this year. Prices went up.Over the summer, local officials were really conscious of these issues and tried to coordinate with power companies to make sure power supply and demand would be balanced. But in September, demand was higher than expected.

Also, wind and hydro were lower than expected in some areas.In some areas also, local officals were not meeting their energy intensity targets.This led to the CCP unilaterally deciding to cut power supply to certain sectors of the economy.At the heart of it is really 'local officials' decisions,' it was said.(Coal has been the best performing commodity this year price wise.) -

Putin assured EU he has all the natgas they wantEuropeans pay 5x what Americans pay for natgas.

-

Climate litigation on rise... like the German case on human rights climate grounds.Norway is facing a climate suit (from Friends of the Earth) for its plans to drill in the Arctic.

-

Tigray war may cost $2.5b according to estimatesTPLF has conquered most of the north and south of Tigray.Ethiopia is one of Africa's largest aid recipients. The US alone contributed a billion in 2020, and therefore has some leverage. Investing in Ethiopia right now comes with significant reputational risks, making companies more reluctant to submit massive investment bids.Ethiopia is finishing their dam and stressing tensions with Egypt and Sudan. The dam fits in with Abiy's plan to lift Ethiopians into a higher economic class. Sudan might benefit from a huge energy production facility on it's border for it's own energy needs.Getting ahead of things, but if Egypt was to take up a campaign against Ethiopia, due to the huge distance, it would have to use Sudan.

-

OPEC reached a deal to increase 400k barrels per day to productionOil was down about 2.5% (although the Dow was down 2% on inflation, stagflation, and Delta variant concerns) and oil company stocks more than that. Natural gas was up less than a percent.However, projections have it that demand will want 1m or more barrels more per day next year, assuming no more lockdowns.US producers could surge new production and crash the market. But no one wants to invest in new exploration. Most companies are hedged at a $50 range.

-

Burkina Faso's electric power grid

Citizens there increasingly have access to electricity, up from 18% to 45% in the past 5 years, and power outages have been reduced from regular multi-hour outages to ones lasting about an hour.The country gets 65% of it's power from Cote d'Ivoire and Ghana, but it is moving towards energy independence with large fields of solar panels in the desert. It expects the investments it is making now in solar will cause it to become 'completely powered' by solar in the coming years.

#BurkinaFaso #Energy