Compact Disks make Comeback: Memory could Exceed Petabytes - YouTube

Not yet. It's from research in China. Writing on hundreds of layers on a disk. Lasers can focus and write at specific depths of the disk. Another laser will target the writes and cause them to emit light.

They didn't write about how slow writing is, nor how much energy it takes, nor where you get the laser to write like this.

#China #Technology

Story coins. jj

-

-

China's Crackdown on ‘Hedonistic’ Bankers Fuels Industry Brain Drain - YouTube

Where are they going though? Some to Hong Kong, some from banking to crypto, to digital banking. 78% of banks have reduced personnel or something. Some big jobs pay have been cut in half.

People don't want this many people in the sector, they want the sector to serve the people rather than lavish lifestyles. Government wants other sectors, like manufacturing. They want sectors to be self-regulated, so China doesn't have the corruption (which they have now).

#China

This P.E.I. senior has no fixed address. He says there aren't enough services for people like him - YouTube

#Canada #Technology

Has AI made it ok to say the economy is sort of stagnating (considering inflation)? -

Macy's and Sunglass Hut.Raped him with a shank pressed against his neck when he went to the bathroom.

Macy's and Sunglass Hut.Raped him with a shank pressed against his neck when he went to the bathroom. -

AI companies that will be valuable will be those that have a valuable dataset (the AI itself less so).

Bigger, existing companies who already understand well their domain, will be advantaged compared with smaller startup companies. The enterprise will eat their lunch.

These datasets, the companies didn't appraise them as highly before this tool came to show how well it could use these big datasets.

People are now locking down their datasets (Google Analytics?). Before, they would make them public, allow Google Search to use them because that meant traffic for them.So far, even according to the Databricks CEO, chatbots seem the #1 use. Also analyzing customer data (medical records, ‘anonymously’) to find patterns. In insurance, there a long piles of papers to sign, but how does that apply to a particular case, and that can be asked. Also in finding sentiment about a product. -

(Even) Tom Lee 'can't' be as positive as he has been previously. They sent out a note saying there'd be ripple effects from SVB.After years of complete bullish comments, past few months he's been a bit more reserved but still voicing that it would be bullish afterall, but this is the first time I've heard him say something bearish."The cost of money for banks is going up so it's going to drive a necessary contraction of credit.Founders (many) are now nervous where they bank. But also some regulators have been advising banks to pull back their lending to Fintech startups. "So I think there's going to be job losses.""I think it's wrong to be bullish short term." Because although the market is down, no one wants to step in and say they want to buy.

-

95% of smartphone sales now Chinese (was 45% a year ago). Apple and Samsung had a combined 53%, and their share is now 3%.

-

Many people are uncomfortable with mRNA vaccines because they're only a step away, they're adjacent, from something that was going on on the Wuhan labs called Gain of Function research, which is basically biowarfare - Peter ThielAll technologies, drab dystopian future, building the machines that will destroy the future.AGI research people used to work hard on it, and say we have to find a way for it to coexist with us, but by 2015, Thiel said, it had devolved into people not really working on it very hard and people quite pessimistic about it's potential. From transhumanist to luddite. A superhuman AGI you would never know what its real intentions were. There was a problem, they avoided it for 20 years, and one day they woke up and the best thing they can do is hand out Cool-Aid, ala People's Temple, to everybody.Another solution is a One World Totalitarian State.

-

And smart glasses.

-

-

Biden signed a 'China competition bill' Chips Act, to 'boost US chipmakers'Haven't looked yet what else is in this bill.

-

Attention and brain waves.

-

Semi conductors versus longterm bonds being analyzed by CNBCSemis down versus longterm bonds up.Talking about going back to 2020 levels as a baseline. That's because then we were not in a rising rate environment, we had a huge tailwind to the overall market, a huge pull forward for semiconductors, hardware, everything across the board, but now we're in a rising rate environment, and everything is calculated on discounted cashflow. That's why tech stocks will run (upwards in value) when rates are low and not when we're in a rising rate environment.2020 might not even be the right thing to look at, because then there was no inflation, and rates were at zero. So equities maybe should be valued even worse than that.

-

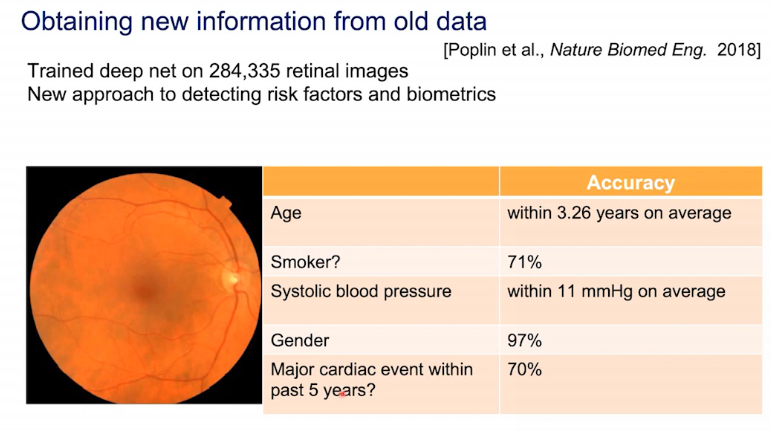

Microsoft Research guy commented on how if there were a breakthrough in privacy-preserving tech, there would be more use of AIApplications of AI to things like the huge datasets of medical records are bottlenecked by privacy issues.Lots of old research that was done, it has since been found that although no one knew it at the time, current tech can see that a person in one research group was the same person as in a different research group.Didn't know it at the time either, but scans of eyes can be used now to predict with some accuracy various thigns:

-

-

Twitter has made it so you can't search for Russia Today and Sputnik, reportedly

-

Ukraine has put up cypto wallets for people to donate... saying the money would be used to destroy as many Russian soldiers as possible, it was reported.They've received several million into these wallets.

-

Removal of Russia from SwiftBut more important, commenters say, are the restrictions US and allies are placing on the R central bank.R has $600b in foreign reserves. The restrictions aim at preventing Putin from using that money to fund the invasion and to keep the R central bank from offsetting the falling Ruble.Putin has built up that big foreign reserve pile (3rd largest in the world) over several years, some say in an attempt to "sanction-proof" his economy. He's cut his debt ratio to GDP.There's talks that Switzerland will even join the sanctions.The Swift and R central bank sanctions may have isolated the R economy and put it into a sort of freefall. The R people will likely feel this, as will the R oligarchs.They have not yet done trade sanctions (ie go after oil and gas), because Europe gets over 40% of its gas from Russia. Such sanctions would cost everyone around the world.

-

EU majority vote against mass surveillance through facial recognition... such as that used by police. It's called 'biometric surveillance.'It's not a law against, that they voted for. It's more of a statement against the idea.

-

Rayban changes leading design into 'waycreepers'?It's been reported Rayban has licensed or partnered or something with fb to put camera's in their most iconic line.So now are we going to be looking for this design to spot people creeping on public locations?The last time a large glasses-camera attempt was made was a few years ago. It was Google Glass. What ended it was when a wearer (you might imagine that people interested in buying these products correlate somewhat with people who don't respect the public privacy of others) was punched for wearing them somewhere. Whether for the pr or whatever that might follow this, the project was turned down or off. Will we see the same thing here, to end the current movement towards spying on all public life?